The top travel destinations

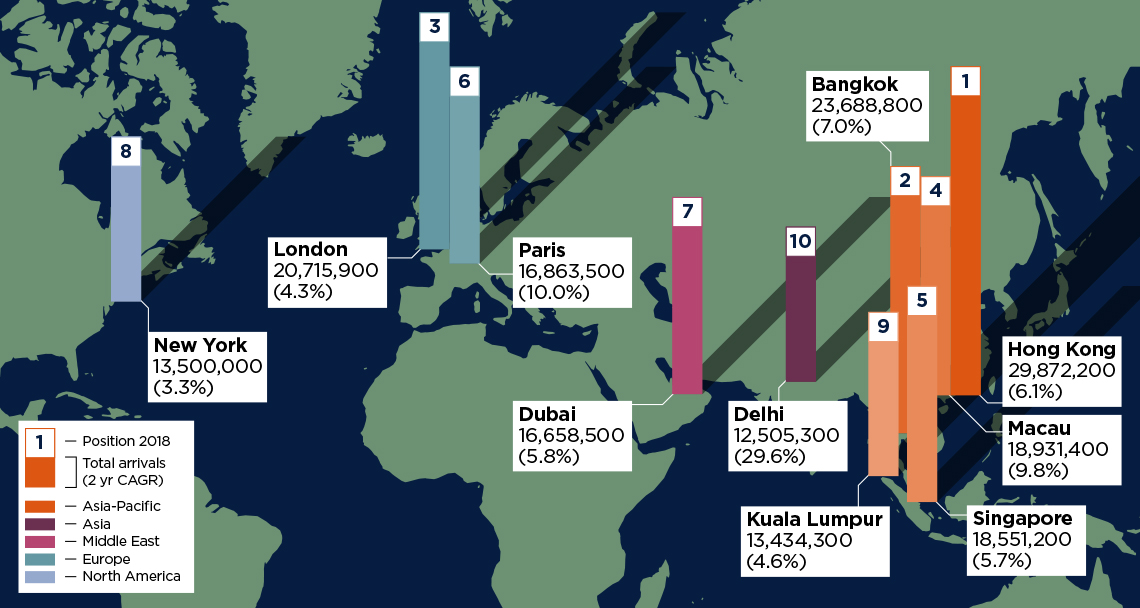

Hong Kong (above) continues to lead the way with the largest overnight visitor market globally, attracting close to 30 million visitors in 2018, with Bangkok and London coming in second and third.

Hong Kong’s proximity and appeal to mainland Chinese visitors is what places it at the top, although the recent unrest in Hong Kong will no doubt dampen numbers in 2019.

The influence of Chinese tourism is reflected in the fact that of the top 25 visited cities globally, 11 are in Asia-Pacific. Macau and Singapore, both popular with mainland Chinese tourists, feature in the top five.

