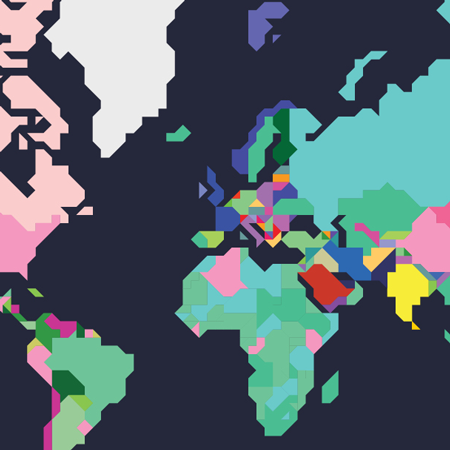

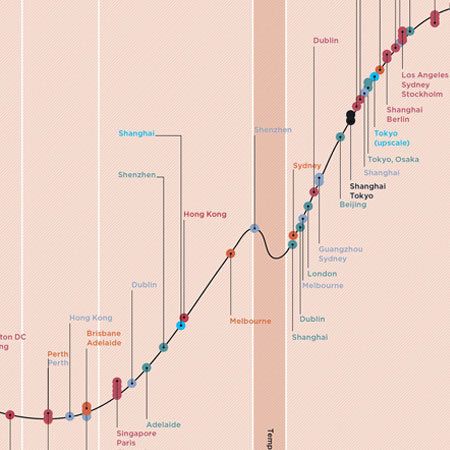

Head of World Research at Savills, Yolande Barnes, calls it “the homogeneity of the global investment community”. She’s referring to the fact that, since the global financial crisis (GFC), yields across both asset classes and geographies have converged remarkably in major world cities – something evidenced by the Savills Global Yields Spectrum research.

In the wake of the GFC, central banks cut interest rates to historic lows and embarked on a policy of quantitative easing. The result, according to Simon Smith, Senior Director, Research and Consultancy at Savills in Hong Kong, was that “an abundance of cheap money found its way into global property and equity markets”.

With sovereign bonds underperforming, investors targeted real estate in proven markets, thereby pushing up capital values and bringing down yields.

“At the same time, countries such as China began to invest heavily overseas to diversify risk away from their home market and into core assets,” says Smith.

With yields for traditional core assets low, investors targeting income, such as pension funds, are being forced to target alternative asset classes.

“The search is particularly frenzied for income production,” says Barnes. “We’ve seen the rise of what has hitherto been called ‘alternatives’, but I would argue these assets are fast becoming core.”

Barnes believes that the time has come for a reappraisal of risk. “The real question is whether the traditional asset classes – stocks, bonds, property, commodities and cash – still apply,” she says. “You have to start following the millennial worker, or whatever it is that is creating the demand.”

Of course, the situation could change rapidly if central banks increase interest rates too quickly. But Keith Breslauer, founder of pan-European fund manager Patron Capital, isn’t worried.

“The market has generally been pricing in a gradual rise in rates,” he says. “There is a fear [they] are going to overreact. We don’t see that.”

So, yields for traditional core assets in global cities are likely to remain low for some time – and investors chasing income will increasingly have to look at both different asset classes and new locations.

Find out more about the Savills Global Yields Spectrum