Cautious optimism defines our occupational outlook for 2025. The global economy is set to moderately expand by around 2.8%, with inflation trending down towards central bank targets. This, combined with other factors discussed below, spells a brighter outlook for next year and beyond.

In a survey of the Savills global network, respondents across the majority of markets forecast increased demand and rental growth in all major property sectors in 2025 – with the exception of Grade B offices. More than 70% expect rents to rise in 2025, versus 13% who believe they will flatline and 15% who think rents will fall next year.

Rent and take-up sentiment

Prime office in demand, but still a place for secondary

The trend of flight to quality will continue to fuel demand for the best-in-class office space in well-located, high-specification and sustainable buildings. Modest rental growth is forecast across all regions, driven in part by demand for trophy assets, which continue to attract a strong premium. Overall, 81% anticipate rental growth in prime office spaces, with 91% forecasting increased office leasing activity.

Rental growth expectations for 2025 are strongest in EMEA, where supply remains limited in many central business districts – particularly in Saudi Arabia, the UAE, the UK, and Spain. Strong rental growth and increased demand are also expected in India, boosted by the tech sector.

Office demand is forecast to register a more gradual recovery in the US. Modest rental growth below 2% is expected in 2025, coupled with a slight increase in leasing activity. Likewise, international occupiers are likely to remain cautious regarding China amid the prolonged capital market downturn and ongoing geopolitical tensions.

Although the market remains challenging for secondary office stock, there is still a place for this type of property in some markets. Our survey respondents foresee modest rental and take-up growth in the Middle East, India, Japan, South Korea, Denmark and Switzerland. Elsewhere, these types of buildings will increasingly be purchased for change of use purposes, which will support the road to equilibrium in the secondary office market.

Occupational sentiment, breakdown by country and sector

Note: Occupational sentiment reflects combined expectations for rental growth and take-up in 2025 across all sectors, including offices, retail, industrial and logistics, and residential.

Residential demand outstripping supply

Overall, 84% anticipate rental growth in residential property for private individuals next year, with 87% expecting an uptick in leasing activity. Rent increases are expected across most regions, with more of a mixed picture in Asia-Pacific. India, Saudi Arabia, and the UAE are expected to be the standout markets for rental growth and take-up in 2025. Modest rental declines are expected in China.

Rental growth in multifamily, senior living, and student accommodation sectors is anticipated by 81% of respondents, with 72% expecting take-up to improve next year, against 24% expecting no change. There is a clear expectation that rental growth in the purpose-built student accommodation sector will continue to rise in 2025, particularly as higher education enrolment has bounced back after the pandemic.

Demand for industrial and logistics is up, as nearshoring trend continues

Buoyed by strong fundamentals, the industrial property market looks set to perform well in 2025. The majority of our poll expect continued prime rental growth (78%) and increased demand (72%) next year, with more strongly positive sentiment in APAC and EMEA and softer expectations in the US. China lags significantly behind, registering negative sentiment in our survey owing to a well-documented array of challenges including slowing economy, geopolitical tensions and related trade disruptions, and over-supply. The Czech Republic is another notable outlier, with sentiment for 2025 weaker than this year due to strong actual performance in 2024.

Geopolitical tensions remain, meaning occupiers continue to re-evaluate supply chain networks, with increased demand for nearshore manufacturing. Across the majority of global markets, industrial and logistics assets that offer strong energy infrastructure and excellent ESG credentials are likely to outperform as occupiers continue to prioritise these factors.

Established retail centres continue to dominate

Retail conditions look set to improve, with buoyed consumer confidence and an uptick in retail sales volumes forecast for next year. Improved outlooks for global wage growth and international tourism, plus lower inflation in most markets, continue to support the recovery of consumer confidence. Overall, modest rental growth and improved demand are assumed across most markets covered in our survey. More than two-thirds anticipate rental growth and increased take-up.

Certain locations look set to outperform, including established luxury retail centres in the US, UK, and Japan. Currency-driven luxury cross-border spending is boosting Japanese retail markets and supporting luxury shopping in the UAE, Indonesia, Malaysia, and Thailand. Across these and other locations, retail properties that offer flexible, tech-enabled spaces for both physical and online integration will likely outperform traditional formats.

In China, retail rents and demand are expected to continue to fall sharply in 2025, although the fundamentals for China still look encouraging over the medium to long term.

