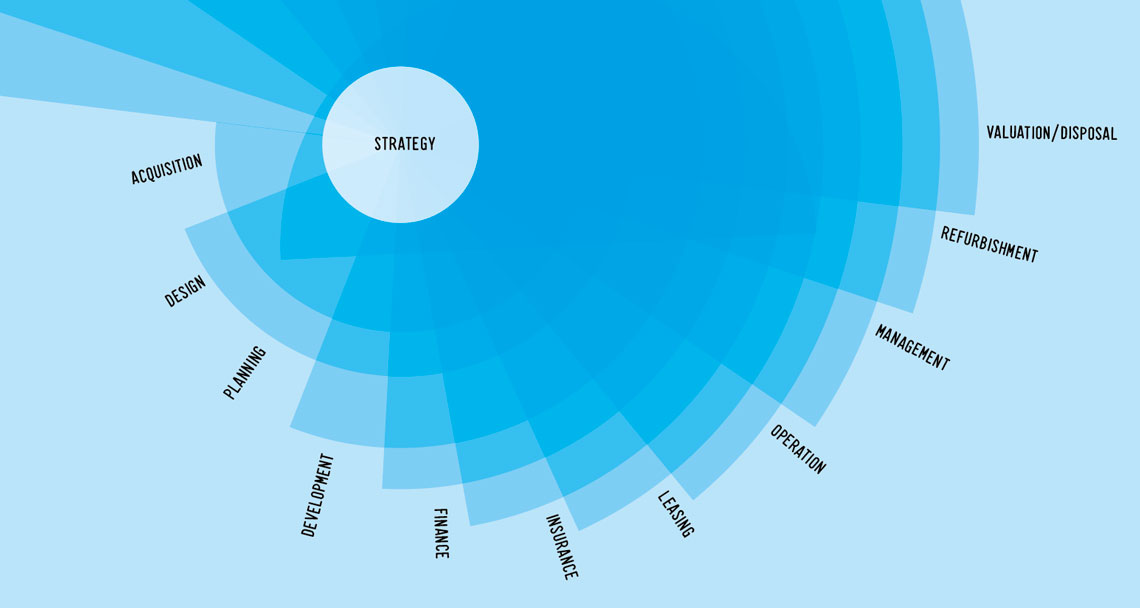

Climate change impacts every aspect of the property lifecycle. From acquisition to disposal, a consistent and collaborative strategy to address climate change during the lifecycle is vital.

Acquisition

Factor current energy performance levels and scope for improvement, in light of current and future regulation

Design

Moving to a circular design mindset can have a positive impact on the environment, occupational costs and biodiversity

Planning

Environmental impact assessments are a legal requirement in most countries for major projects and climate risks are moving up the agenda

Development

Developers and funders are considering mitigating the environmental impacts of sites and offsetting their carbon emissions

Finance

Funding institutions are building ESG criteria into their terms of capital. New products are competitively priced for those focused on future-proofing their assets

Insurance

Wildfires, storms, floods, droughts and heat waves are all increasingly recognised by real estate insurers as physical risks to property from climate change

Leasing

Assets that recognise healthy, sustainable design are becoming more valued by and attractive to occupiers

Operation

Smarter, more energy efficient operation of plant and machinery. Heat pumps will be the key heating technology to replace gas

Management

Asset managers focus on physical sustainability improvements that will be visible at a property level: energy audits and efficiency improvements

Refurbishment

Proactive, value-enhancing renovations and repairs can help significantly improve the energy efficiency of existing buildings

Valuation/disposal

According to MSCI, greening the property portfolio will be imperative in the face of a looming ‘brown discount’