The structural shift we’ve seen in the office market in recent years is not simply the result of pandemic-enforced work-from-home policies. It also reflects a broader recalibration of workforce priorities and lifestyles – alongside pressing environmental, social and governance (ESG) concerns.

Much of the world’s existing office stock needs to adapt to meet the evolving needs of businesses, individuals and cities – so owners have decisions to make. Those confident in the appeal of their well-located stock will still need to innovate to appeal to workers. At the other end of the spectrum, some will need to give their space a second life and repurpose to optimise value.

Woven through both these options is a strong need to meet high environmental standards – both to remain relevant with occupiers and meet growing regulatory requirements – at a time when economic viability is challenged.

Global differences in office occupancy

Although the debate about the changing office is global, its impact is anything but uniform. Cultural differences, housing costs, commuting expenses and social norms influence a dynamic landscape across Europe, Asia and the Americas.

Asia has the highest office occupancy rates, at an average of 88%, followed by Europe. The US lags, with cities such as San Francisco and Los Angeles still below 50% occupancy.

Simon Raper, Savills Head of Workplace Strategy for APAC and Singapore, says: “Even within the same organisation, there’s a need for flexibility as cultural nuances necessitate adjustments from country to country.

“Understanding these differences is crucial for corporations – particularly as some contemplate relocating to meet changing workplace design requirements; environmental upgrades due to more stringent regulation; or employment demands driven by economic recovery.”

As an example, in China and Hong Kong, intergenerational living and smaller homes drive people into the office. In contrast, traditional working models in Japan coexist with flexible arrangements due to high commuting costs, and younger generations are embracing this flexibility.

In Europe, Germany and France have mainly stayed in the office as the cultural preference is for face-to-face interaction and collaboration – although younger generations are pushing for more flexibility. In contrast, in Sweden, innovative policies such as “no-meeting Fridays” acknowledge the importance of autonomy and flexibility in the workplace.

Average office utilisation rate by region

Source: Savills Research

Office amenities to ‘earn the commute’

In the US, where attendance rates are the lowest globally, companies strive to “earn the commute” through amenity-rich offices and perks. Here, commuting time and house prices are key factors because many workers relocated to more affordable areas and larger houses during the pandemic.

To be successful in this environment, companies need their offices to act as a magnet to attract and retain talent. Creating spaces that resonate with employees’ needs is a strategic imperative. Younger generations of workers prioritise wellness, professional development and meaningful experiences – all these need to be present if they are expected to turn up to the office regularly.

Companies with workspaces designed to prioritise flexibility, human scale and community can expect to see improvements to recruitment, retention, productivity and purpose. Many companies are already adopting and promoting these trends, including Savills (see box).

In Singapore, insurer Munich Re has created a “Together at work” approach, which supports remote work, but recognises the importance of the office as a place to bring teams together. It has combined flexible working practices with a workplace in which employees feel empowered and connected. This includes a choice of workspaces, adjustable workstations, and accessible and inclusive community areas.

Escape to the country and mixed use office spaces

In Portugal, the “countryside” surroundings of the Quinta da Fonte office park are now more of a selling point than when it was established in 1995. They also underscore its five pillars of work-life balance. This includes an amenity-rich environment with restaurants, gym and a spa, and promotes a thriving community by encouraging neighbouring companies to mix.

In the US, investment manager Jamestown is using a combination of tech-enabled common space, hospitality-style amenities and creative placemaking to develop enriching workplaces. At Raleigh Iron Works in North Carolina, the renovation of historic steel mills and warehouses means office workers are part of an innovation hub and community centre with a wide mix of uses including shopping, dining and living space.

West meets east at Savills NY HQ

Savills own New York headquarters is enticing employees back to their desks by importing some West Coast office culture. The 5,850 sq m Midtown office at 399 Park Avenue has cold brew on tap, high-end espresso machines, living walls and plants, a contemplation room and a wellness room. The workspace includes standing desks, 11 Zoom rooms, soundproof phones, plus various collaborative spaces, huddle rooms and a podcast studio.

This need for workplaces to change has led to a wave of office refurbishments across most major economies. With growing concerns about climate change, refurbishments must meet environmental regulations if they are to satisfy the growing demand from occupiers for high-quality, sustainable space.

