Our survey of research heads across Savills global network provides a view on 2022 for investment, leasing and the importance of ESG across 36 cities globally. The findings point to the resilience of real estate in an era of accelerated change and evolution, rather than revolution, in the wake of the pandemic.

1. Outlook for yields

Most Savills research heads expect prime yields to remain static over the 12 months to Q2 2022, but there are exceptions. For industrial and residential, more respondents expect yields to move in than to remain static or rise, reflecting investor interest in these sectors. Offices show resilience from an investor perspective, with 97% of our researchers anticipating yields to remain static or fall.

Prime yields: direction of travel Q2 2021 to Q2 2022

2. Tech occupiers to drive leasing activity

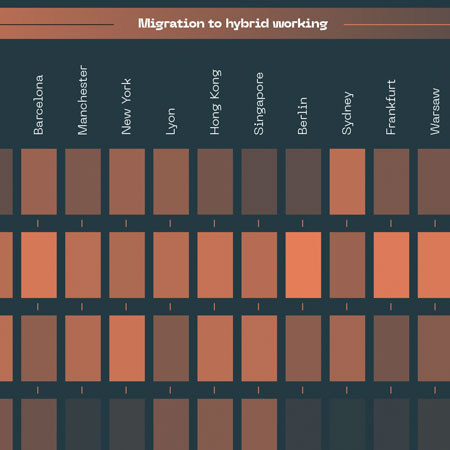

Savills research heads expect to see office leasing activity comparable with pre-pandemic levels by 2022 – but this varies by city. Those in emerging markets such as China, Indonesia and Vietnam are the most bullish on leasing activity, spurred by strong economic growth and a slower shift to flexible working. Tech occupiers are expected to lead demand across the board, with 79% of respondents anticipating higher leasing activity than in 2019. In spite of embracing flexible working practices, the office will remain integral to tech companies.

Office leasing activity compared to pre-pandemic levels (2022 vs 2019)

3. Sustainability matters

75% of Savills research heads indicated that sustainability is an important consideration for investors. Cities in Asia-Pacific dominate those where it is not yet deemed important, such as Hong Kong, Tokyo, Jakarta and Seoul. Given the significance of the ESG agenda, it is unlikely to be long before they do. Company reputation is the strongest motivation behind sustainable investment, cited by 54% of respondents as significant, while 46% indicated the opportunity to increase returns was also an important motivator.

Motivations for sustainable investment

4. Share of international capital to rise

Investment is predicted to become more international as travel restrictions ease. In 2022, research heads expect, on average, 47% of all investment to come from international investors (of which just under half from neighbouring countries).

Note Average across respondents Source Savills Research

5. Offices rule, beds and sheds in demand

Offices, the largest real estate sector, will remain in demand. In more than half of cities surveyed, offices are expected to be the dominant asset class for investment in 2022. In Shenzhen, Beijing, Guangzhou and Seoul, 60% of all investment is expected to flow into this sector.

Logistics and residential are the next top picks as investors pivot to ‘beds and sheds’ strategies, with investors in North America in particular expected to favour residential, the world’s biggest market for investable product in this space.

Dominant asset class for investment, for selected cities, in 2022