Back on their feet after the trials of the pandemic, the world’s cities have faced new challenges of late, including a straitened economic environment and reduced real estate investment. But there are positives, too: global travel and migration have recovered fully, and environmental, social and governance (ESG) factors continue their ascendency.

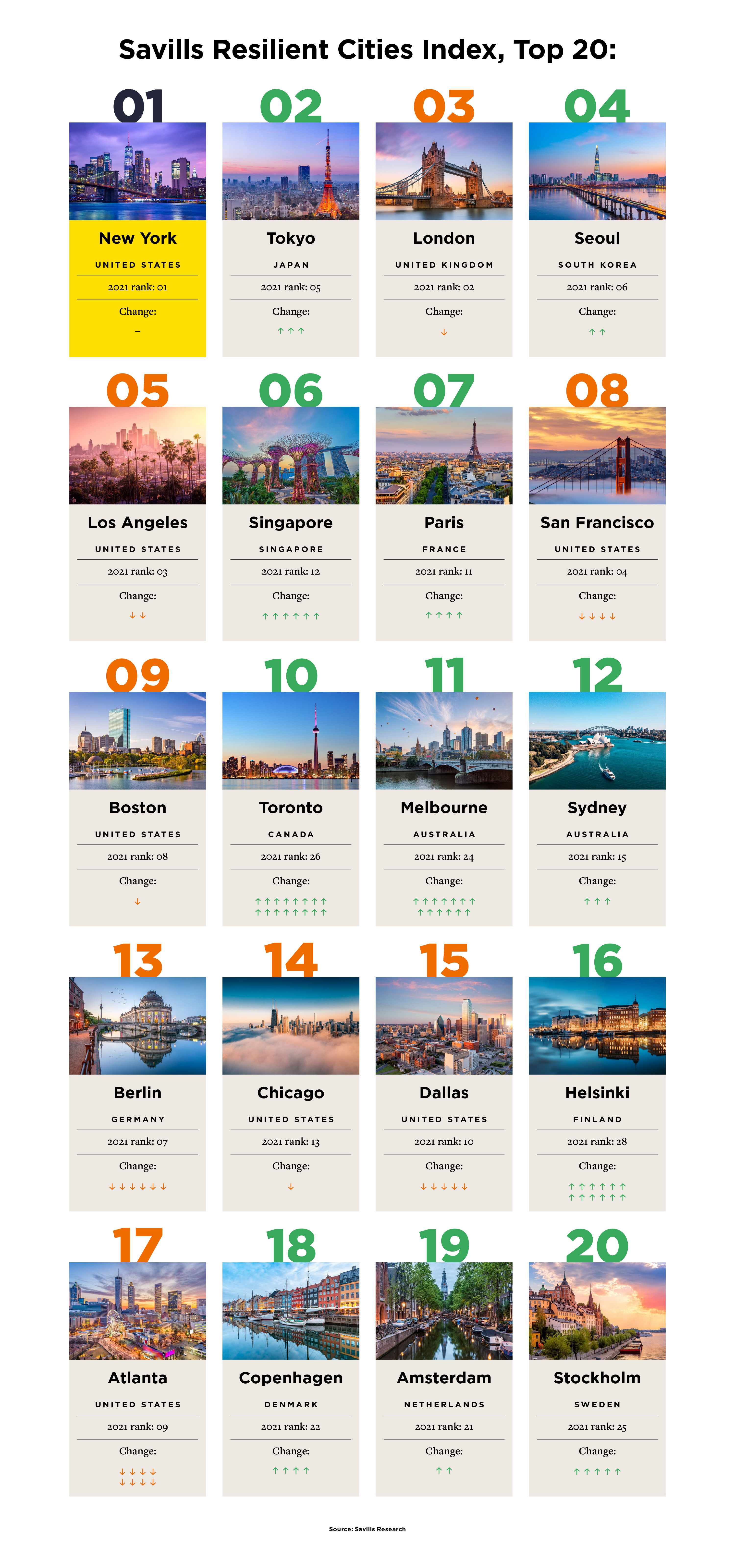

New York holds on to the number-one spot in the Savills Resilient Cities Index and is one of seven US cities in the top 20. However, US dominance as a whole is down compared to 2021, when it accounted for 12 of the top spots. Since then, many US real estate markets have experienced tougher conditions.

