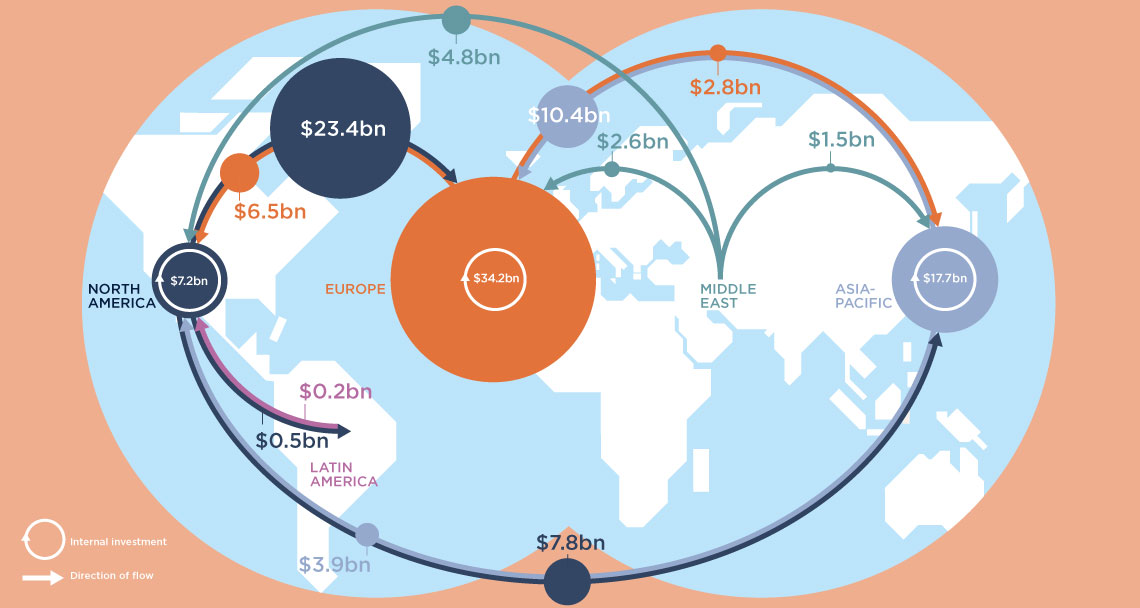

Cross-border global capital flows (H1 2019)

Source: Savills Research using RCA

With US$1.8 trillion invested worldwide, 2018 was the most active year ever in the global real estate market. Investment volumes slowed in the first quarter of 2019 as political and economic uncertainty impacted the market. However, activity picked up in the second quarter, leaving volumes at the half-year mark just slightly below the same period in 2018.

Despite the slight dip in investment volumes, values have remained stable. “The fall in volume is not due to people not wanting real estate,” says Rasheed Hassan, head of Savills Cross Border Investment. “We are seeing demand for everything, provided the price is right. The search for income-producing assets is a key driver of the market and investors are typically buying to hold, which is limiting stock levels.”

Region-by-region investment

Cross-border capital flows have also slowed. During the first six months of 2019, volumes were 20% below the same period in 2018. The biggest fall by value were outbound flows from Europe, with US$43.8 billion invested in H1 2019, a 26% fall compared with the same period last year. However, investments from Europe to Asia-Pacific actually increased 67% over this period, albeit off a low base, now accounting for 6% of all cross-border European investment.

This is part of a wider trend as inbound cross-border investment to Asia-Pacific increased 14% in H1 2019 compared with H1 2018. Investment in Asia-Pacific increased from all regions with the exception of North America, although the largest investment is from closer to home with 59% of cross-border capital flowing into Asia-Pacific coming from neighbouring countries. This was driven by flows from investors based in Hong Kong into markets such as mainland China, Japan and Singapore.

Despite the fall in activity in Europe, the largest cross-border investment flow was still within European borders, with European countries investing $34 billion in their neighbours’ real estate in H1 2019.

The busiest route for money across regions was from North America to Europe. The UK was the most popular country for capital, followed by Germany.

The Middle East stands out as the only region to see outbound investment increase as interest in global real estate strengthens across the region. A total of US$8.9 billion crossed borders in H1 2019, an increase of 62% compared with the same period in 2018. North America was the largest recipient of this capital and offices was the sector of choice.

Leading cities by investment

By city, New York was the most popular place for real estate investment, with US$33 billion of capital invested in the first six months of 2019. The majority of the money was domestic with just 15% coming from overseas. Paris was in fifth place for total investment volumes and highest for cross border activity, as South Korean investment, in particular, focused on the city.

In sixth place was London, with 58% of investment coming from overseas. Although investment volumes have fallen across the city following the lingering uncertainty over Brexit, the fundamental drivers that make London attractive remain sound. Additionally, as the pound weakens, it opens up currency play opportunities for investors, particularly those looking for a long holding period.

Outside the US, Hong Kong had the highest level of investment, coming in fourth place. Despite its high global ranking, volumes have fallen over the past year as the on-going US and China trade tensions and the political unrest over the proposed Extradition Bill, have hit investment sentiment.

Top cities by international and domestic investment volume, H1 2019

Outlook

The global economic uncertainty looks set to continue in the short to medium term. The International Monetary Fund has cut its growth forecasts for the global economy for this year and the next. Among other things, the trade tensions between China and the US and a potential no-deal Brexit are contributing to heightened uncertainty.

On the flip side, interest rates are expected to remain low or even be cut in some cases and there is little distress in the market. The search for yield continues and the comparatively attractive returns real estate can offer keeps demand high. Although investment volumes are unlikely to reach the highs of 2018, it’s not unimaginable that 2019 activity could be in line with the US$1.7 trillion invested in 2017.

Demand is likely to be highest for the best-in-class assets. “People don’t want average,” says Hassan. “There is fierce competition for prime stock and we expect top-grade assets in the best locations to continue to attract multiple bids.”