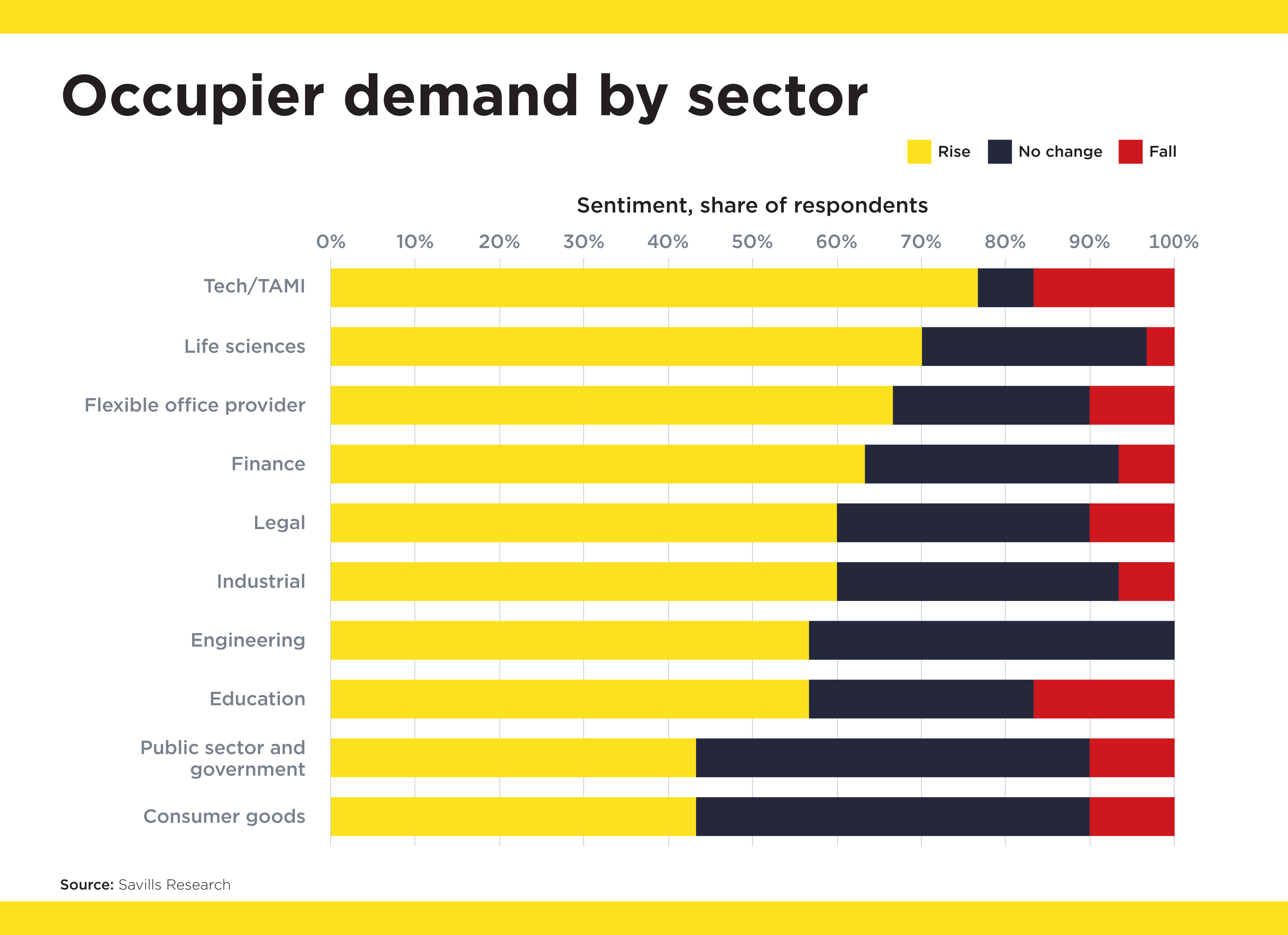

Tech and life sciences to see largest increases in office occupier demand

The outlook for 2025 varies by industry sector, with knock-on effects for real estate occupier demand.

According to our survey, the technology sector should register the largest increases and the largest falls in demand. The former will be fuelled by the promise and capability of AI, the latter by some areas slowing down after a period of “hypergrowth”. Despite challenges, the life sciences sector is also expected to experience increased demand for space in 2025, fuelled by continued innovation in drug development, including AI-led drug discovery, as well as advances in regenerative and personalised medicine. Engineering was the only sector to register no negative sentiment for 2025.

How do you anticipate office occupier demand from the following industries performing in 2025?