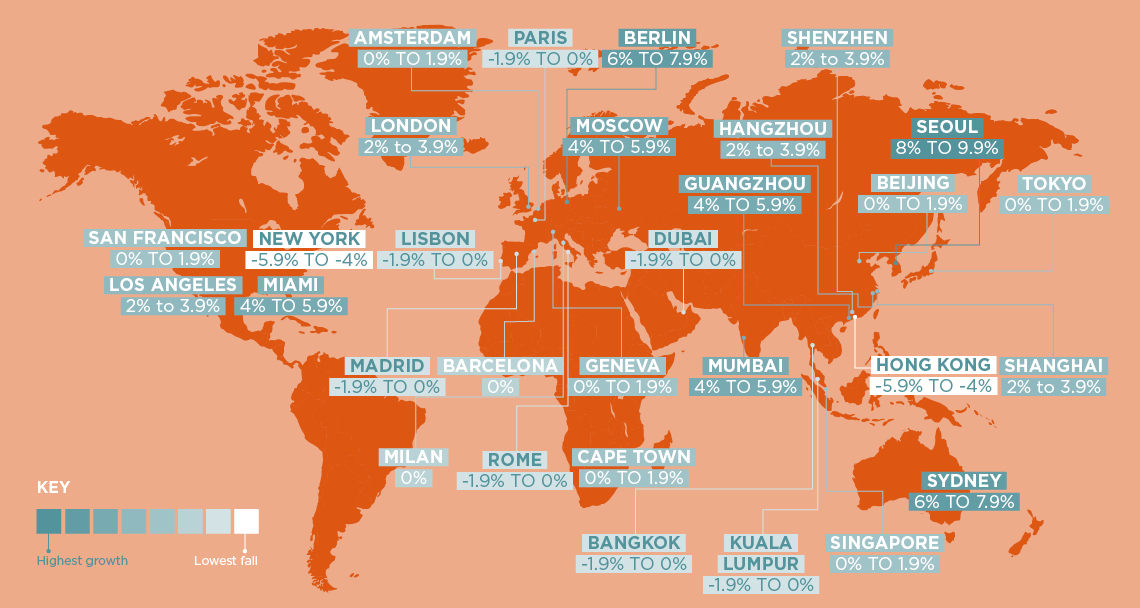

The prime residential forecasts for the 30 cities in Savills World Cities Prime Residential Index highlight the strength of prime residential property.

Average growth for the cities in the index is forecast at 1.6% for 2021. Sentiment is improving as the rollout of the Covid-19 vaccine begins in many countries and, despite the uncertainties which still linger, prime residential property is expected to remain an active market.

The resilience of prime residential markets was highlighted during the second half of 2020. Savills World Cities Prime Residential Index recorded an average increase of 0.8% for the cities in the index at a time when global GDP is recovering from the impact of Covid-19 and subsequent lockdowns.

Many of the factors which helped drive the prime residential market in the second half of 2020 are expected to continue into 2021, including low stock levels in some locations and the desire for more space.

Historically low interest rates, which are expected to remain low for some time, also make the sector attractive for wealth preservation. These factors, and the sector’s strong fundamentals, mean positive price growth is expected in 19 cities, compared with nine that are expected to see small price falls.

Prime residential capital value growth forecasts, 2021 (click map to enlarge)

Source: Savills Research

The high fliers: +6%

Of the cities in the Savills World Cities Prime Residential Index, Seoul saw the strongest growth during 2020 with prices increasing 8.6%. This strong performance is expected to continue over the coming year. The market remains on an upward trend, driven by high demand from historically low interest rates, strong economic performance and short supply.

Berlin and Sydney are the next strongest performers. The German capital has been on an upward trend with high levels of demand that exceed supply. Sydney has seen comparatively weaker performance in recent years but is expected to improve in 2021 as economic activity picks up.

The strong contenders: +4-6%

Guangzhou is expected to see the highest growth out of the Chinese cities in the index over the coming year. The city is benefitting from urban regeneration projects as well as its proximity to comparatively higher-valued Shenzhen.

In the USA, as with many Western markets, the search for more space was a pandemic-driven trend during 2020. This is expected to continue over the coming year, benefiting cities that offer space, such as Miami.

Miami also has particularly attractive tax advantages. Should the rise in remote working continue, those who no longer need to stay in one location for work may find Miami appealing.

Mumbai has seen stamp duty changes over the past year. The forecast growth in Mumbai, driven by the stamp duty reduction and low mortgage rates, follows price falls due to an oversupply.

The steady cities: >0-4%

Despite the headwinds of 2020, supply remains a significant influencer of price movements. Many cities that expected to see positive growth of up to 4% in 2021 are markets characterised by low supply levels, e.g. San Francisco, Amsterdam and Tokyo.

London’s prime market is expected to see a turnaround, with forecast growth underpinned by the value on offer compared with its peak in 2014.

The Chinese cities of Shanghai, Shenzhen, Hangzhou and Beijing are expected to see growth of between 0% and 4%. These markets have performed well in 2020 as economic activity returned. Residential is seen as a safe investment, which is expected to continue in 2021. Beijing has a slightly weaker forecast than the other cities in China due to heavy local regulation.

A softening of prices: -2-0%

Some prime residential markets are more reliant on international demand than others. For these markets, travel restrictions have hindered performance during the past year. While vaccine news does bolster optimism for the return of travel, a number of markets that are driven by international demand, including Dubai, Kuala Lumpur and Lisbon, are expected to see a slight softening of prices over the coming year. Lower international demand is also expected to impact the prime market in Paris.

A weaker economic environment is expected to impede growth in a number of cities in Southern Europe, including Milan, Rome, Barcelona and Madrid, while oversupply also continues to play a role for a few cities in this price growth tier, namely Bangkok and Dubai.

Down, but not out: <-2%

In Hong Kong, the highest valued city in our index, prices have been impacted by political uncertainty. Prime values are expected to continue their downward trend over the coming year.

New York’s prime market has been on a downward trend in recent years due to oversupply. The pandemic has also caused a temporary move away from densely populated urban living – whether this becomes a long-term trend, however, still remains to be seen.