In London’s West End, the refurbishment rate as a share of development space in the pipeline is expected to increase from 35% (10-year pre-pandemic average) to 43% (five-year average, 2023-2027).

In current market conditions, the need to invest capital expenditure into existing stock is challenging. This is more pronounced in European markets, where stock is often older – although in most locations, the definition of “prime” has narrowed to such an extent that a large proportion of younger office stock also needs upgrading to meet future environmental standards.

Refurb or repurpose? Creating green offices

The potential to achieve higher rents serves as a strong incentive for landlords and aligns with the projected upward trend in prime rental growth. However, not all offices will be able to follow this trajectory. For lower-grade stock, retrofitting to new standards may be prohibitively expensive: offices in less desirable business locations may never attract the tenants – and therefore the rents — to justify the investment. In these cases, repurposing becomes the obvious or only alternative.

James Evans, Savills UK National Head of Office Agency, says: “Businesses are driven by how they can attract the best people. Today, that’s in the top-grade building but not the second-grade one – so what do you do with that building?

“That’s a challenge for the existing landlord – but it can be exciting. We’re seeing some interesting alternative uses popping up in city centres, particularly around the education sector and hotels. In many instances this will be to the benefit of the wider location, as tired, half-empty offices can be transformed into more dynamic, energetic uses that will drive footfall.”

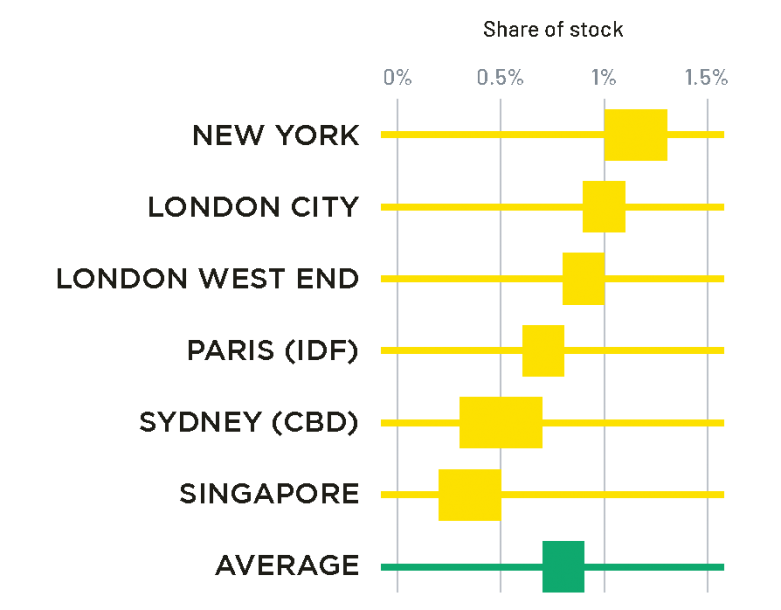

In its analysis of the demand-and-supply dynamics of six major global office markets, Savills estimates that between 0.7% and 0.9% of total office stock needs to be repurposed each year to strike a balanced market by 2033. In 2023 values, that equates to between 8.4 million and 10.5 million sq ft of the existing stock (0.98 trillion sq ft) – or between three and four Empire State Buildings across the five cities – annually, until 2033.

Annual office repurposing requirement by 2033

Source: Savills Research

The levels of repurposing required are not consistent across cities, however. New York could see the greatest transformation, with between 1.1% and 1.3% of office space needing to be repurposed into alternative uses each year to create equilibrium by 2033. In contrast, Sydney (0.3-0.7%) and Singapore (0.2-0.5%) have much lower requirements.

The scale of the change is a challenge, but the range of alternative uses is growing: housing, hotels, life sciences and education all feature highly. In Sydney, an Indonesian family office is repurposing the former 15-storey Bank of China building close to Wynard Station into a hotel in an AU$30 million redevelopment. In London, Oxford Properties has teamed up with UK lab specialist Pioneer Group to convert more than two-thirds of the 27,870 sq m Victoria House in Bloomsbury Square into a wet lab-enabled life sciences space.

