We’ve seen the growth of innovation districts in cities such as San Francisco (above), Boston and Cambridge in both the UK and USA. But now, the intersection of these technology-rich environments with the demand for advances in medicine and healthcare, means that the life science sector is truly reaching a tipping point.

Life science covers a wide range of medical fields, such as biotechnology, pharmaceuticals, biomedical technologies, life systems technologies, nutraceuticals, environmental and biomedical devices.

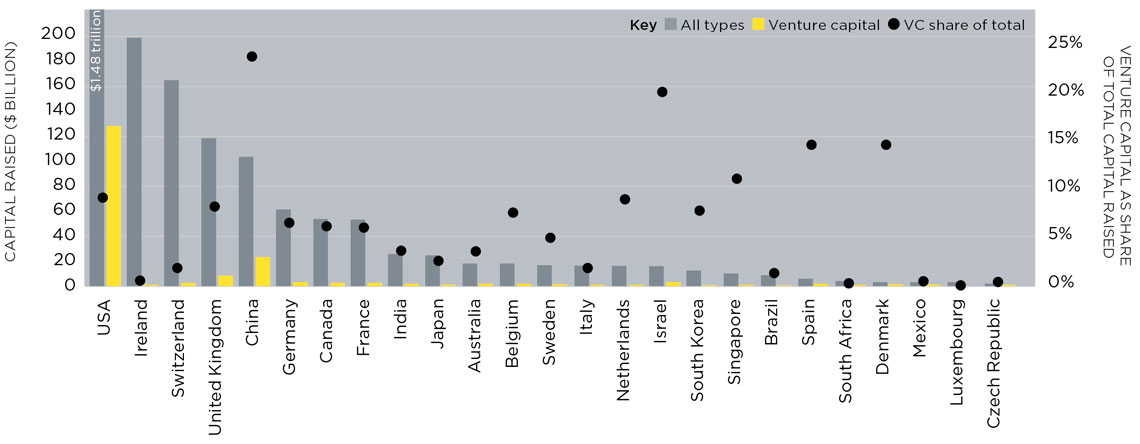

Its funding levels are as deep as the sector is broad. During the past five years, more than $2.5 trillion of capital has been raised globally, a 111% rise on the previous five-year period.

