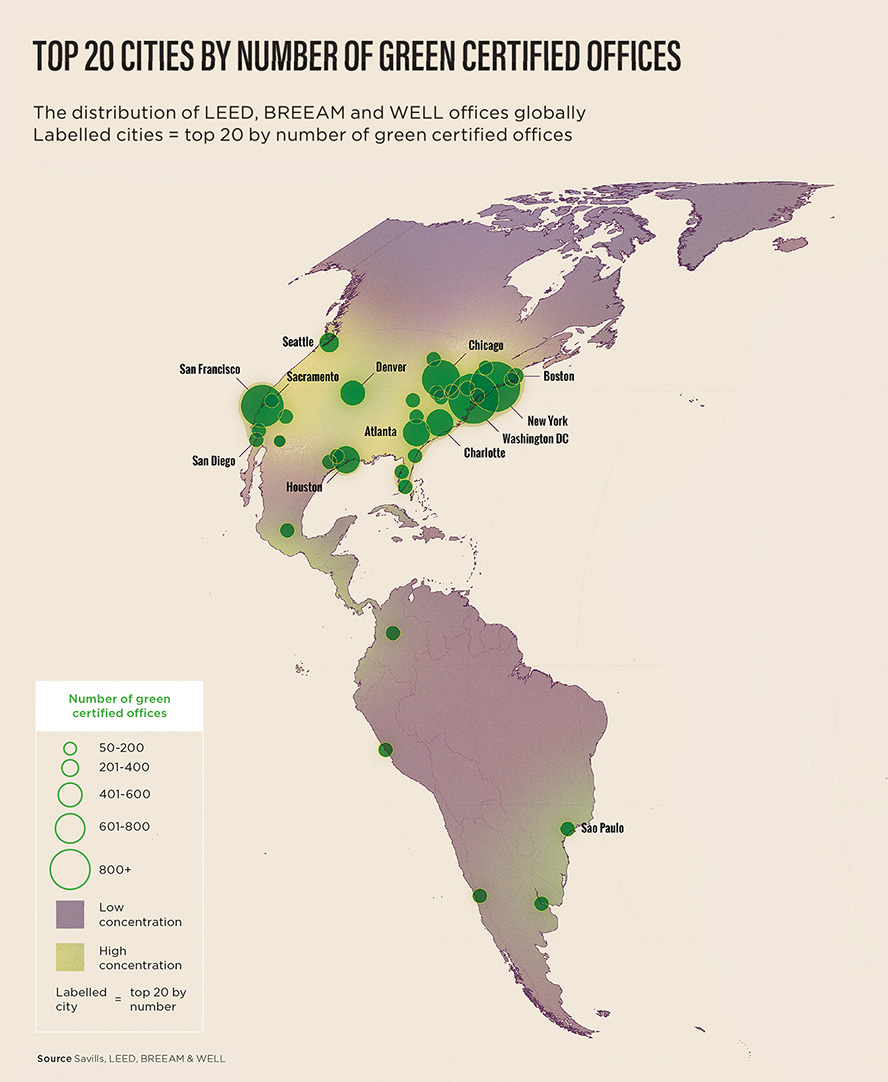

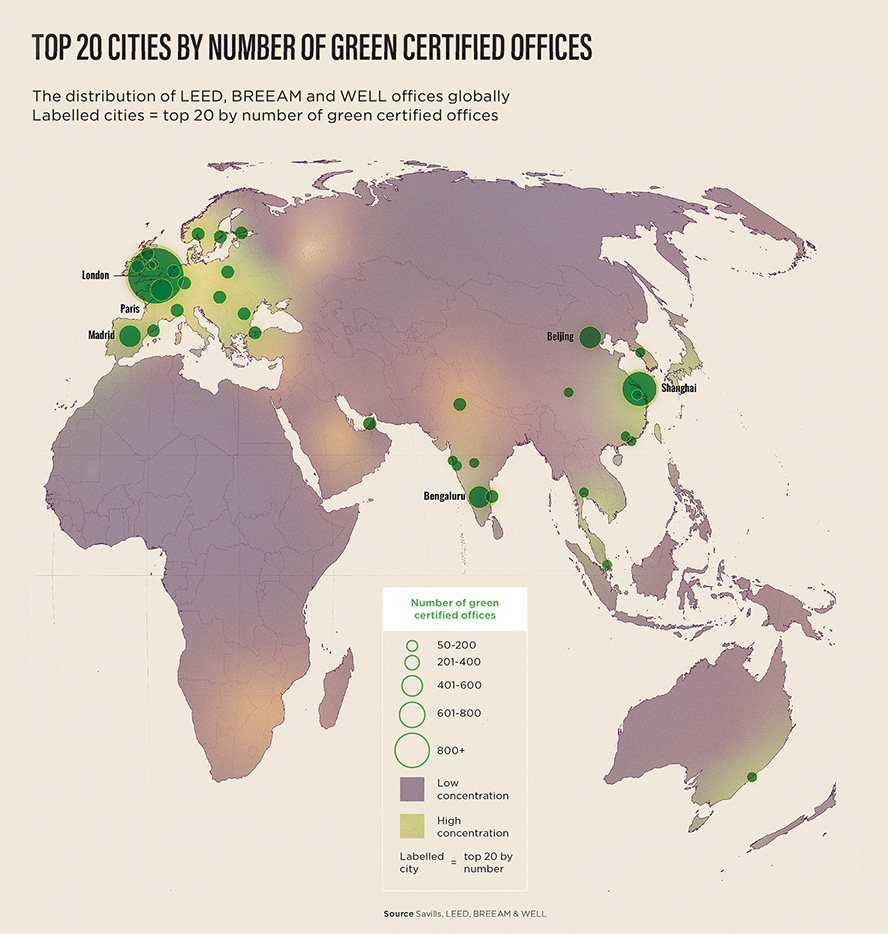

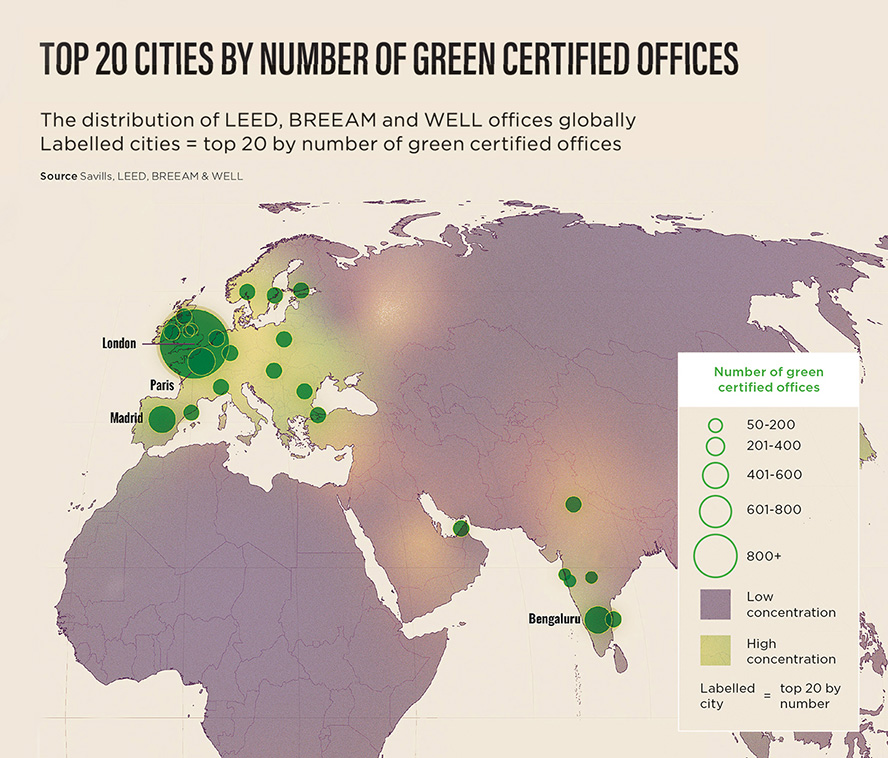

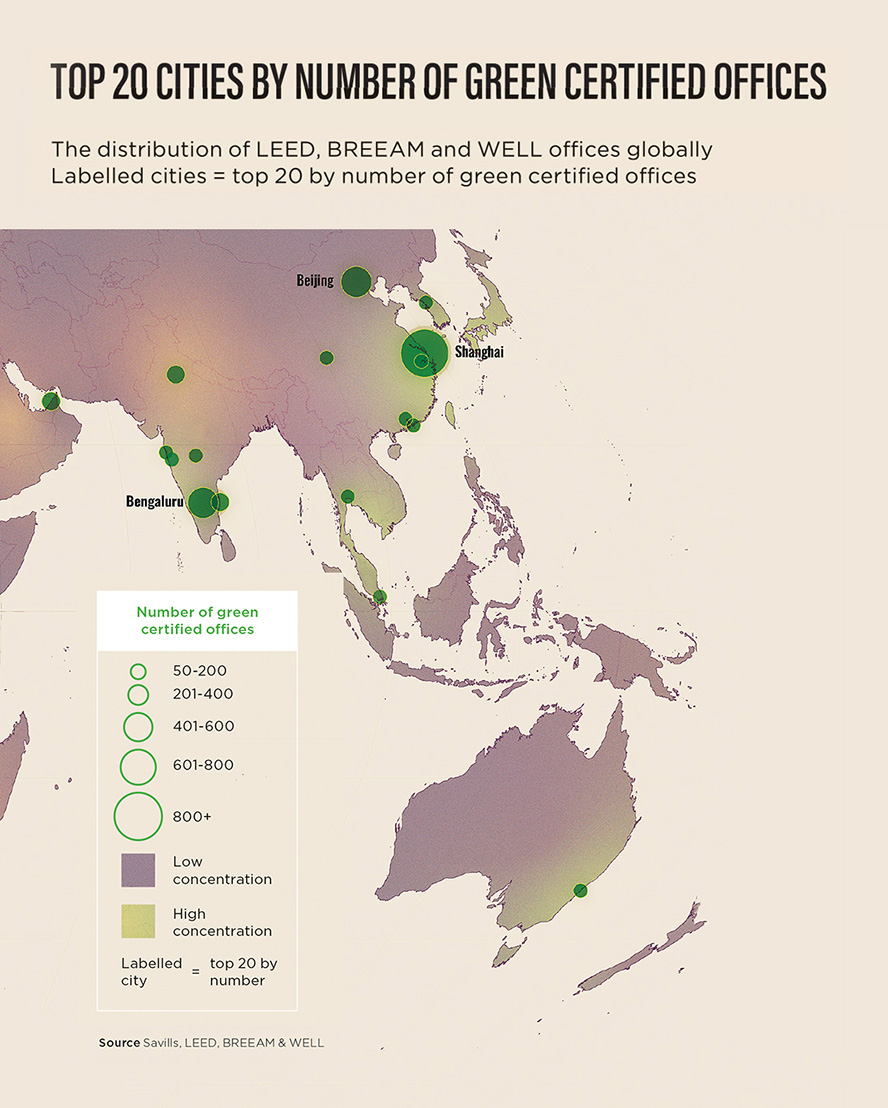

In cities across the world, office stock is being reassessed as environmental, social and governance (ESG) commitments grow in importance for organisations and investors alike. Our analysis of the global distribution of LEED, BREEAM and WELL office buildings shines a light on the most progressive cities in terms of adopting green certification.

Here, the US is well represented in our top 20 cities by number of green certified offices, as are commercial hotspots such as London, Paris, Beijing and Shanghai. “We are seeing big increases in demand for in-use certification,” says Brad Johnson, Principal Sustainability Consultant, Savills. “In terms of other benchmarks, we cannot ignore GRESB as an international reporting tool.”

Savills Research also examined the data in terms of cities with green certified office space as a share of total stock. Again, many US cities feature strongly, with comparatively high proportions of green certified offices, often as a result of national and state legislation.

