Today’s markets are possibly too preoccupied with near-term fluctuations, where political instability controls the lion’s share of people’s attention. Real estate, and specifically the rural sector, must take a longer-term view.

In the UK, the repercussions of Brexit are dominating the debate, often distracting from factors that will materially dictate the sector’s long-term prosperity. Depletion of natural resources will be a key theme to watch in the future, and will likely mean change before stocks run dry and irrevocable damage is done.

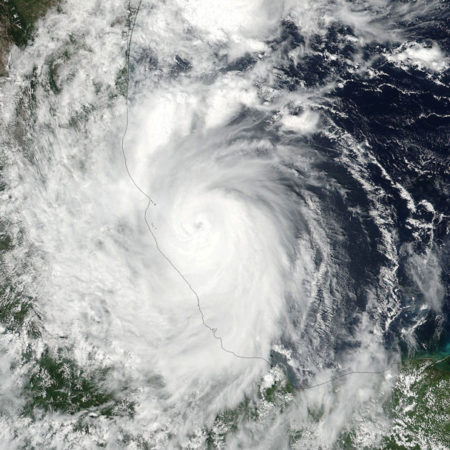

The 21st century signalled society’s awakening to the impacts of climate change, as the consequences of human development altered our weather patterns. For agricultural land, we can expect to see shifts in average rainfall, temperatures and frequency of weather extremes affecting farmland’s productive capacity. The outcome of change will vary with geography, but negative consequences could, in turn, impact on value.

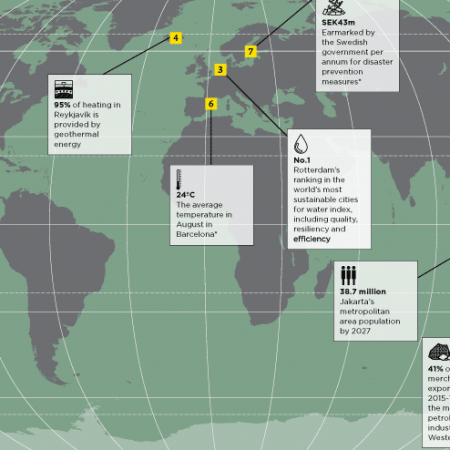

The availability and quality of water is another key factor to consider, intrinsically linked with land’s productive capacity and thus value. Across the globe, we see the emergence of water stress as growing freshwater demand increases pressure on groundwater supply. For example, in parts of coastal Australia, falling water tables have prompted communities to become increasingly reliant on desalination plants.

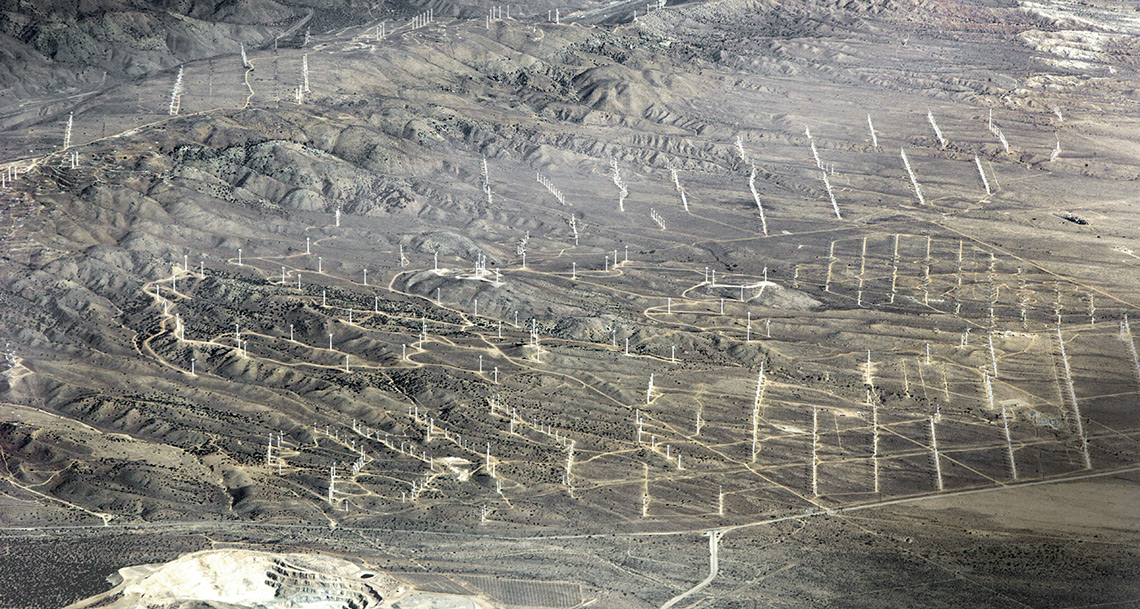

Oil is not going to run out. Instead, much of the identified reserves will likely need to stay in the ground if we are to stabilise a changing climate. Therefore, further uptake of cleaner, renewable sources of energy will have to occur to ensure a smooth transition to a low-carbon global economy. In Western Europe, wind (on and offshore) has played the largest role to date, and even the oil-rich Middle Eastern economies have begun a shift towards providing renewable energy, with significant investment in large-scale solar farms and the latest technologies in battery storage needed to smooth the intermittent renewable output.

Image: offset.com