Before the Covid-19 pandemic, investors were already putting life science real estate under the microscope. It had always been an alternative real estate sub-sector that was developed, in most cases, by specialist investors/developers.

However, the past six months has seen an explosion of interest from investors looking to diversify their portfolios to capture the expected increase in demand from life science companies.

The pandemic has seen significant funding into vaccine research which, in the earlier stages of company growth, is usually in the form of venture capital (VC). Growth in this type of corporate funding will result in growth of employee headcount. More employees needing to be accommodated in the office and/or laboratory results in a larger footprint in terms of real estate.

Chart 1 shows the growing level of VC going into companies involved with vaccines over recent years. The strength of 2020 is no surprise, with $2.3 billion going into the sector. Compared with all sectors, the past five years (2015 to 2019) has seen vaccine-related VC account for 0.6% of the total global VC spend. So far in 2020, this has risen to a 1.2% share.

Both the US and Germany have been dominant countries in the vaccine market – faster growth in the smaller companies bodes well for developing a strong life science ecosystem, which attracts the global larger corporates. This is good for real estate demand.

Venture capital raised by vaccine companies by country (US$ millions)

Source: Savills Research using PitchBook

Chart 2 shows the growth of money going into vaccine companies headquartered by country. The period 2015 to 2019 saw a significant increase in the annual average level of investment for vaccines companies compared with the preceding five-year period in most countries. However, it is the comparison with the total for 2020 which is significant, albeit not that surprising considering the scale of the pandemic.

Annual average venture capital raised and the 2020 total as at end-August (US$ millions)

Source: Savills Research using PitchBook

So, what does real estate demand from vaccine companies look like? Overall, it’s difficult to determine the global real estate impact at the moment. However, in occupational terms, as shown during the lockdown period, scientists will always get into the laboratory to work. This more consistent level of occupation, compared with office-based companies, suggests that life science companies, on the whole, will have a much higher willingness to maintain or increase their office and laboratory real estate footprint. As shown with a substantial rise in the level of funding, this will have a positive impact on the demand for the relevant real estate.

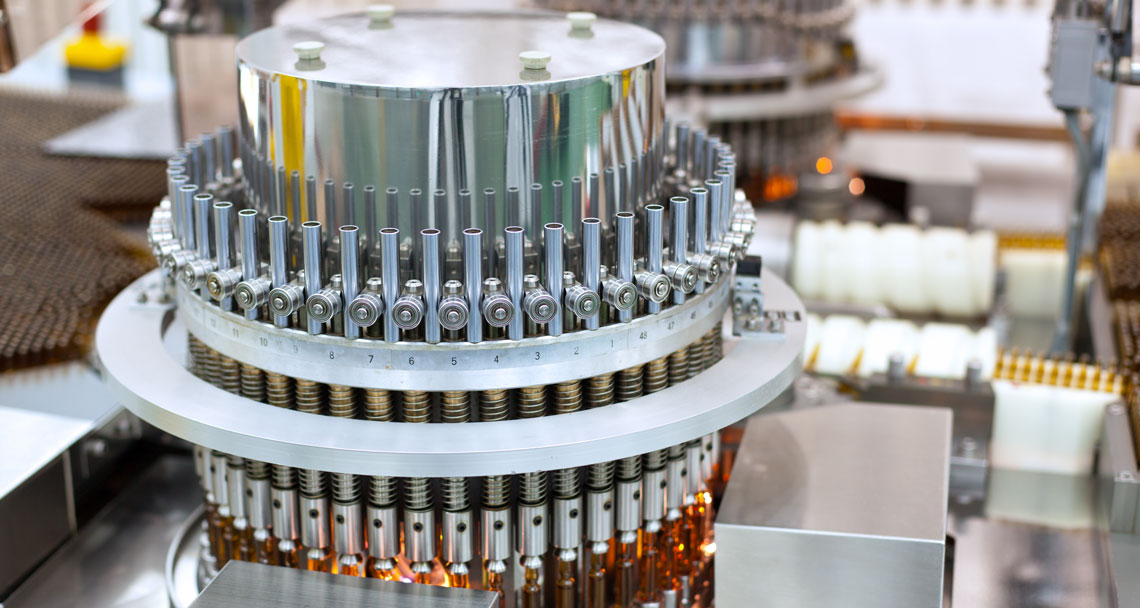

Boosting vaccine manufacturing capacity

In the UK

An immediate real estate response to Covid-19 in the UK was the fast-tracking of building the Vaccines Manufacturing and Innovation Centre (VMIC) at Harwell in Oxfordshire. This part of the UK was already leading the way, globally, in vaccine research and manufacture. The new 7,500 sq m (footprint) facility will increase the manufacturing capability by 20 times and can provide 70 million doses within six months of opening – enough for everyone in the UK.

VMIC was founded in 2019 by academia (University of Oxford, Imperial College and London School of Hygiene & Tropical Medicine) with support from industrial partners (Merck Sharp and Dohme, Johnson & Johnson, and GE Healthcare). The planned opening date was 2022. However, soon after the UK lockdown the collaboration between the contractor, planning authorities and the academic institutes fast-tracked delivery to 2021.

In France

French pharmaceutical company Sanofi will spend $554 million to build a vaccine manufacturing facility at Neuville-sur-Saône, north of Lyon, adding to its 12 global manufacturing facilities currently in operation. Modular production facilities will be built around a central hub, providing flexibility to switch to the production of a single and multiple vaccines, future-proofing for future pandemics. The facility will be built out over the next five years.

In China

In China, where several Covid-19 vaccines are in development, AIM Vaccine Group is investing CNY 550 million ($79 million) on a new manufacturing and R&D base in Ningbo. Vaccine production is slated to start on the site in the first half of 2021. Demonstrating the fast-moving nature of the sector, the facility will be used to develop the company’s Covid-19 vaccine which is yet to start human trials.