Green offices abound, but room for growth remains

However, many cities analysed have opportunities for growth in green certified office stock. On average, 28% of total stock in the top 20 cities is green certified, meaning that more than 70% of existing stock will need to be retrofitted. This future upgrade of office stock will be driven both by occupiers and investors.

There is strong competition in the investment market for office buildings with high green credentials and pricing for these assets is keen. On the other hand, interest in value-add opportunities – buildings in good locations that can be retrofitted – is also rising, but pricing needs to reflect the capital expenditure required for upgrading. Local conditions and market dynamics mean solutions can be highly localised and tailored.

And there’s one more thing. “Bringing office stock up to standard is not just about building certifications, it’s also about management,” says Tanya Broadfield, Director of Sustainability, Savills. “Particularly relevant are ISO 14001 in Environmental Management and ISO 50001 in Energy Management (an extremely useful tool for net-zero pathways). For example, BREEAM/LEED would give you a great score if you had a solar panel on the roof, even if the solar panel was broken and no one knew how to use it. ISO focuses on the actual operational management of a site and requires performance improvement.”

UNITED STATES

EUROPE

MIDDLE EAST

ASIA-PACIFIC

With companies trying to win the war for talent, a greener office is now an important part of the mix in the US. “Companies are trying to earn back the commute,” says Sarah Dreyer, Senior Vice President, Head of Americas Research, Savills. “They want to get employees back to the office, collaborating, and using space in a different way. Sustainability is one of those factors.”

It’s difficult to separate out the trend as it’s wrapped up in lots of other drivers, such as softer markets post-pandemic that have allowed companies to seek out amenity-rich locations with better green credentials. But there is no doubt that the pandemic has ratcheted up the requirement.

