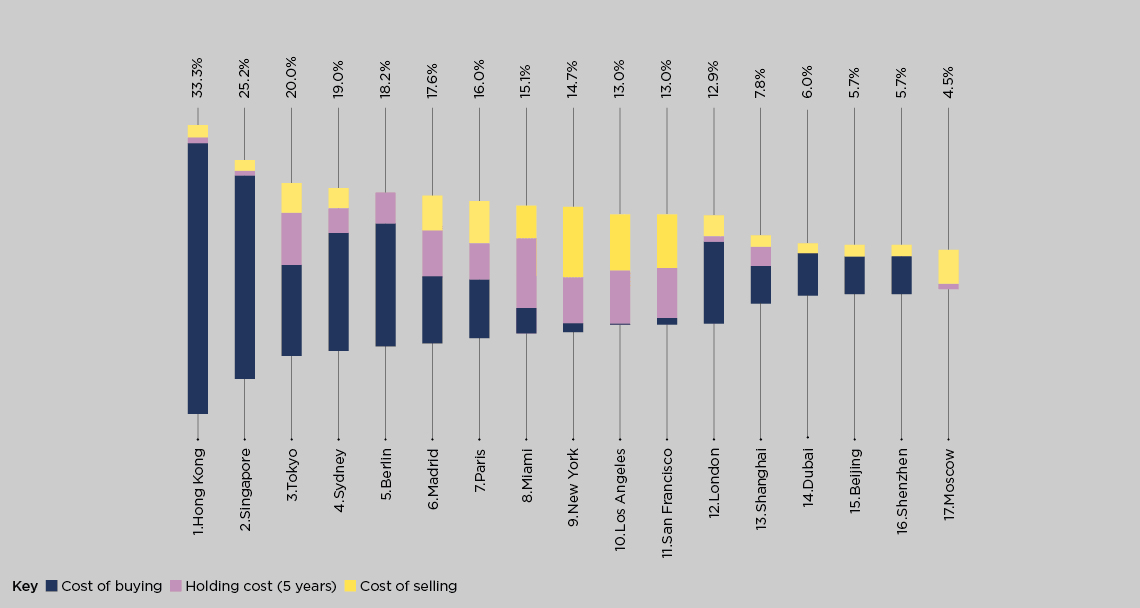

Buying, owning and selling a US$2 million second property can increase the purchase price by up to a third. Here’s how the additional charges break down in the world’s major cities.

San Francisco

As with other US cities, holding and selling costs are high, while buying costs are low. Over a five-year hold, property taxes amount to almost 6% of the purchase price, while selling costs are a little over 6%.

New York

Although buying costs are low, New York has the highest disposal cost of these cities, at close to 8%. This is driven by high agency fees, a factor for other US cities too. In addition, for foreign sellers, 10% of the sales price is withheld until all taxes are paid.

London

Brexit aside, this is one of the most accessible cities. Although buying costs are close to 10% of the purchase price, low holding (0.7%) and selling costs (2.3%) make London 12th overall. There is an additional 3% stamp duty tax for second homes payable by domestic and foreign buyers alike.

Paris

Buyers in Paris face a more evenly weighted split of taxes. Purchase and selling costs are 7% and almost 5% respectively. With holding taxes over five years of 4.2% (only Madrid beats that in Europe at 5.5%), Paris ranks seventh overall.

Berlin

Driven by a property transfer tax of 6% and agency costs of 7%, Berlin is the third most expensive city in which to buy a second residential property. However, the exit is easier. There are no costs to sell as the agency fee is fully covered by the buyer.

Moscow

With no stamp duty and just a $65 registry fee, Moscow is the cheapest of our global cities in which to buy a second residential property. The main costs come when it is time to sell, with the 3.5% agency fee paid by the seller.

Dubai

International buyers will find a low overall cost to buy (5%) and sell (1%) in Dubai. With holding costs of 0% (as is the case with Beijing and Shenzhen), Dubai ranks 14th in overall costs.

Hong Kong

Overseas buyers face an additional 30% stamp duty charge, making Hong Kong the most expensive city for overseas buyers. There is also a penalty of between 10% and 20% for speculators who try to sell within three years of purchase.

Sydney

In 2017, New South Wales doubled stamp duty for foreign buyers from 4% to 8% in an effort to cool price rises in Sydney. The city is the fourth most expensive place to buy and fourth for overall costs.

Buying, holding and selling costs on a US$2 million property in key global cities

Source: Savills Research. Note: Our scenario assumes a non-resident overseas buyer purchasing a US$2 million property for use as a second home for less than nine months of the year over a five-year hold. No capital growth or inheritance tax has been applied, avoiding the complication of having to forecast that for each city.