Warehousing has been a sector in the spotlight in recent years; a beneficiary of a booming logistics industry and the global diversification of manufacturing. That fuelled significant rises in warehousing property costs, but we’re now seeing growth slow.

In the first half of 2024, global prime warehousing costs increased by just 1.7%, marking the third consecutive six-month period of decelerating growth. On an annual basis, costs rose by 5.2%, a significant drop from the 9.0% growth observed a year earlier. This trend reflects higher supply and more moderate demand following exceptional cost growth post-pandemic.

These averages mask significant regional variations. While 74% of markets recorded growth, particularly in Europe and Asia, many US and Chinese markets saw costs fall as tenant demand weakened and supply increased. Despite these fluctuations, structural drivers of demand remain positive for the sector; e-commerce penetration has largely held firm after the pandemic, while the reorientation of global supply chains continues.

Average global growth in prime warehousing costs (prime rents plus taxes and service charges)

Source: Savills Research. Average of cost growth across 54 global markets, change calculated in local currency.

London leads the pack

London remains the most expensive market for prime warehousing property occupier costs, at $44 per square foot (rent, plus taxes and service charges). Kevin Mofid, Savills Head of EMEA Logistics Research, explains “Whilst a gentle increase in vacancy has taken some of the pressure out of the market, it is a region with constrained land supply, many competing uses and a broad church of occupiers in competition for the best space. A large population and increasing online retail penetration rates continue to drive demand for good quality space.”

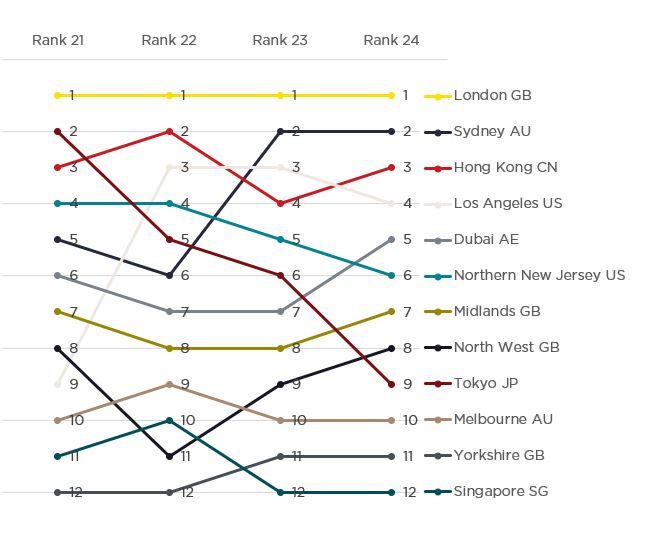

Dubai has climbed to the fifth position, with costs increasing by 15% year-on-year as of June 2024, due to a shortage of quality stock and rising demand from the non-oil sector.

Conversely, Los Angeles and Northern New Jersey, the two US cities in the top 12, each dropped a position with total costs falling by 9.5% and 7.1%, respectively. This came amid rising vacancy rates and more subdued tenant demand. Tokyo has also fallen to ninth place in this US dollar cost comparison, primarily due to a weaker yen and faster rental growth in other markets.

Top 12 warehousing markets by cost, 2021 – 2024

Source: Savills Research. Total costs converted to USD at prevailing exchange rates

Nearshoring beneficiaries see cost increases

Moving beyond the top 12, Monterrey (ranked 32nd) saw warehousing costs surge 28.4% in the 12 months to June 2024, as Mexico surpassed China to become the largest exporter to the US. This shift is part of a broader trend of companies diversifying away from China, adopting a ‘China plus one’ strategy that has benefited markets like Mexico and Vietnam.

Australian markets also experienced high cost growth, most notably in Perth, where vacancy rates are exceptionally low. The US, by contrast, is transitioning to a more balanced market and costs are falling, although rents remain significantly higher than pre-pandemic levels.

In Asia, the Chinese market has been characterised by high supply in recent years, prompting developers to lower rents. The region continues to offer the best value for warehousing space, most notably in the major Vietnamese cities ($5.50 per sq ft), and Indian cities (averaging $3.90 per sq ft). The title for lowest cost market goes to China, however; costs in the inland city of Chengdu stand at just $3.40 per sq ft.

Change in warehousing property costs, June 2023 – June 2024

Source: Savills Research.

Prime warehousing costs, June 2024

Source: Savills Research.