Elsewhere, some Asian and European cities have gained ground – notably Tokyo, which climbed three spots to take second place, and Paris, up four places to seventh. Seoul rose two places to fourth, while Singapore climbed six to sixth.

Smaller cities – those with fewer than two million people such as Helsinki, Wellington, Oslo and Edinburgh – performed well, climbing an average of six places. These are all liveable hubs with ambitious climate targets and an open attitude towards a variety of residents and workers.

Overall, there remains a strong correlation between economic fundamentals and resilience. In turn, real estate investors continue to focus on bigger cities – notably those with a deep and broad economic base.

Large cities, particularly those in the top five, are regaining their allure as places to make connections – whether that’s through in-person meetings, working collaboration, cross-pollinating industries or a wealth of entertainment.

Cities are likely to see an inflection in 2024 as funding environments improve and real estate investment volumes start to recover. However, with the impact of climate change and other ESG factors rising up the agenda, economic growth at the expense of everything else is increasingly being challenged.

Tokyo

2021: 5th | 2023: 2nd

A city built to withstand earthquakes and other natural disasters, Tokyo knows plenty about physical resilience. However, its performance in this year’s index owes a lot to its economic strength as well.

The city has emerged from a long-term deflationary period to record-breaking inflation and wage growth. The weaker yen has opened the door more to international interest too, boosting tourism and catching the attention of global investors.

Much of Tokyo’s resilience comes from scale. Its metropolitan population of 36 million overshadows the likes of Seoul, Shanghai and New York. It’s also home to the world’s third most valuable real estate market.

Although 2023 real estate investments were 25% down on 2021 levels, this drop was less pronounced than the 54% drop in total global investment – a factor that helped to propel the city from 16th to fourth place for investment volumes. Because Japan took its time reopening after the pandemic, it is now seeing the benefits of pent-up demand.

Tetsuya Kaneko, Managing Director and Head of Research & Consultancy at Savills Japan, says Tokyo’s lack of volatility, which supports the city during slower markets, is also a factor in its resilience. “The nation with stability shines brighter in an increasingly uncertain world. Japan’s position does not change much, but it becomes more appealing when other nations experience slowdowns.”

Japan may lag in the global tech race, but it excels in consumer technology, precision manufacturing, semiconductors and automation, with a deep skills base. This puts it in a strong position as the world realigns supply chains and companies seek productivity gains.

Paris

2021: 11th | 2023: 7th

The eyes of the world will be on the French capital this summer, when it hosts the 2024 Olympics. Infrastructure development goes hand in hand with global sporting events, and the opening of a six-station extension to metro Line 11 is planned for 2024. Four completely new lines, alongside an extension to Line 14, are also scheduled. Collectively dubbed the Grand Paris Express, these new routes, which will enable people to travel around greater Paris without entering the city centre, should be completed by 2030.

Paris appeals as one of the largest real estate markets in Europe. Prime office rents have risen 4.7%, while vacancy rates in the central business district are just 1.9%. “The appeal of Paris has never been so high – and the difference in rents between central Paris and the rest of the surrounding city has never been so great,” says Lydia Brissy, Director of European Research at Savills.

After the Olympics many venues in the outskirts of Paris will be repurposed into residential properties – thus helping, albeit very modestly, to ease the undersupply of homes.

For now, the city expects a good boost in hotels and hospitality later this year. At the same time, office occupation could fall temporarily – Paris City Council recommends Parisians work from home when the world arrives on their doorstep this summer.

New York

2021: 1st | 2023 1st

New York tops the rankings once again – proving that resilience, beyond size, is about having a talented workforce to help the city adapt to an evolving business landscape.

“Being diverse of thought creates a mutual fund for the mind,” says David Goldstein, President, Tri-State, Savills. “We have workers who are able to bring different ideas to the table and to continually challenge each other to innovate – because there’s such heightened competition on the New York stage, no matter what industry you’re in.”

Goldstein is confident the city will overcome the challenges of a reduced real estate tax base, as it contends with the knock-on impact of changing working patterns.

New York’s robust transport system – providing a relatively friction-free commuting service for knowledge workers across the city – coupled with its extensive network of not-for-profits, hospitals and universities, put it in a good position to weather most storms. “When you tether those industries together, I think you create a pretty robust platform for sustained growth through different economic cycles,” Goldstein says.

Certainly, it’s a sound foundation to attract the second-highest levels of venture capital (VC) globally. With $35 billion invested in its real estate in 2023 – despite a fall from $60 billion in 2021 – New York overtook Los Angeles to take top place in terms of investment volumes.