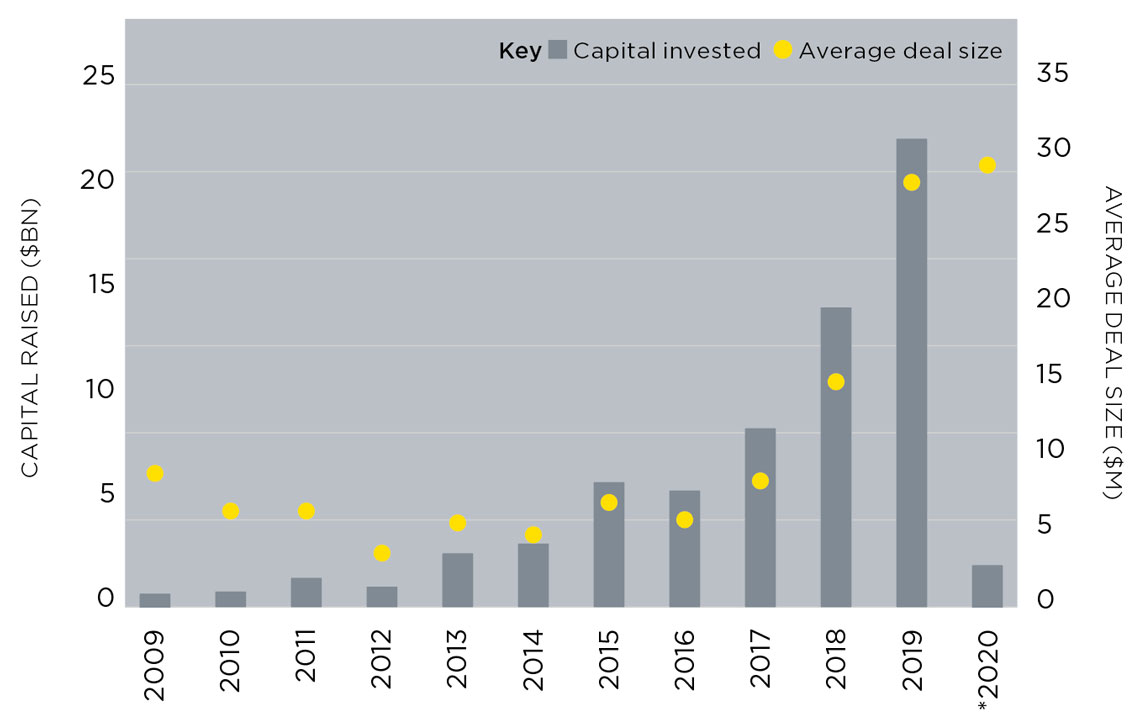

One major influencing factor is technology. Global funding for the digital health market reached $22 billion in 2019, a pace that has essentially doubled every two years over the past decade. Potential for software and hardware tech offers new avenues to improve human health, whether through artificial intelligence (AI) and machine learning, or data-driven approaches to health solutions.

The growth has not gone unnoticed by traditional technology companies. Google entered the health market five years ago with the acquisition of DeepMind, which uses AI in the development of new drugs.

In a post-Covid-19 world, there will be a continued rise in the vaccines sector as well. The early money into this sector, being venture capital (VC), for the last five-year period (2015-2019), has seen around $5 billion invested, globally. This is 150% higher than the preceding five-year period.

Global life science sector

The level of capital raised by the top 25 countries, 2015-2019

Source: Savills Research using Pitchbook

Life science as a real estate sector

The rise of the sector has ramifications for real estate, and life science is about to be recognised as a real estate sector in its own right. Life science gives investors a chance to build a portfolio around investments that benefit from clustering in innovation districts and the triple helix of government, universities and industry to deliver on a specific aim, which, among other global issues, will include dealing with coronaviruses. From startup incubators and R&D facilities to major headquarters, the sector can also offer diversity of investments. Capital flowing into life science can help be a predictor of future real estate demand.

When it comes to VC money, merger and acquisition activity and private equity investments, the USA dominates the field, taking a 61% share of countries that raised $1 billion or more in the past five years.

Capital raised in global digital health

Note: *as at mid-February. Source: Savills Research using Pitchbook

The global reputation of San Francisco, San Diego and Boston-Cambridge is essential to this appeal. For early VC money, which is a good indicator of rising areas of innovation, the USA remains dominant with a 68% share (2015-2019 period).

However, China has emerged with a 12% share during the same period, compared with a 3% share in the preceding five years (2010-2014). The growth of the VC market also highlights some interesting locations that may not yet be on the radar for real estate investors. Countries that sit within the top 25 global markets, but which also saw significant VC growth in 2019, include India, Spain, Australia and Austria.

Investor insight: Q&A

Tim Schoen, President and CEO, BioMed Realty (right) discusses investment in the life science sector with Simon Hope, Head of Global Capital Markets, Savills (left)

Simon Hope How have you have built up your portfolio?

Tim Schoen We’ve focused on established core life science markets: San Francisco, Boston-Cambridge, San Diego, Seattle, New York and Cambridge in the UK. Our total portfolio represents 11 million square feet and a further 2.5 million square feet under development.

SH Will you expand on those locations?

TS Our strategy has been to go deeper into these markets but we would like to expand in the golden triangle in the UK (Cambridge, Oxford, and London), and we’ve looked to some extent at Western Europe (e.g. Switzerland and Germany).

SH What are the important ingredients to these being successful ecosystems?

TS Each location needs to have the three tribes: researchers, venture capitalists and entrepreneurs. They all speak their own language, but when they are located in one area it creates a pretty powerful ecosystem.

SH What role do institutions other than universities play?

TS The medical system, along with the university in that hub, is very important. The mix of universities and hospitals provides the ‘bench to bedside’ research that is so important for innovation.

SH What can real estate do to support companies in life science?

TS Companies are starting to use real estate to attract and retain talent. They need places where researchers feel they are part of a community. A good example is our Canal District complex in Kendall Square, Cambridge, where it’s easy to meet with other researchers.

SH How important is sustainability?

TS We want to be a good steward of the capital we invest. One quarter of our portfolio is LEED certified and we look at reducing energy in all of our buildings.

SH Do you see long-term implications on real estate from the Covid-19 epidemic?

TS The magnitude of long-term implications to real estate will be sector specific and correlated to the ability to widely test and develop an effective therapy/vaccine for the virus. Resumption of tenant and consumer demand are dependent upon it.

In the life science sector, scientists and researchers collaborate more extensively to accelerate R&D solutions, a trend that will likely increase in the core innovation markets. Also, I would expect biotech companies and research institutions to seek out experienced, well-capitalised owners with full-service, integrated platforms to ensure their mission critical facilities operate without interruption.