November 2018

Branded residences have been around for more than a century, but only in the last two decades has the sector really taken off. Rapid expansion has gone hand-in-hand with a growing, globally-mobile high net-worth population that has risen fourfold in 20 years.

Cash-rich, time-poor, and brand-conscious individuals are attracted by quality design, security and the high levels of service branded residences offer, says a new report by Savills World Research. Hoteliers have diversified into residential as resorts and prime city-centre buildings incorporate a wider mix of uses. Developers, meanwhile, recognise the value-add of a brand in a competitive global marketplace.

To date, branded product has been focused in the US and Asia, and located in resorts or major international gateway cities. But there remains significant untapped potential.

The recovery of Europe’s leisure markets has made projects in the Mediterranean viable once again, and branded projects are first off the starting blocks. With many top-tier world cities looking fully valued, the market is also turning to secondary urban centres for new opportunities and growth.

Looking ahead, continued wealth generation in emerging markets will underpin expansion, but we expect to see the sector evolve as it matures. New brands will enter the market and the service and amenity offer will widen, with an emphasis on experiences, particularly as younger buyers grow in importance.

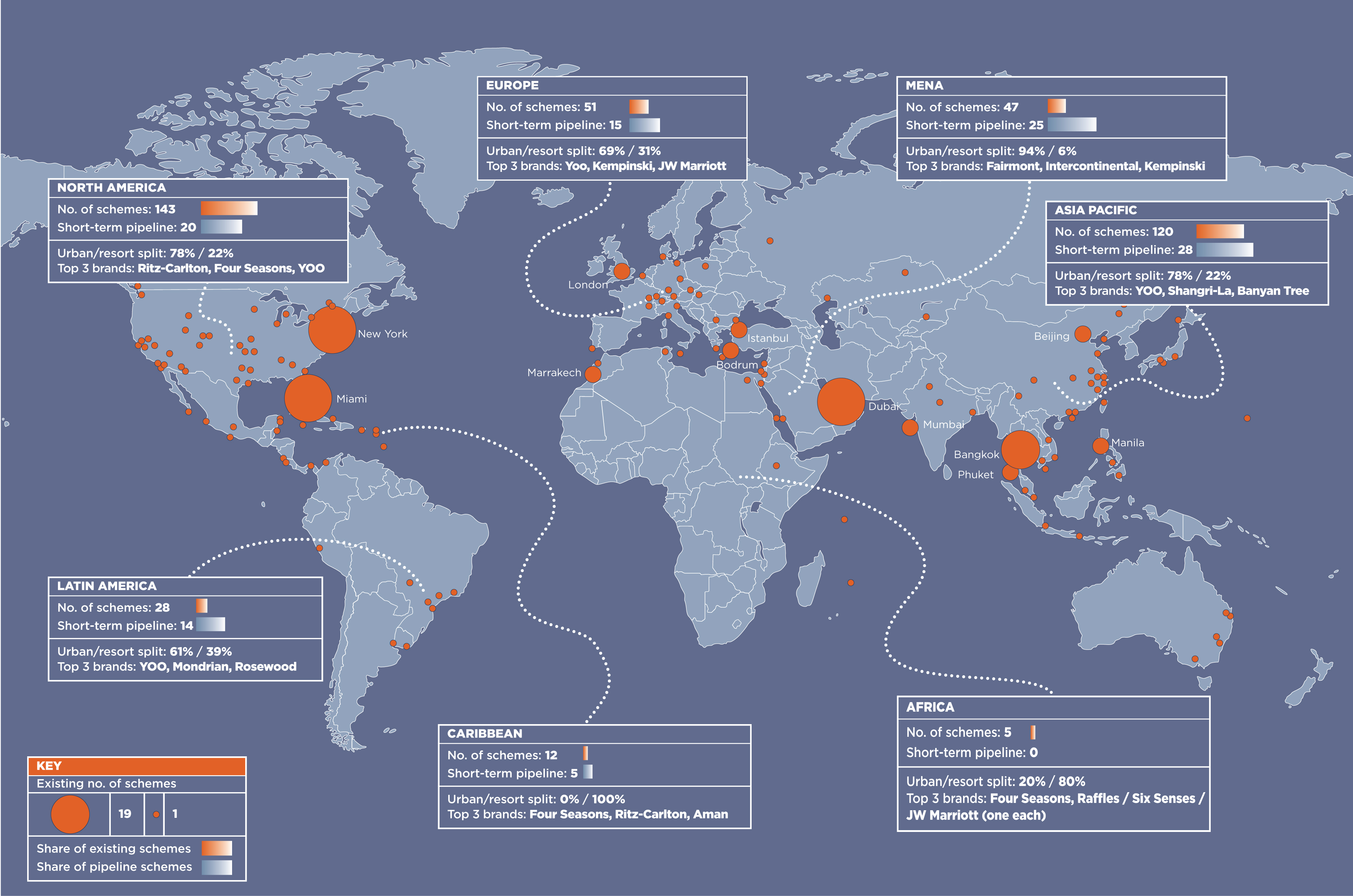

Branded residences around the world

North America

No. of schemes: 143

Short-term pipeline: 20

Urban/resort split (%): 78/22

Top three brands: Ritz-Carlton, Four Seasons, YOO

Europe

No. of schemes: 51

Short-term pipeline: 15

Urban/resort split (%): 69/31

Top three brands: YOO, Kempinski, JW Marriott

MENA

No. of schemes: 47

Short-term pipeline: 25

Urban/resort split (%): 94/6

Top three brands: Fairmont, Intercontinental, Kempinski

Asia-Pacific

No. of schemes: 120

Short-term pipeline: 28

Urban/resort split (%): 78/22

Top three brands: YOO, Shangri-La, Banyan Tree

Latin America

No. of schemes: 28

Short-term pipeline: 14

Urban/resort split (%): 61/39

Top three brands: YOO, Mondrian, Rosewood

Caribbean

No. of schemes: 12

Short-term pipeline: 5

Urban/resort split (%): 0/100

Top three brands: Four Seasons, Ritz-Carlton, Aman

Africa

No. of schemes: 5

Short-term pipeline: 0

Urban/resort split (%): 20/80

Top three brands: Four Seasons, Raffles / Six Senses /

JW Marriott (one each)

For more information, read our latest sector report Branded Residences

Images: Twenty Grosvenor Square, London, by Finchatton in partnership with Four Seasons (top); One&Only Mexico in the Riviera Nayarit (middle); Mayfair Park Residences, London, managed by the Dorchester Collection (bottom).