November 2018

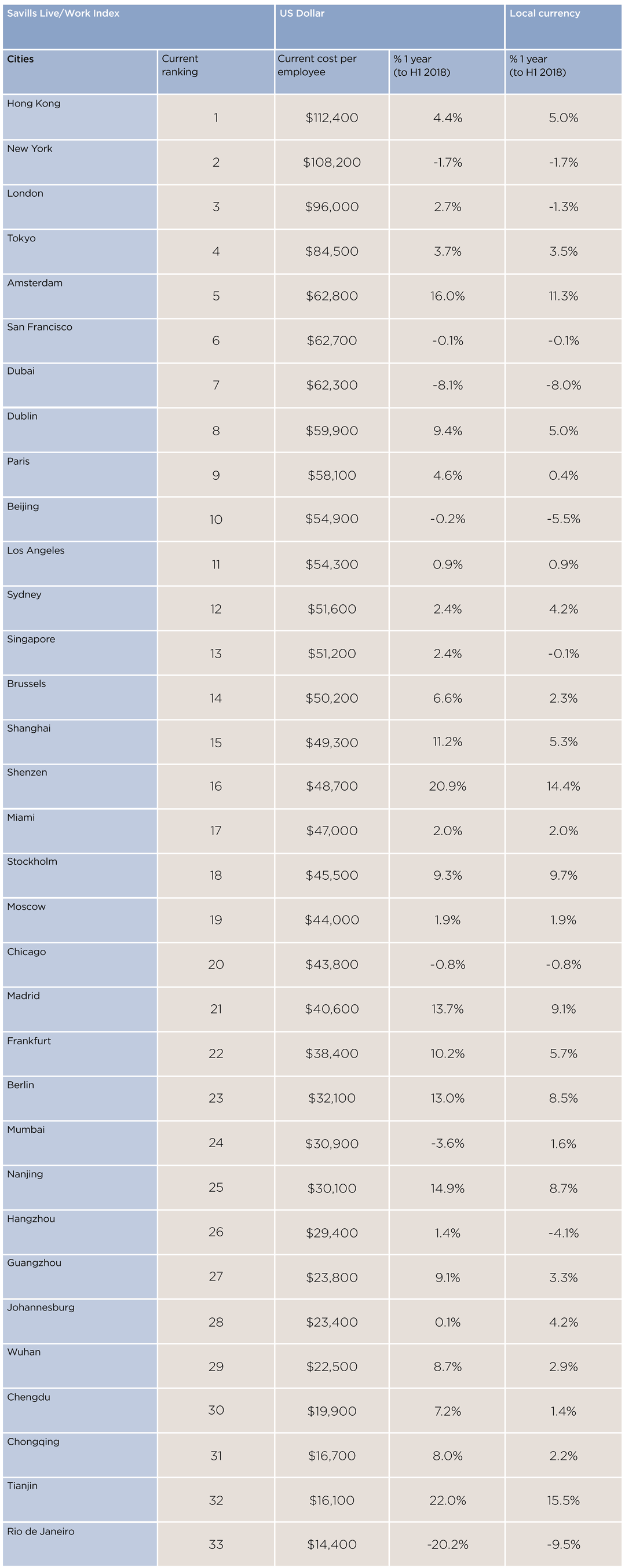

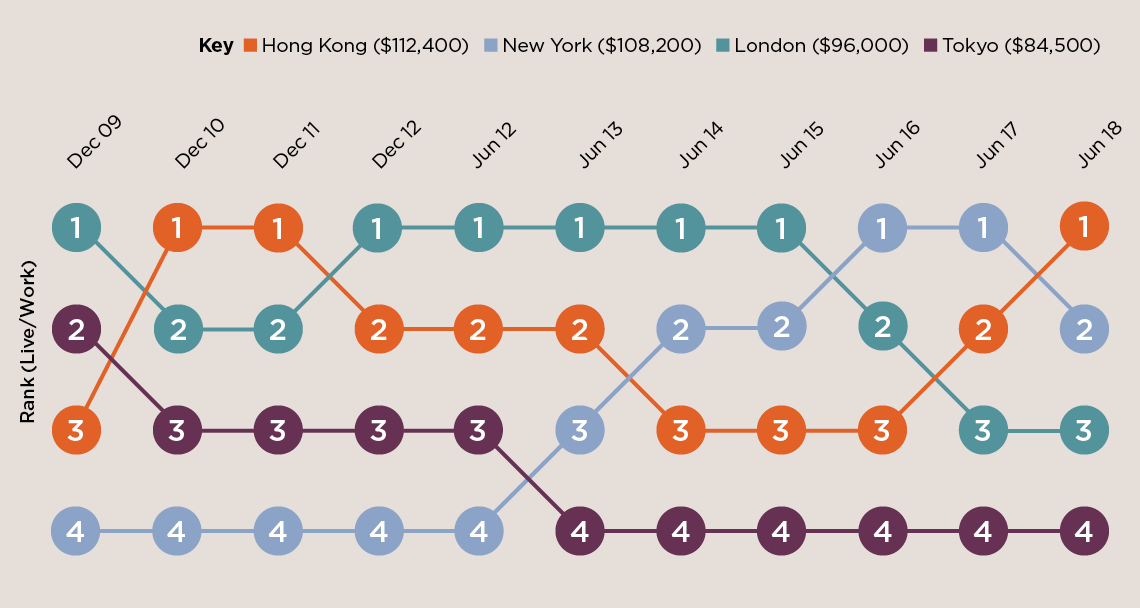

For the first time since 2011, Hong Kong is the most expensive city in the Savills Live/Work Index. The report is based on the costs per employee of renting residential and commercial space and is, therefore, an indicator for organisations of the costs of doing business in different global cities.

Rises in residential rents were the main driver for moving Hong Kong to top place, especially in core prime markets, such as Southside, where supply is limited. Office rents have also been rising due to demand from mainland firms as well as new tech (notably fintech) and co-working operators. As such, Hong Kong’s real estate costs per employee grew 4.4% in US dollar terms in the year to H1 2018, to $112,400.

New York and London

New York fell to second place at $108,200, down 1.7% (year to H1 2018). Here, residential rents have continued on a slight downward trend, especially for prime properties, as the market experiences a supply glut. Prime office rents have also been in a slight downturn as employers in the city are continuing to shrink their footprint and ‘densify’ their office space.

The rise of co-working has also coincided with landlords attempting to differentiate their assets. Notably in areas such as Midtown, activity in new build and renovated prime buildings has been strong, but demand is struggling to keep up with supply.

London remained broadly static, experiencing a slight decline of 1.3% in local terms, but remaining in third place. Affordability and Brexit uncertainty continues to impact market sentiment.

Although, London remains by far the most expensive European city in which to accommodate workers, the gap is beginning to close, thanks to fast-growing city economies fuelling rent rises, and a strengthening Euro making cities in the currency union more expensive for occupiers from outside the Eurozone.

Amsterdam on the rise

Amsterdam is now the second most expensive European city, after costs shot up 16% in dollar terms over the past year (11.3% in local currency terms), driven largely by rising residential costs. The annual per employee cost now stands at US$62,800 (still around a third cheaper than London), and continues to rise.

Other European cities are also coming under the Brexit spotlight. In the top 10, Dublin has seen costs rise by 9.4% to US$59,900 per annum, while Paris has seen a rise of 4.6% to US$58,100. Lower down the table, Brussels, Stockholm, Madrid, Frankfurt and Berlin have all seen costs rise well above the index average of 5.2 per cent, but, for now, still represent relative value compared to the index leaders.

