1. Risk is the watchword. We are reassessing, recalibrating and redefining what risk is. Locations that used to be considered secondary or even tertiary are now rivalling the old bastions of prime. Workspace that used to be considered Grade A is proving less popular among some occupiers than novel co-working and co-creation spaces. Whole asset classes are changing or even disappearing as e-commerce changes the face of retail.

2. The risks now looming large seem totally different to those we took for granted in the late 20th century. In an age when disruption confronts even large, well-established institutions, we start to wonder what constitutes a quality ‘covenant’. Is a single corporate office tenant in a purpose-built office block on a 25-year lease really a better risk than a tatty building let on short leases at low rents to a deep pool of small local businesses? The reliability of the latter income stream may prove greater.

3. It is income streams that matter. Pension funds, insurance companies and other institutions are having to pay pensions to ageing populations throughout advanced countries. Such calls on income are new for them – but won’t go away. If the quality of income is the major consideration, it changes everything.

4. Asset classes formerly considered to be ‘alternative’ have appeared on institutional shopping lists. It is not late-cycle, asset-seeking desperation that drives this demand, but something bigger. The questions are: What to build? What to invest in? Which buildings to lease? Mixed-use, fine grain, flexible accommodation for living, working, playing, visiting and making needs to be reassessed. It is tricky to manage, although new technology should help, but it should be better able to provide very long term, stable, diversified income compared with a big-box, single-use building let on an institutional lease to tenants in obsolete industries.

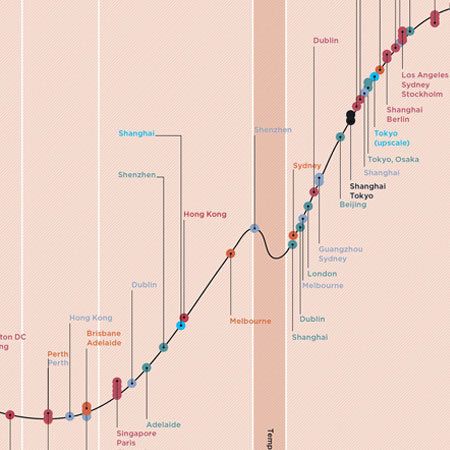

5. Real-estate investment risk is about people and where they want to be. To understand the investment performance of the future, we have to understand occupiers, of all types. World yields are at or near their nadir, so there will be no capital growth without rental growth.