Warehouses are an asset class in vogue. Across the globe, surging online retail sales, accelerated during the pandemic, have fuelled occupier demand for warehousing space.

Investors and developers have followed suit. Businesses and manufacturers have had to adapt to rapidly evolving consumer trends and production techniques, not to mention supply chain disruption in the wake of the pandemic. In response, they are demanding smarter space in a wider range of locations.

The cost of this space varies significantly across the world and can be an important factor in occupier location and expansion decisions. Whether a third party logistics provider (3PL), ecommerce retailer, business or manufacturer, the cost of warehousing to serve an increasingly dynamic supply chain matters.

High property cost markets

We’ve analysed warehousing property costs in 54 markets across 21 countries. In addition to rents, we’ve also factored in taxes and service charges which, on average, account for 19% of total property costs.

Warehousing property costs are highest in the largest world cities where big populations and constrained land supply meet high demand from consumers and businesses. Four markets stand above the rest: London, Tokyo, Hong Kong and Singapore. All have total costs well above $20 per sq ft (see chart).

The highest combined warehousing property costs globally (rent + service charges + taxes) are in London, and total $32 per sq ft. Soaring take-up from ecommerce business and higher levels of stockpiling saw vacancy rates fall to 3.49% in London and the South East in 2020, the lowest level since 2016.

Tokyo tops the league for rents alone, at $25 per sq ft. Here, vacancy rates stand at just 0.4%, and rental growth was close to 7% in Greater Tokyo in the year to September 2020.

In these land-constrained world cities, warehousing competes with other use classes including data centres, another sector which has seen a pandemic boost. Prime sites are being intensified with multistorey buildings in response. In Tokyo, ESR’s six-storey Amagasaki Distribution Centre completed in June last year. At 390,000 sq m it is the largest logistics building in Asia-Pacific.

Other high-cost markets for warehousing property are Sydney (5th), New York (6th), Dubai (7th), Beijing (8th) and Los Angeles (9th).

Lower property cost markets

The lowest warehousing property costs can be found in India, at between $3 and $4 per sq ft. Lower ecommerce penetration rates (just 5%) and a less developed manufacturing sector mean that India has yet to see the same development as other markets, but its potential is vast.

“India’s population is forecast to rise to 1.5 billion by 2030, by which point it will have overtaken China to become the world’s most populous,” says Arvind Nandan, Managing Director of Research and Consulting, Savills India. “Urbanisation is bringing hundreds of millions more people to cities, with associated new infrastructure investment supporting the development of logistics hubs.”

Warehousing property costs around the world

Source: Savills Research

Additional costs: labour and energy

Property costs don’t tell the whole story. Labour costs are typically the single largest component of a warehousing operation, usually making up more than half of all operational costs. They average $11 per employee per hour across the markets we have studied. Electricity and diesel costs, for the running of buildings and vehicle fleets, are also a major factor in warehousing operations.

We’ve combined these three costs to show total warehousing operation costs by location (warehouse labour costs per hour, electricity prices per kilowatt hour and diesel prices per litre). A higher weighting is given to labour costs as the primary cost component for occupiers.

Value in Vietnam

Very low labour costs coupled with extremely low energy costs make operations in Vietnam the cheapest location of our sample, led by Hanoi. These low costs make Vietnam highly attractive to multinationals setting up operations in the country, but the government is actively targeting higher value companies.

“The government has been investing heavily in all manner of infrastructure while promoting industrial clusters to attract businesses higher up the value chain,” says Troy Griffiths, Deputy Managing Director of Savills Vietnam. “High levels of corporate taxation relief are also available to ensure healthy regional competition.”

India, also characterised by very low warehousing property costs, is the second cheapest location in our sample.

In the UAE, warehousing property and electricity costs are higher than in India and Vietnam, but these are offset by the lowest diesel costs of our sample, contributing to its position as one of the cheapest locations for warehousing operations globally.

