Investors have been increasing allocations to real estate across all regions, both structurally, as they see that real estate plays a key role in diversifying a multi-asset portfolio, but also because the fixed income market is generating very low returns.

This is a particular driver for investors with lower domestic yields. In Japan, where government bond yields are typically negative, there is strong motivation for investors to look overseas.

We have also seen US investors looking at Europe and Asia-Pacific, and they tend to view further up the risk spectrum than regional counterparts. Some are looking at core funds, but they are in the minority.

At the same time, more Europeans have been heading to Asia, attracted by exposure to the structural growth characteristics and the region’s demographics.

The consequence of Covid-19

Having said this, the synchronised economic shock from the Covid-19 pandemic has churned the real estate markets and is likely to have short-term implications for real estate strategies and capital flows. The investment market saw a meaningful fall off in transaction volumes globally since the beginning of March. This is due to weaker activity on both the supply side, measured by deals coming to the market, and the demand side, measured by confidentiality agreements signed.

Until the spread of Covid-19 is contained and restrictions on movements are relaxed, investment activity in global real estate is likely to remain very subdued. Domestic capital flows are likely to benefit first from the easing of restrictions.

The large falls in equity markets may see allocations to real estate exceed specified thresholds, thereby constraining further capital deployment. Although forced sales have so far been limited, investors tend to divest abroad first and return their focus to their domestic markets.

Of course, real estate markets will be dictated by the size and the duration of economic disruption, which itself will also be influenced by the quantum of defaults (both tenant and banking covenants) and the impact on employment. Short-term concerns about the global economy may also affect capital raising activities.

Roadmap to recovery

Risk aversion is likely to drive some short-term tightening in the credit market, which highlights the importance of secure income streams and reducing exposure to over-leveraged strategies.

An analysis of global office markets by RCA indicates that, on average, markets with higher average liquidity tended to be the first to recover their pre-crisis pricing. To investors in these markets, this should provide some comfort and also justify the potentially higher prices paid for assets in the most liquid markets.

Despite this, real estate has not lost its attraction compared with other asset classes. Volatility in equity markets has increased due to the global turmoil and bond yields seem set to remain lower for even longer in the context of lowered policy rates and resumed quantitative easing (QE) programmes by the major central banks globally.

While there will be some near-term challenges in deploying capital, there is, nonetheless, a huge amount of dry powder. According to INREV, the amount of capital raised last year for new investments into real estate reached more than €200 billion, the highest level on record, of which 39% was not deployed at the end of 2019.

The risk-off sentiment and tighter credit environment also presents other opportunities, such as for alternative lenders or debt funds given the lack of such products in Asia at the moment.

Investment flow from South Korea

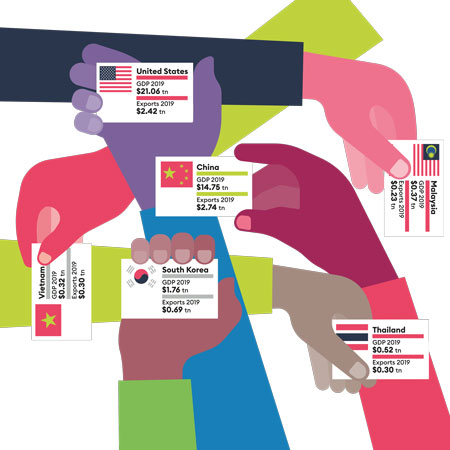

As economies and real estate markets begin to return to some degree of stability, we expect the strong flows from South Korea into Europe to continue. The size of their savings pools are large and growing quickly, and have outgrown the ability of their domestic real estate market to absorb them. It is key for them to look overseas.

There will likely to be significant competition for good assets at that point. Investors are increasingly relying on third parties with a strong local presence to help them access deals.

They are also controlling risk by diversification through region and sub-region, by having good teams on the ground to help them invest and manage the assets, and by a judicious approach to leverage. In the past, cycles have been exacerbated by the magnetic effect that real estate seems to have towards leverage. These days, investors are more conservative in approach.

Alternative approaches

With real estate moving towards more operational business models, levels of international experience are also dictating what risk investors are taking in newer alternative sectors, such as private rented residential and student housing.

Investors who have not invested in European real estate before, for example, will still take a more traditional approach to building up an exposure to the established sectors first. Those who have a substantial invested portfolio overseas will be looking to counter the lower yields for office and logistics by investing in alternative sectors that could potentially achieve higher yields. Many of these newer sectors are driven by structural factors other than the cyclical health of the economy.