November 2018

1. Digital revolution

Online short-let rental services, such as HomeAway, have expanded rapidly and are increasingly competing with the hotel sector. Instant booking, mobile platforms, feedback and rating systems make these services appealing to tech-savvy millennials, time-poor business travellers, and globally mobile students and professionals. This has helped diversify and broaden the demand base beyond the traditional holiday rental market, providing more opportunity for owners to let on a full or part-time basis.

2. A source of income

In a low-interest rate environment, investors of all types are seeking out income-generating assets. Today’s second-home buyers need properties to work for them financially and, increasingly, to make them a profit. The majority of buyers today purchase their property with the intention of renting it out in some form. The number of buyers intending to use their property solely for their own use has fallen from more than 90% in 1971 to less than 40% today.

3. Demand for market intelligence & new services

Forty-five per cent of owners want their property to at least earn its keep when they are not using it. These buyers are going to want to know about achievable rates, letting voids and operating costs in advance of purchase. They are also an increasing source of demand for letting and management services (both digital and conventional) as well as on-the-ground hosting/hospitality/housekeeping services.

4. Changing finance

Demand for smaller, cheaper properties has grown since 2013 as a wider variety of buyers has returned to the market. Immediately after the global financial crisis (GFC), the market retreated to prime, established locations and was led by wealthy, capital-rich individuals with little or no reliance on mortgages or other borrowing. The gradual easing of credit conditions since then has led to a modest resurgence of borrowing, but nothing to rival the early noughties.

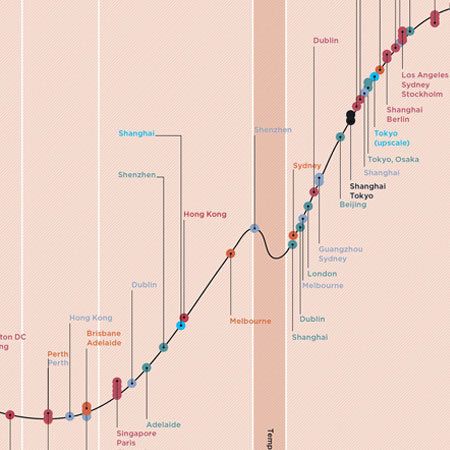

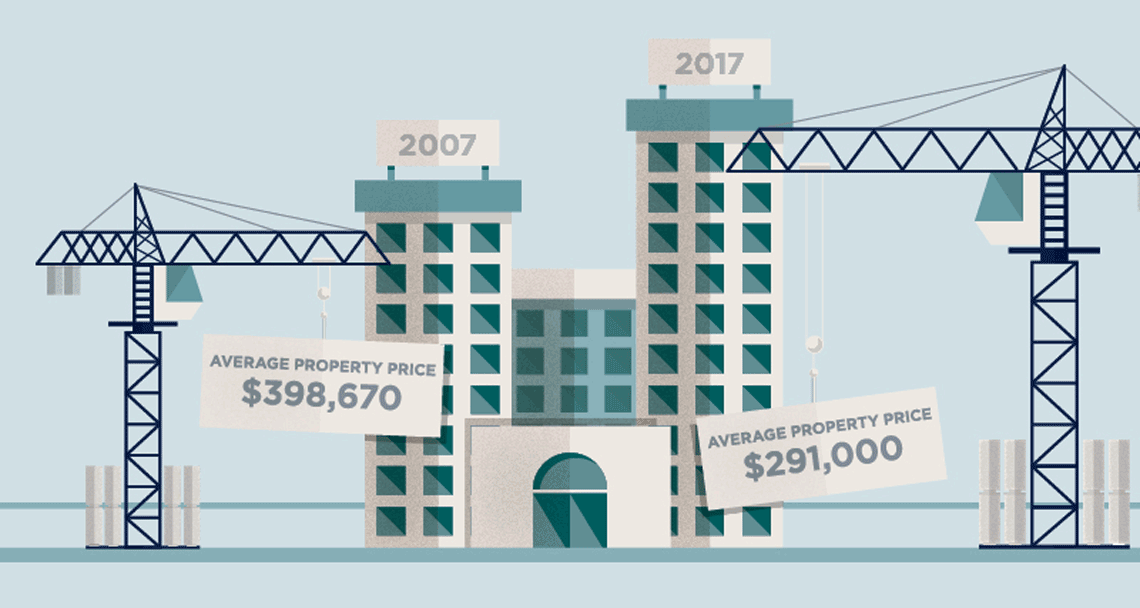

5. Cheaper apartments are on the rise

As lending has opened up again, and at record low rates, the lower tiers of the market are expanding. In 2017, 37% of sales were of properties priced under $200,000. Based on our survey sample, the average price of a property purchased last year stood at $291,000, 37% lower than a decade prior. This has gone hand-in-hand with the expansion of the apartment market, which accounted for 34% of the properties purchased in our sample in 2017, compared with 26% in 2007.

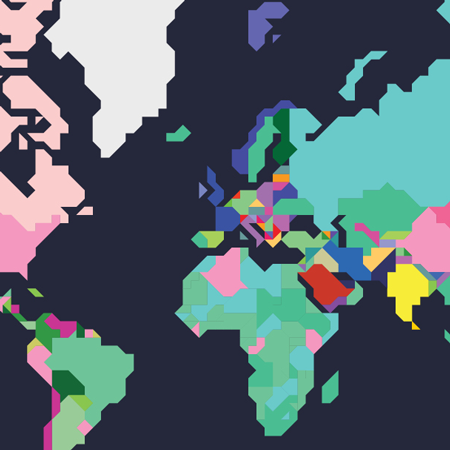

6. A global market

British buyers dominated the European second-home market in the years preceding the GFC, accounting for 29% of second-home buyers in 2007 (based on our sample). Today, a much wider range of nationalities are participating in the global second homes market. In 2017, the British share dropped to 17% of buyers as the demand base diversified. British activity is now back to where it was a decade ago, but other national groups have risen faster. The number of Dutch purchasers has doubled over the same period, for example.

7 . Spain is back

Spain has grown in appeal as its housing market recovery continues. It accounted for just over 21% of all sales within Europe last year, up from 2011, a low, when its share was just 11%. Back on the radar for many prospective buyers, Spain was cited as the top foreign destination for their next investment by the British, Dutch, Germans, Italians and Portuguese survey respondents, among others.

8. Air connectivity matters

Air routes continue to have a profound impact on where people want to go and where people want to buy. While the opening up of new routes can have a strong positive impact on local property markets, so too can route closures – or the threat of them. So, the fortunes of some second-home owners are intimately connected to the fortunes of flight operators. Those on routes served by multiple airlines are probably less exposed.

9. Home sweet home

A major trend has been the tendency for buyers to purchase in their home country rather than abroad. This is particularly true of British buyers. In the last three years, some 39% of Brits in our sample bought their short-let property in the UK. Only 14% bought at home in the years preceding the 2007 GFC. We think this is a trend that is likely to continue as properties are easier to visit, manage and service if they are in the same country as the owners who are seeking to maximise income.

For a more in-depth look at the second-home market, read our latest Spotlight Second Homes: global trends in ownership and renting.