The UAE has seen stable warehousing occupancy and rents, with take-up led by ecommerce companies. Underlining the importance of quality infrastructure, Swapnil Pillai, Associate Director of Savills Middle East Research says: “End-user demand is likely to remain strong for automated build-to-suit, temperature-controlled centres with high-quality specs and new technologies.”

The cost of space in Europe

Turning to Europe, labour costs are the key differentiating factor between Central and Eastern and Western Europe. Low labour costs in Poland mean total warehousing costs are comparable to those of China. In Western Europe, high labour costs in Sweden and Germany mean cities from these countries account for six of the top 10 most expensive locations by total cost.

Looking ahead, pressure on costs will remain. The booming ecommerce sector is driving demand in a majority of markets, although this will be offset to a degree by bricks and mortar retailers scaling back operations. With many occupiers operating in crisis mode during the pandemic, 2021 should see a return to longer-term strategies.

ESG and longer-term strategies

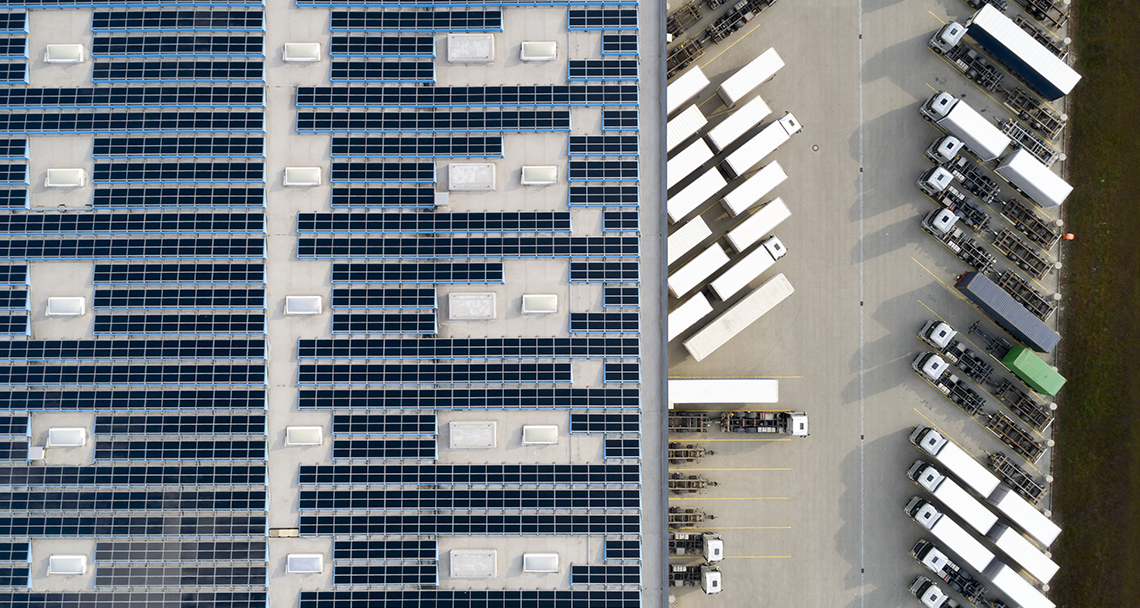

Cost alone is not the only driver of location strategy. The shift to low carbon technologies means that the need for high capacity power supplies has increased and will continue to rise as we embrace automation, electric vehicles and heat pumps.

“Reliable power and grid infrastructure – from a low carbon source – is becoming essential to occupier requirements,” says Thomas McMillan, Head of Savills Energy Consulting.

“Large grid connections with the ability to import and export electricity help to futureproof for low carbon technological advances, while helping to meet corporate and government environmental targets.”

Long-term strategies will include ever greater emphasis on the ESG agenda. Warehouses are becoming more sophisticated than ever, offering greater operational efficiencies, improved environmental credentials, and better workplace environments.

Online retailers are leading the way in reducing their carbon footprint, and are demanding warehouses that meet tough environmental criteria, leaving older assets that don’t at risk of a ‘brown discount’. This is likely to further pivot occupier demand to high-quality Grade A space, with costs increasing to match the higher-quality stock on offer.

Property, labour and energy costs index