The Global Financial Crisis (GFC) has been the largest factor shaping housing development over the past two decades. Following the global economic downturn, most countries experienced a slowdown in residential construction. The fall in the number of building permits ranged from just 7% in Russia to a staggering 97% in Spain. Similarly, prices fell almost everywhere, from as little as 3.0% in Belgium and Malaysia to as much as 40% in Spain and the US.

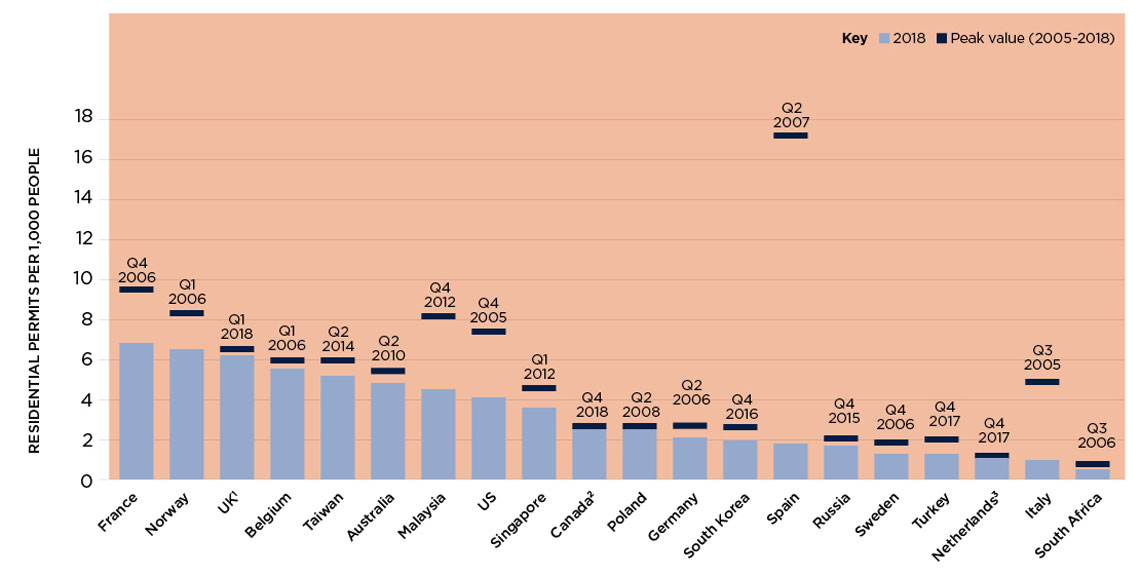

We analysed 20 countries to understand where the highest number of homes are being built and whether construction is rising or falling.

Where is most building taking place?

On an absolute basis, the US had the highest number of residential permits approved in 2018, totalling more than 1.3 million. However, this is primarily due to its large population. The more insightful data is permits per capita. In this respect, the US ranks eighth with 4.1 approvals per 1,000 people.

France heads this list with 6.8 permit approvals per 1,000 people, closely followed by Norway and the UK at 6.5 and 6.2 respectively.

Conversely, in South Africa, the challenges of slow economic growth and high unemployment have resulted in low levels of house building, leaving the country bottom of the list.

Residential permits per 1,000 people: 2018 values vs peak values

Note: 1. UK, data from Q4 2007 onwards 2. Canada, data from Q4 2018 onwards 3. Netherlands, data from Q3 2013 onwards. Source: Savills Research

UK vs France: comparison in construction

In 2011, the number of approvals per capita in France was two and a half times higher than the UK. Now, that figure is just 1.1 times, which creates an interesting comparison between the two countries in terms of house building.

Housing stock in France has been increasing at nearly double the rate of population growth, driven by government incentives to real estate investment and first-time buyers. Activity has now started slowing due to weaker economic growth and the end of certain tax exemptions.

In the UK, the number of housing approvals increased steadily from 2013, accelerating in 2017 following government efforts to increase supply and improve affordability for first-time buyers. Similarly, activity has now also begun to slow.

The impact on prices is telling. In France, where residential construction has consistently been higher on a per capita basis, prices have been relatively more stable. In the UK, prices have been more volatile.

Rate of housing approvals and price changes in France and the UK

Changing fortunes: Singapore, Spain, Malaysia

In 2018, Singapore had the biggest increase in approvals per capita, increasing to 3.5 per 1,000 people from a low of 0.7. This coincides with house prices rising, although not at the same rate, after falling for four years. However, the permit numbers in 2019 have already begun to slow, indicating the rapid increase is unlikely to continue.

Spain, on the other hand, is on an upward trajectory that looks likely to continue, albeit after very dramatic falls. The country had one of the highest levels of residential development prior to the GFC and one of the most severe drops following it. Similarly, house prices also had one of the largest falls.

There are now signs that construction of new homes is starting to pick up again as developers return to the market. In 2018, 1.75 new dwellings permits per 1,000 people were granted across the country, an increase of 29% from 2017.

Between 2017 and 2018, the biggest fall in residential approvals per capita happened in Malaysia as house price growth plateaued following nearly a decade of growth and high development activity. There are concerns around an oversupply in the market, but recent government policy to encourage homeownership is expected to provide an opportunity for developers to clear some existing stock.

Change in residential approvals per capita across the world (2018 v 2017)

Why does development matter?

The residential building industry is critical to a country’s economy and what happens to property prices. How the industry operates can differ significantly by country. In most, a combination of the private and public sector is responsible for housing delivery, and building regulations often vary by district as well as by country.

The relationship between house prices and residential construction is delicate. Price movements can often be boiled down to supply and demand fundamentals. Demand does vary by country, depending on factors such as economic stability, mortgage availability and migration policies. However, the world’s population is increasing, which creates constant demand for housing. Over the past decade, the global population grew 12% and is forecast to continue rising by 10% over the next decade.

Therefore, the supply – the number of properties being built – can often tip the balance. Too little supply can create a sellers’ market and typically values will rise. Too much supply will shift the favour to buyers and can cause price falls. A balance is essential and enough homes need to be built to meet demand from a range of occupiers. Striking the right balance will invariably require a mix of private and public sector funded development.

Outlook

Rising populations, rapid urbanisation, and low interest rates will continue to drive the residential construction market globally. However, there are headwinds as the global economy slows. The governments of individual countries will need to find the right policies to enable the construction of enough housing for the growing demand.

There is a global drive to increase productivity in the sector and new technology is likely to be the solution. Modular construction methods have already proven to reduce construction time and there is an expectation that once scale is reached, costs will fall too. Increased productivity will need to be balanced with environmental factors as the rising awareness of the climate crisis is resulting in a global focus on sustainability.