Tobias Frenz, CEO, Munich Re Singapore

As the future of work evolves, collaborative workspaces, flexible working arrangements and sustainable environments have become the prevailing norm. A working environment which actively fosters all aspects of wellbeing leads to a stronger sense of belonging, and empowers our people to be their best selves. In designing Munich Re’s new workplace in Singapore, our vision was to create a space where employees feel connected and supported through a variety of spaces that cater to their diverse needs.

When you step into the office, there is flexibility and choice behind where you work. There are collaboration rooms for team meetings and focus pods for quiet concentration. Inclusivity is also a major consideration; height-adjustable standard workstations, automated entry doors, contactless exit buttons, and lowered pantry counters are examples of small but critical adjustments to ensure the workplace remains accessible to all.

Our commitment goes beyond functionality; it extends to sustainability. In selecting a building for our new office, we chose to be in a building which has a similar sustainability philosophy to our business. Within our office, we have deployed sensors and lighting timers to manage energy consumption more efficiently. Our pantries are fitted with water leak sensors to cut off water supply in the event of a leak. Our waste collection points mirror the building’s waste management process. With these collective efforts, we expect to reduce our carbon footprint by an estimated 30% over the next 5 years.

Public-sector support for sustainable offices

Any successful transition of office stock into a wider range of uses requires public-sector support. Governments, city administrations, policymakers and planners will play a pivotal role in shaping the future of workspaces – through incentives, changing land usage and supporting sustainable urban environments. Developers can also be encouraged to rethink ageing office stock through financial incentives for higher densification. New York offers a strong example of how the public sector can support the life cycle of offices in a city (see box).

Meanwhile in Singapore, the government is driving change through its Singapore’s Green Plan 2030, a long-term roadmap to make the city more sustainable and resilient. Retrofitting building stock is a key component of this, given that the flight to new, more sustainable buildings has led to rising vacancy rates in older Central Business District (CBD) buildings. The government has grants for green upgrades for buildings, as well as planning incentives such as encouraging a net increase in floor area intensification in mixed-use developments. This has the added benefit of bringing a mix of uses to enliven the CBD on weekends and after office hours.

Alan Cheong, Executive Director of Research and Consultancy at Savills Singapore, says: “Whether it’s the greening of older buildings or the repurposing of offices, the role of the government is key in achieving those aims. Singapore has offered incentives to certain areas with the hope that older buildings in those locations may get repurposed or redeveloped to mixed uses, thereby injecting more vibrancy to the CBD on both weekends and in the evenings.”

This kind of future-proof thinking needs to be applied to workspaces worldwide to meet the evolving needs of employers, their staff and the cities in which they work.

New York City is tackling the office dilemma on both fronts, with support for those needing to improve offices and those looking to repurpose.

For existing offices, the New York City Economic Development Corporation and the New York City Industrial Development Agency launched the Manhattan Commercial Revitalization Program (M-Core).

M-Core provides tax benefits to Manhattan office owners to support the transformation of up to 10 million sq ft of underperforming office space. Eligible buildings need to be more than 250,000 sq ft, be built before 2000 and located south of 59th Street.

The city is targeting projects that introduce significant technical improvements – such as new building systems and energy-efficiency measures (ensuring compliance with Local Law 97, which sets carbon-emissions targets) – as well as the new layouts, amenities and wellness considerations that tenants are seeking.

The first recipients of M-Core tax breaks are 175 Water Street, which will be upgraded to a mixed-use building to foster a community of high-growth fashion, arts, creative and technology tenants; and 850 Third Avenue, which will transform into a transit-oriented, sustainable building with a greater street presence to attract a wider variety of tenants.

The city is also using repurposing to address its chronic housing shortage. The New York City Office Conversion Accelerator programme streamlines the permit process for owners who want to convert offices to provide 50 or more residential units. It also provides financial incentives and technical assistance to help developers navigate the complexities of conversion. The Accelerator already has 52 participating buildings and the Mayor’s office estimates that 135 million sq ft of office space could potentially be converted into 20,000 housing units.

Marisha Clinton, Savills Vice President of Research East, based in New York, says: “It’s local government programmes such as the NYC Office Conversion Accelerator and M-Core that can help move the needle more meaningfully when it comes to the repurposing and renovation of buildings – the latter making them more sustainable and attractive to both businesses and employees.”