Populism is in the ascendancy in today’s political environment. Whether its rise is a result of the global financial crisis may be a subject for debate, but one thing is clear: populism thwarts long-term economic progression.

Loosely defined as any ideology that separates ‘the people’ from a ‘corrupt elite’, populism has existed in various forms over the last century. While it is often believed to be the preserve of the right, populism and democracy are not mutually exclusive: parties on both sides of the political aisle espouse populist platforms under the guise of being ‘anti-establishment’. On the left, one might find policies advocating for a diminished role of the private sector; on the right, more libertarian moves to reduce government regulation. Regardless, a common theme for populists across the political spectrum is the invocation of an existential crisis (either real or imagined) to justify the need for political unity. Typical policies include income redistribution, public spending increases, a rise in trade barriers and tariffs, tax cuts, restrictions on immigration, and a pro-nationalist or anti-global rhetoric.

Non-economic consequences of populism include increased polarisation across political parties, and criticism of outlets that seek to check power (such as the media) and other branches of government (such as the judicial system). In the extreme, a rise in scapegoating, civil unrest and human rights abuses may result, as leaders consolidate power and increase autocratic rule.

But what about the economic impact? Some items on the populist agenda can spur growth in the short term. Few would argue against an increase in spending on outdated public infrastructure, for example, or disagree with the notion that tax cuts can boost consumption and investment. However, populism has the potential to hinder growth, fuel inflation and result in a loss of competitiveness and productivity over the long term.

An increase in government spending – especially in the form of rising transfers and benefits, combined with tax cuts – can increase the budget deficit, the financing of which can crowd out private investment and potentially lead to higher inflation. Restrictions on migration can hamper worker mobility and have a similarly inflationary impact on wages from a mismatching of labour, skills and demand. Attempts to limit the independence of external agencies, such as a country’s central bank, can also lead to inflation as politicians run expansionary policies at the expense of fiscal discipline in order to fuel short-term growth.

Excessive taxation on incomes and capital can discourage labour and productivity-enhancing investment. Taxation on acquired or inherited wealth can lead to avoidance strategies and a shifting of assets offshore. Trade barriers can lead to the suboptimal use of resources under the show of protecting national security interests, when those same resources could have been used in more productive capacities.

Implications for global assets

One of the primary channels by which populism can affect financial assets is through protectionist policies. Countries that impose restrictions on foreign investment may end up limiting the investor base for global assets, resulting in inefficient price discovery and potentially lower valuations. Capital controls – whether designed to alter the composition, size or timing of foreign investments, and/or restrict capital flowing out of the economy – can be harmful to inward investment, particularly if foreign investors are uncertain about their ability to dispose of assets at their discretion. Uncertainty surrounding the conduct of monetary and fiscal policy, too, can weigh on investment decisions to the extent that inflationary policies can lead to destabilising currency depreciation, adding a source of additional risk to the investment.

Foreign capital matters

As trade continues to grow (and, indeed, has risen more rapidly than overall GDP), countries such as the US and the UK, which have run trade deficits for decades, should be mindful of their dependence on foreign capital for financing consumption. Trade deficits do not imply a lack of economic health, but rather a dearth of savings versus investment, which must be imported from abroad. Investment from overseas – which includes net purchases by foreigners of equities, corporate and government debt, and real estate, among other assets – plays a significant role in making up for the US and UK’s relative lack of national saving.

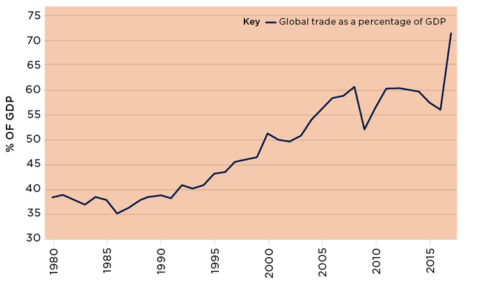

Gross trade as a share of global GDP

Sources: World Bank, OECD

As the International Monetary Fund points out in a recent issue of its Finance & Development magazine, “Protectionist policies are unlikely to be of much use in improving the current-account balance because there is no obvious connection between protectionism and savings or investment”. However, protectionist policies can act as a disincentive for new foreign investment, necessitating a drop in the value of the foreign currency or an increase

in yields in order to drive investment.

Foreign direct investment

While financial transactions supporting a country’s current-account deficit can take the form of a purchase of fund shares, a bond or currency (to name a few examples), foreign direct investment (FDI) is particularly important. FDI refers to cross-border investments made by residents and businesses from one country into another, with the aim of establishing a ‘lasting interest’ in the country receiving the investment, as measured by a minimum 10% controlling interest. (In contrast, investments with less than a 10% controlling interest are referred to as portfolio investments.) FDI includes the impact of mergers and acquisitions activity, flows from investment in the form of equity and loans, as well as reinvested income, and has been an important source of financing capital for both the US and the UK.