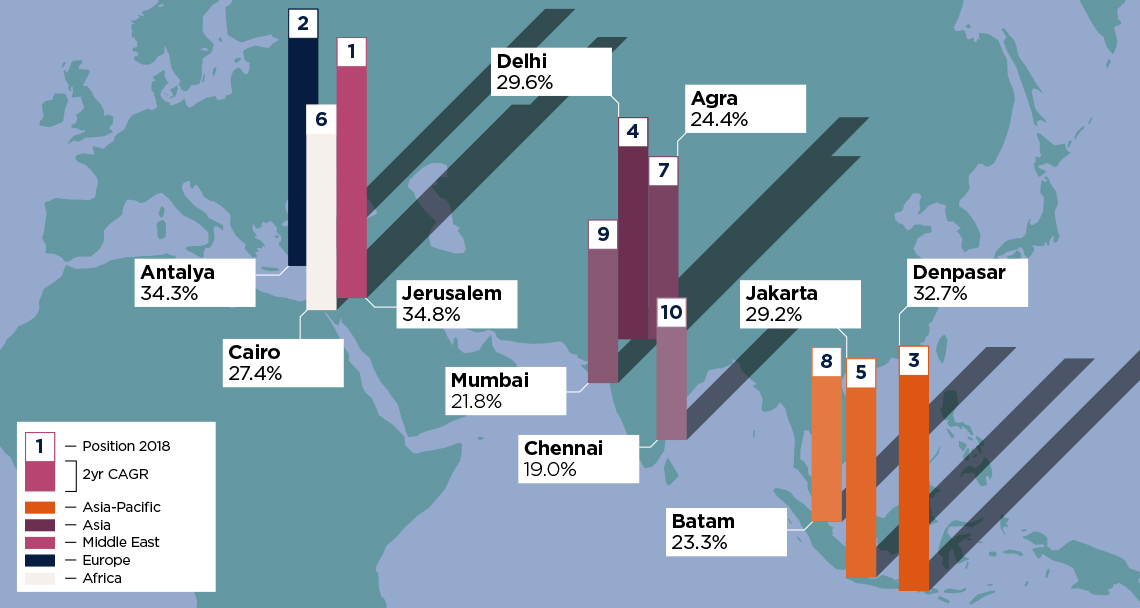

The top 25 cities in growth terms, however, have largely been those in India, with Euromonitor expecting Mumbai to enter the Asian top 10 for 2019. While not in the top 25 in terms of size, Jerusalem is the fastest-growing tourist city, with annual growth of 35% over the past two years. This has been driven by relative stability and a strong marketing drive providing hotel development and investment opportunities.

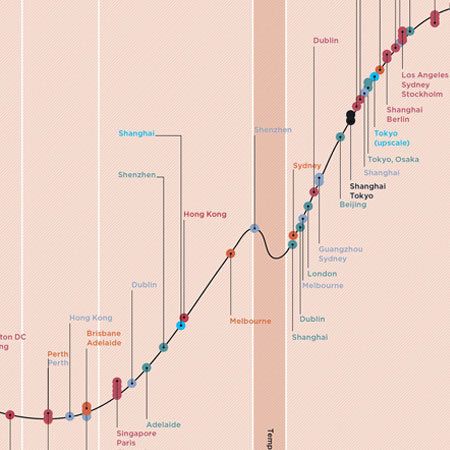

Top 10 cities by number of arrivals (2018). Percentage shows two year compound annual growth rate

Source: Savills Research using Euromonitor

Top 10 cities by growth. Percentage shows two year compound annual growth rate

Source: Savills Research using Euromonitor

150 million trips: the impact of Chinese tourists

China is now the single biggest source market for international tourists globally with an estimated 150 million trips in 2018. According to the Chinese Ministry of Culture and Tourism, this is 15 times that seen in 2000 and there are no signs that this growth is abating. For example, Tourism Economics predict that one-in-seven visitors to the world’s top 300 cities in 2025 will be from China.

While the growing number of Chinese tourists has positive implications for a city’s hospitality sector, it also has a direct bearing on a city’s retail market, particularly luxury. Chinese consumers are now the biggest spenders when it comes to luxury goods, with 76% of this spent outside their domestic market. Luxury brands tend to focus new store openings in cities that attract significant numbers of Chinese tourists. For example, London and Bangkok led the way in terms of the number of new luxury store openings in 2018, with London seeing Chinese visitor numbers increase by 69% over the past two years. But, while Chinese tourism can be a driver growth, these travel patterns can easily shift in respect of political disputes, as seen with South Korea, Japan and the US.

The next big thing

India is increasingly viewed as the future growth source market globally, thanks to a population of 1.3 billion and, like China, a rapidly growing middle class. However, don’t expect the same trajectory as seen with Chinese tourism. The United Nations World Tourism Organisation (UNWTO) forecasts that outbound trips from India will reach 50 million by 2020. That is double the number seen in 2017, but only where China was 10 years ago.

While India’s tourism trajectory might lag that of China, it still has the potential to be a future driver of hospitality demand within its borders, region and globally. What might differentiate it from Chinese tourism, however, is the countries and cities that appeal to Indian tourists.

For example, while Paris has been a firm favourite for Chinese tourists, historical ties between the UK and India, plus language (English is typically used for official and business purposes) suggest that London will likely be a key destination market for the growing number of Indian global travellers.

How experience will impact the market

While China might be the biggest source market, it is millennials and their younger counterparts, Gen Z, that are, and will be, the key drivers demographically.

Rather than ‘buying stuff’, they are looking for experiences – a key element of which is travelling. For example, the under-30 households have increased spend on holiday accommodation abroad by more than 300% since 2009, with staycation accommodation spend up by more than 100%. For the travel industry, this makes them a key target – one that will be driving the market given that, from next year, global millennial spending power is expected to overtake that of Gen X.