Fast-growing Chinese cities

Looking to Asia, Hong Kong is in a league of its own in terms of costs. But mainland Chinese cities have risen rapidly up the rankings over recent years – the most expensive being Beijing. Here, total rental costs are US$54,900 per person, down 0.2 per cent (-5.5% in local currency) year on year as measures aimed to stabilise the market stay in place.

Shenzhen has risen four places to 16th in the index – experiencing one of the largest Live/Work cost increases overall. Totals here rose by 14.4% in local currency and 20.9% in dollar terms, to US$48,700, just behind Shanghai at US$49,300. Population growth caused by internal migration means residential rents in Shenzhen continue to trend upwards, while demand for office space also remains high – particularly from the financial, professional services, high-tech and advanced manufacturing sectors, as well as co-working operators.

Rental growth in other Chinese cities has ranged from 8.0% in Chongqing to 22% in Tianjin – the highest rate of growth in the index. Despite this growth, the per employee Live/Work bill in Tianjin is still just a little over one-seventh of the cost in Hong Kong.

The cost of accommodation is only one driver when companies are deciding where to locate office hubs. But this analysis gives insight into the shifting relationship between world cities over time.

Rising costs for residential and commercial space are a barometer of a city’s success at a point in time, but the mid- to long-term fundamentals of a city and its country’s broader economy are the best guide to likely future occupier costs as well as yields for investors.

The fact that London has retained its significant lead over other European cities, despite high levels of uncertainty surrounding Brexit, points to its fundamental appeal as a place to live and do business.

The Live/Work Index H1 2018

Source: Savills World Research

The top four cities over time

Source: Savills World Research

Methodology: These costs are formulated using a core business unit measure: the Savills Executive Unit. This is a seven-person strong staff team, representative of a start-up business, designed to be a comparable measure across all cities. For the Live/Work Index, we have measured costs for two teams, one based in a prime financial sector location, the other in a secondary/creative location to give a representative cross-city costing. The Savills Live/Work Index measures the annual per person cost of renting and occupying both home and office space in key world cities, taking an average across the Savills Executive Unit.