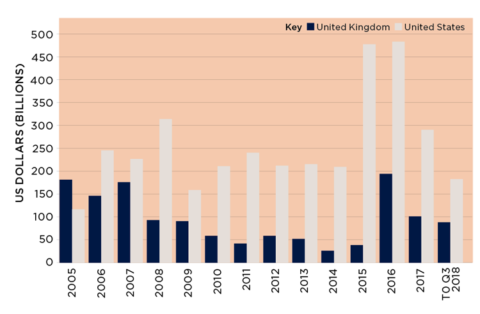

Foreign direct investment in the US and UK

Source: OECD

Note: Includes current-cost adjustment for reinvestment of earnings

FDI has been linked with greater knowledge transfer and management expertise, generally leading to increased productivity. As with trade, FDI also stimulates competition and investment in new, more productive technologies. A UK study by the Office for National Statistics showed that firms with inward FDI were 74% more productive than non-FDI firms, with the highest productivity among those with both inward and outward FDI flows, although they acknowledge the relationship is not necessarily causal.

According to a study by the UK’s Centre for Economic Performance that used bilateral flow data to assess how FDI was impacted when countries joined the European Union (EU), membership was found to increase FDI by approximately 28%, and ranged from 14% to 38% depending on the statistical method used. In contrast, no gains were found for membership in groups such as the European Free Trade Association (for countries such as Switzerland, for example). With 43% of the UK’s estimated £1.3 trillion stock of FDI having come from other EU members as of 2017 – already down from 51% in 2008 – a reduction in FDI from the EU could prove problematic, particularly if greater FDI is linked to EU membership.

Similarly, the current protectionist trade war between the US and China could imperil FDI flows between the two countries. China’s stock of FDI in the US is low – it stood at 1% at the end of 2017 – but had been growing until recently. FDI flows from China into the US, which totalled $5.1 billion in 2015, rose to $25.5 billion in 2016 before becoming negative (a net disinvestment) to the tune of $500 million in 2017.

The US and UK already have some of the more restrictive policies towards FDI among Organisation for Economic Co-operation and Development (OECD) members. According to the OECD, restrictiveness can take the form of “new rules or more rigorous enforcement of existing ones; greater conditionality attached to regulatory approval mechanisms; or a more expansive notion of strategic industries, the national interest and national security”.

While the absolute level of restrictiveness is still low in the US and UK, the OECD has found evidence that in Brazil, Korea, Vietnam and the Philippines – countries with previously high levels of restrictiveness – there has been a clear correlation between improved regulatory reforms and greater FDI inflows. One cannot ignore the possibility that an even greater level of restrictiveness under the guise of protecting national interest could lead to a reduction in FDI.

The future of cross-border real estate acquisitions

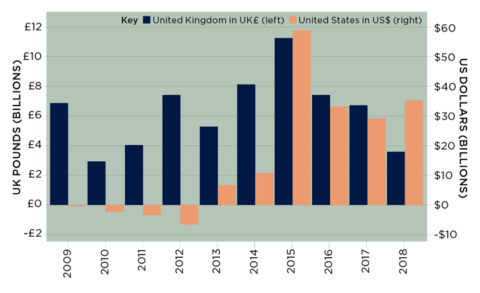

While much of inward FDI in the US and UK is focused in financial services, non-residential real estate assets have been a growing area of investment for cross-border investors. Even so, after reaching a peak in 2015, net acquisitions of commercial real estate assets by cross-border investors have declined for the past three years in the UK, even as cross-border activity rose in the US in 2018 (led by the sizeable acquisition of Westfield by Unibail-Rodamco). Slowing global growth (particularly in less open economies) could cause cross-border investment to slow in the year ahead; already, China’s government has restricted outbound flows through capital controls amid a decline in economic activity, resulting in a year-on-year decline in cross-border capital from Greater China of 60% in 2018.

Cross-border acquisitions in the US and UK

Source: RCA

Note: Includes sales of office, industrial, retail, hotel, apartment, seniors housing and care, and development sites/land

It is too soon to tell what long-term consequences a rise in populism will have. An increase in protectionism may raise the return premium demanded by investors as compensation for increased country risk, particularly for less liquid assets such as commercial real estate. To paraphrase a comment from a European Central Bank panel member, there will be no winners under protectionist policies – just different degrees of losers.