However, the travel demands of this generation look to be very different to that of previous generations. From an accommodation perspective, price point and experience will be key and can already be seen in the growth of boutique hostels and hybrid space providers. For example, The Student Hotel in Amsterdam is a cross between student housing, hostel and hotel all set against an Instagrammable backdrop.

Over-tourism

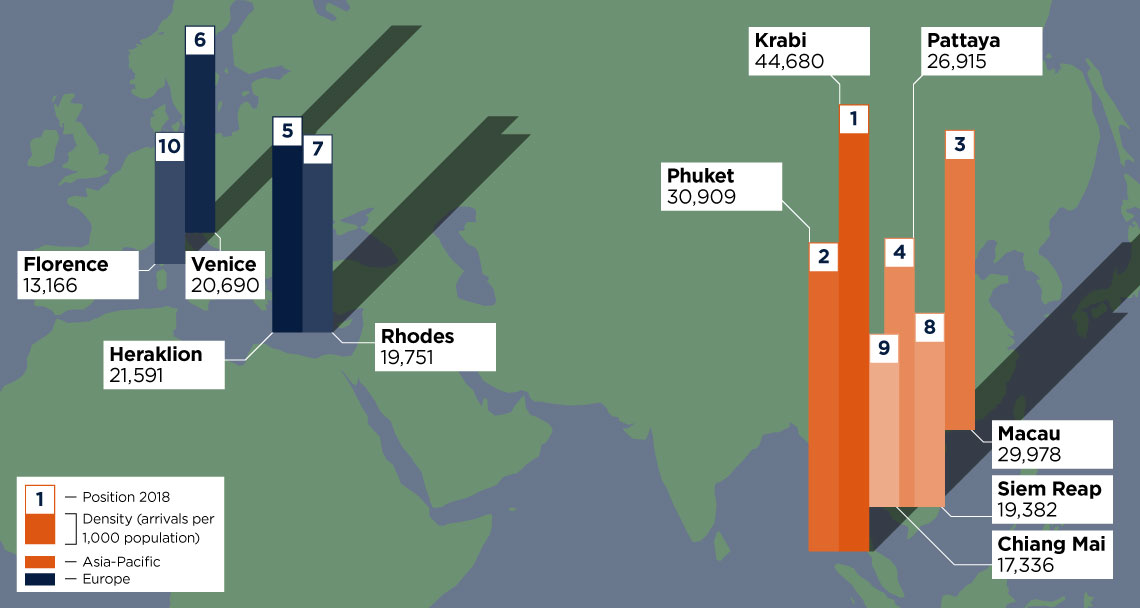

The UNWTO forecasts that global cross-border tourism will increase 46% to 1.8 billion by 2030, driven by a growing middle class, particularly in Asia. This is providing significant real estate opportunities around the development of tourist accommodation. Yet, the risk of over-tourism could ruin the party in some cities.

Barcelona and Amsterdam have already looked at placing restrictions on the use of Airbnb due to the negative role it was having on the availability and cost of homes for residents. Barcelona took this a step further by placing a ban on new hotel development in its city centre. This is exacerbated in cities where the ability to develop new hotels is restricted, as is the case with Venice, which has the highest tourist density in Europe.

However, the real challenge is less about total over-tourism, but how you spread tourism, and its associated benefits, across a city. With travellers increasingly looking for a more ‘local’ experience, this could open opportunities for tourism development in less-developed parts of a city.

Top 10 cities by number of arrivals per 1,000 population

Source: Savills Research using Euromonitor and Oxford Economics

What if the ‘no fly’ movement gains traction?

While millennials are a key driving force in the growth in global travel, they are increasingly environmentally aware and aviation is a significant contributor to greenhouse emissions. As climate change moves up the agenda for many economies, it’s not just on the agenda for younger generations. So far, this has had little impact on our appetite to travel. However, in Sweden, the ‘flight shame’ movement has been attributed to a decline in air passenger traffic and a growth in train travel. We could see this trend expand to other markets.

Whether this movement could slow or reverse the growing trend in international travel globally remains to be seen. However, it’s likely to result in more people travelling by train and, in some cases, people avoiding international travel in favour of ‘staycations’, further boosting domestic tourist markets.