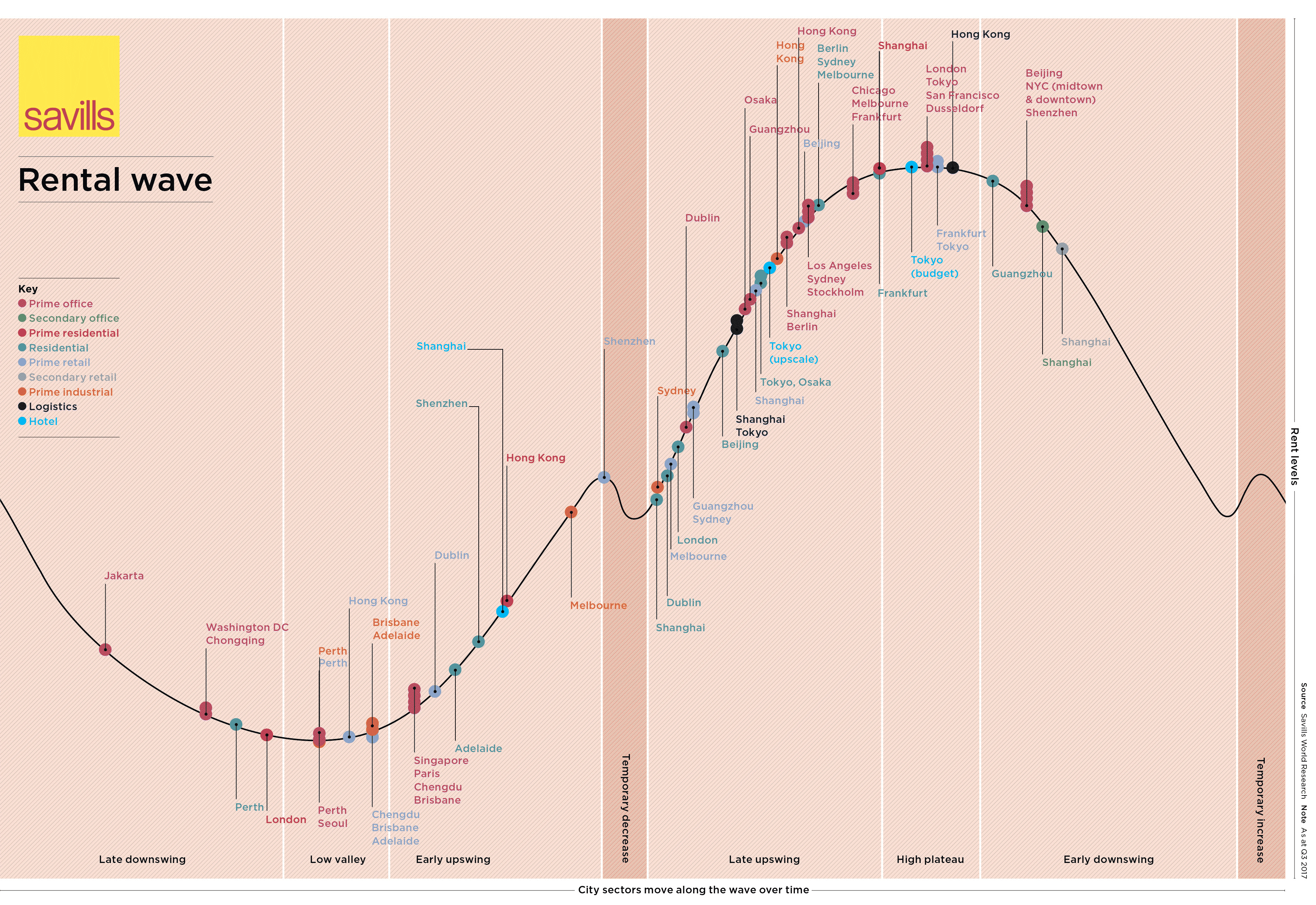

Occupier demand is the key component of rental growth in all sectors, but it interacts with the level and quality of supply. This supply of buildings is dependent on how much investment and construction activity there has been in a given city or sector and that, in turn, is often dependent on credit availability and cost in different jurisdictions. This means that in some cities rents are growing while others are falling; some are stagnant at a low level while others are hovering on a high plateau. The Savills ‘wave’ describes all the possible stages of rental growth and enables our researchers to pinpoint the stage that different sectors in different cities reached as at June 2017. Here are a few key comments from our global researchers:

Residential

There is a wide range of stories within this sector, with different experiences in prime and mainstream markets even within the same city. High capital growth hasn’t always gone hand in hand with rental growth, so Chinese cities such as Shenzhen and even Shanghai are likely to start pleasing owners with rising income streams. Only Guangzhou looks like disappointing in this regard. For investors, Perth looks like it may now be in recovery.

Logistics

Savills research suggests there is still inflationary pressure on rents in Shanghai and Tokyo – though not as much as there was. Occupiers would still do well to lease before rents hit peak, but investors may find it difficult to find the right stock in the right place (or even know where the right place is) in this fast-moving world market.

Investor opportunities

The best bets are cities in the early upswing, with room for further growth. But you may find yourself competing hard for stock, especially for core assets in gateway cities such as Paris and Singapore, where prime office yields have compressed, despite rent falls, in expectation of future rental growth.

Retail

Retail rent prospects are a mixed story. Medium-term rental growth looks likely in Shenzhen, Melbourne, Sydney and Guangzhou. Prime Shanghai rents still have room to grow, while secondary rents are now on the way down. A case for picking the right quality location as well as the right city.

Hotels

Few of our researchers wanted to stick their necks out in this sector, but those who did have illustrated how there is a world of difference between the budget and luxury sectors. In Tokyo, there may yet be an Olympic run-up rally for the latter.

Offices

Our researchers see a peak in a wide variety of markets, with cities as diverse as London (City and West End), Tokyo, San Francisco and Dusseldorf at the top of the curve. But there is low supply in many markets as development was so subdued after the global financial crisis, so these rents could remain on a high plateau for some time, rather than falling precipitously. Chicago, Melbourne, Frankfurt, LA, Sydney and Stockholm look like they still have legs but are heading toward the peak. Investors may find it hard to transact in time to catch the crest of the wave.