The conversion conundrum

Occupiers will consider new buildings, as well as those that have been well retrofitted. However, upgrading space is a tough ask for owners in a market with rising construction costs. For many, that means delaying environmental upgrades until some of the risk is mitigated. “Some are going out to market to see if they can get a big anchor tenant to help with that pre-lease activity,” says Amanda Thomas, Senior Director, Project Management, Savills US. “Others are getting in their permits and then using that time as their marketing time.” For types of offices that are now less favoured, repurposing has become an option.

In Orange County, California, 2.4 million sq ft of office space across nine buildings was sold in 2021 to industrial developers to be converted to last-mile fulfilment space. The same trend is now being seen in Los Angeles for office properties in heavily industrial-zoned areas.

Existing and upcoming regulation is a strong driver for environmental upgrades of buildings across Europe, with Energy Performance Certificates (EPCs) being one of the main metrics for change. From 2023, landlords will be unable to let buildings in the Netherlands with an EPC rating below a C. In the UK, landlords will likely have until 2030 to ensure all their buildings hit a B rating, although there are some exemptions. EPCs derive from European legislation but were enacted differently at country levels.

These ambitious targets support net-zero goals but require major investment by owners in the intervening period. Currently, more than 11% of the office stock in the Netherlands does not meet the legislation criteria set for 2023, while more than 32% has no energy label at all yet. In the UK’s major cities, that figure is starker, with 87% of office stock predicted to become unlettable as it doesn’t currently meet a B rating. Savills Research estimates that the cost to get the entire commercial office stock in England’s six largest cities to an EPC B rating could be as high as £63bn ($82bn)

Repurposing to residential?

Other metrics point to greening being the only direction of travel. “Across all European offices, on those that have a BREEAM rating of very good or above, the yields have compressed by an additional 44 basis points in the past 12 months,” says Mike Barnes, Associate Director, Savills European Research.

For buildings not making the cut, repurposing is being seen most strongly in Europe. “We are seeing house prices rise, so there could be potential for conversion to residential in the right locations to create more mixed-used environments,” he adds.

The Middle East may have a relatively young office stock, with most of the space built in the past two decades, but this is not making the environmental challenge any easier. A desire to replicate established international markets has left the region with many energy-intensive, glass façade skyscrapers struggling with heat retention and cooling issues in Middle Eastern climes.

However, there are efforts to improve. In the UAE, for example, governments are promoting more environmentally friendly space, while in Abu Dhabi, all government entities must take space in buildings certified by the Pearl Rating System, a region-specific framework to evaluate sustainable building development.

The Kingdom of Saudi Arabia is the largest construction market in the MENA region and sustainability is at the heart of activity. The office market, in particular, is on the cusp of strong growth, with many international corporates set to enter. As a result, most of the recently completed and upcoming developments are built on sustainable principles, to ensure global compliance and set new benchmarks on sustainable development.

Meeting global standards

In Egypt, host of the 2022 UN Climate Change Conference, authorities are keen to showcase the nation’s green credentials after it was selected in recognition of its progress on climate adaption. LEED is the most commonly adopted certificate with around a dozen office buildings rated. International occupiers now insist on environmental standards instead of accepting market norms.

“We’re seeing more corporates either push their landlords to make sure they’re retrofitting the building to meet the basic global standards, or they are moving out of their building completely and looking at new developments,” says Swapnil Pillai, Associate Director in Savills Middle East research team.

This focus on prime is expected to cause problems for lower-grade buildings. For owners of grade C and D buildings, the high levels of vacancy in the region – 30% in some locations – means that even with a costly retrofit, there is no guarantee of a tenant.

Premiums are starting to be seen in the Asia-Pacific market for highly rated green buildings, whether that is in rent or capital uplift.

“We hear of transactions that have not gone ahead because environmental ratings weren’t met,” says Sam Crispin, Regional Head of Sustainability and ESG, Savills Asia-Pacific. “We see that as an opportunity for investors with the expertise to come in, upgrade a building and then achieve the premium when they exit their investment.” Crispin adds that the rental premium for a newly built, highly rated sustainable building is likely between 5% and 10%.

Environmental expectation

Environmental improvements are being driven by a range of factors: the business case for reducing operational costs, occupier pressure, and mandatory reporting measures, most commonly for the listed sector. For example, Hong Kong now has mandatory ESG reporting, which drives change as “the expectation is that there’s continuous improvement,” says Crispin.

One significant challenge that remains is the lack of renewable energy sources, which are not as readily accessible as in other regions. In addition, smaller mid-cap property companies are finding it difficult to implement change without the same access to resources and education on the topic.

On average, 28% of total stock in the top 20 cities is green certified, meaning that over 70% of existing stock will need to be retrofitted or repurposed in the coming years to meet strengthening environmental standards