Singapore

2021: 12th | 2023: 6th

An influx of people choosing to live and work in Singapore has helped the city climb six places in the index. Prime residential rents increased significantly – by 42% between 2021 and 2023 – as the city shifted from recording net outflows of people to net inflows.

Meanwhile, real estate investment volumes have remained stable – no mean feat amid broader economic uncertainty and a global slowdown. A competitive tech scene also puts Singapore in good stead for the future: VC investment increased from $8.2bn in 2021 to $9.4bn in 2023, despite an overall worldwide fall in VC volumes.

Melbourne

2021: 24th | 2023: 11th

Liveability underscores Melbourne’s resilience. Its leap from 24th to 11th place in the index is all about a city bouncing back from extended Covid-19 lockdowns.

A wealthy, educated city with top marks globally for education, and also renowned for its hosting of major events, Melbourne is especially attractive to international investors, with cross-border investment consistently around 40% of total investment.

Michael Lang, State Director Victoria, Residential for Savills Australia, says: “While housing affordability remains a challenge, our city’s growth prospects have remained robust, attracting international investors even amid the recent economic headwinds, which are now clearing.”

San Francisco

2021: 4th | 2023: 8th

It’s a fall of four places for the tech powerhouse, which recorded a drop in investment from $40bn in 2021 to $13bn in 2023. Cross-border capital made up 2% of that total – down from 15% in 2021 – suggesting that the city was viewed with caution by international investors.

Despite this, San Francisco remains the world’s preeminent global tech centre, supported by the world’s most developed VC ecosystem. It’s the highest-ranked US city in the knowledge economy and technology subsector – fourth overall – and tops the VC investment table. But after riding the wave of the pandemic tech boom in 2021 the city has reverted to its 2016 placing.

The diversity of its tech base will likely support San Francisco’s continued resilience in years to come.

Savills resilient cities support the well-being and success of their residents and workers against the backdrop of economic, social, environmental and technological change. This makes them attractive to investors and occupiers – particularly as investment and business-expansion criteria encompass a wider range of factors, including ESG.

The index comprises four pillars: economic fundamentals; knowledge economy and tech; environmental, social and governance; and real estate.

Click on each icon to read more about the factors of a resilient city

Real Estate

Economic fundamentals

Knowledge economy and tech

ESG

Real Estate

Across the top 20 cities, real estate investment volumes totalled $262bn – down 54% on 2021 volumes of $574bn. Half of the top 20 cities in the real estate index are in the US, reflecting the continued depth of the US market.

Toronto, Paris, Singapore and Tokyo significantly improved their real estate rankings. Despite investment volumes falling by 14%, Toronto leapt from 35th to eighth place in the real estate pillar, buoyed by major deals in the industrial and office sectors.

Real estate sub ranking

Source: Savills Research

Economic fundamentals

Economic fundamentals underscore the strong performances of Tokyo and New York in the overall index. These cities have robust, diversified and growing economies, supported by inward migration and personal wealth. Those traditional fundamentals also helped Singapore and Seoul claim places in the top 10, both cities recording strong GDP growth. For Singapore, this was allied with a significant rise in immigration.

Economic fundamentals sub ranking

Source: Savills Research

Knowledge economy and tech

In the digital era, cities that generate, attract and retain tech-savvy individuals find themselves with a competitive edge. Seoul leads the knowledge economy and tech index, thanks to its top-ranked universities, deep domestic talent pool and strong track record of progressing R&D to production. South Korea’s patents-per-capita ratio is the highest in the world.

Knowledge economy & tech sub ranking

Source: Savills Research

ESG

How well does a city score on environmental, social and governance (ESG) principles? This is increasingly a key factor influencing where individuals decide to live and work – and, as a result, where investors allocate their capital.

In this category, smaller cities shine through: all those in the top 12 are home to fewer than two million people. Of these, several cities – notably Copenhagen, Glasgow and Edinburgh – have committed to more ambitious net-zero targets than their nations.

Bergen and Oslo lead the ESG rankings, helped by Norway’s reliance on renewable energy and boosted by its equitable social policies and protections.

Cities in Canada and New Zealand also score highly. Although their environmental credentials are not quite so strong, they have low levels of air pollution and have strong social protection that reaches a high share of the population.

ESG sub ranking

Source: Savills Research

Watch the Resilient Cities, a new form of resilience? webinar on demand