There are two factors fundamentally affecting real estate in the early part of the 21st century. First, the transition of millennials to being the predominant age group in the workforce, and second, their disposition towards urban living.

This has created massive investment into urban cores, including in cities that were previously regarded as Tier 3 cities. For example, nobody used to want to live in downtown Raleigh, North Carolina, but now it’s a thriving urban centre, and growing. Young people want to live, work and play within a close distance of each other.

But there is a big question everyone needs to wrestle with now. Will this generation go through what every other generation has previously gone through, which is: once they’ve started a family, will they want to relocate out of the city centres, to access more space and affordable schools?

The cost of private education in desirable cities can be prohibitively expensive. A lot of millennials are at the age where they may have only just started to have children, or think about having children, so they haven’t faced the question yet.

The rise of the millennials, and their preference for urban living, is at the heart of many investment decisions right now. It’s a consideration we try to discuss with every client thinking about where to invest.

Ten years ago, it was all about advising clients on ‘the right region’ to find properties in. Now, it’s more about studying the inter-market dynamics within that region, which ultimately comes down to: ‘which specific location do I want in this region, to get the kind of talent I want?’ These days, we don’t even start our property search with the client until we have completed an inter-market analysis. In a way, this means the actual property is becoming somewhat less important – because you’re not going to buy or lease a shiny new building that’s in the wrong location, no matter how much you like it.

Tiers of a town: A global definition

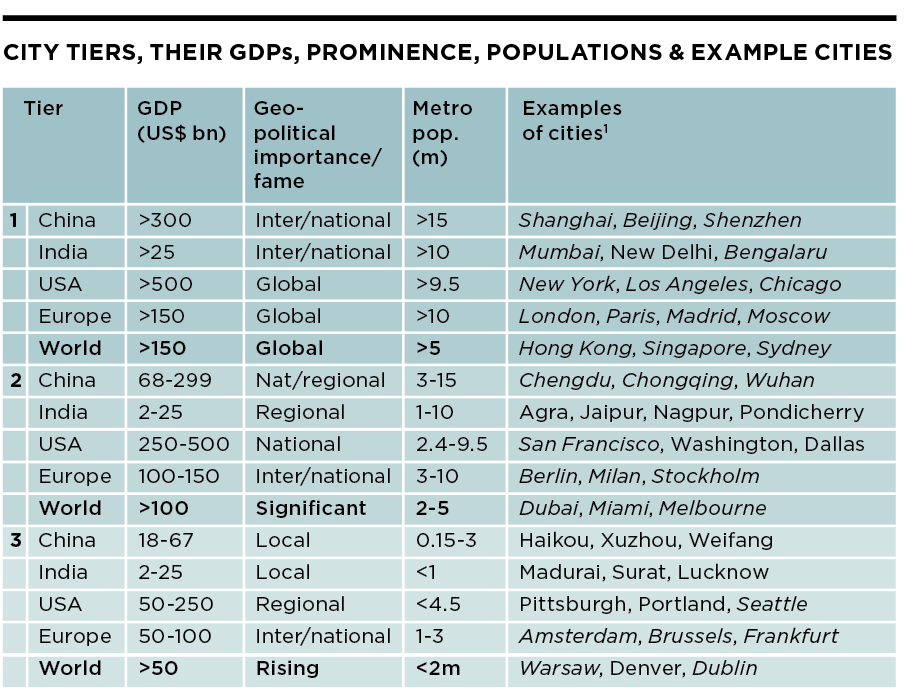

There was a time when real-estate location was referred to as prime, secondary or tertiary, and the quality of building graded. As real-estate investment has become more global and centred increasingly on cities, new terms have been adopted from different countries, one of which refers to city ‘tiers’. But the definition of a tier varies from country to country. Tiers are ultimately subjective, determined by geo-political influence and even fame as much as precise metrics. Here’s a quick guide, with our view of what it means globally:

Tier 1 almost universally refers to the biggest cities in a country, but not all of the biggest cities in the world have large and internationally invested real-estate markets. Some are restricted for foreign investors or, in the case of emerging economies, can be seen as too risky for intensive asset allocation.

Small cities, in Europe especially, may technically fall into Tiers 2 and 3 globally, but still have important real-estate markets. Some Tier 3 cities are strategically important and some are becoming more important, attracting investors in the fifth, digital, age.

Source: BIS, Savills World Research. Note: 1. Cities in italic are among the ‘Savills top 50 World Cities’

Image: Shutterstock