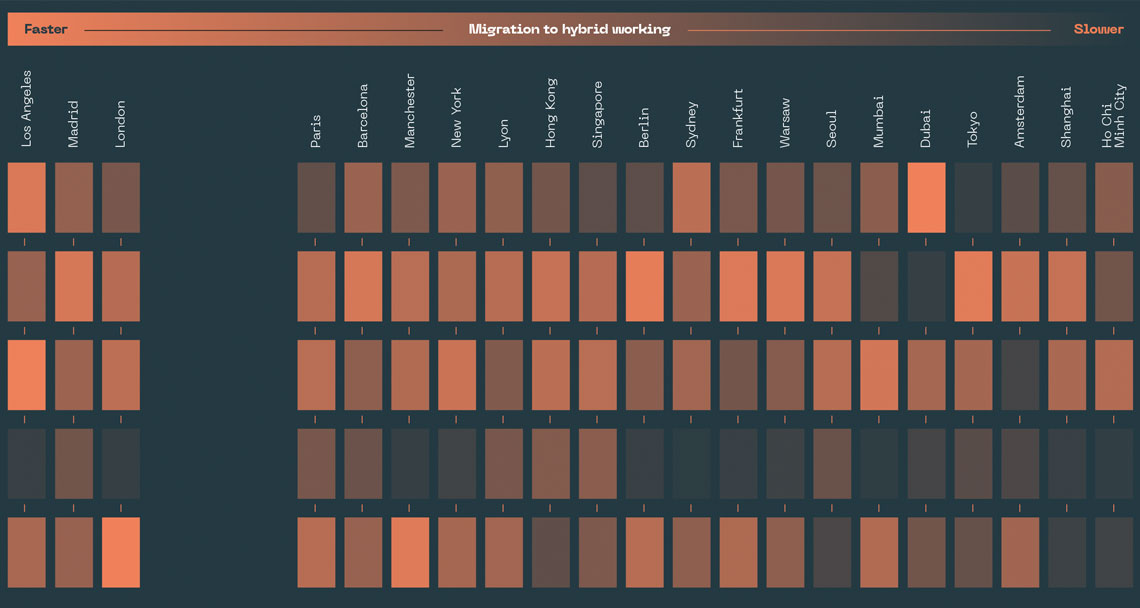

Covid-19 and the city-by-city shift to hybrid working

Some companies are considering a hybrid combination of work from home and in the office. But where might this work best? Savills Hybrid Working Index analyses 21 global cities to assess how quickly each could embrace this transition.

The pandemic has had many effects on the office market and people’s working lives. Savills Hybrid Working Index analyses employee- and employer-focused factors to examine which cities could make a transition to hybrid working – a mixture of office and remote working – more rapidly. The shift to hybrid working is not a zero-sum situation. Most workers want to be in the office at least some of the time, and most firms are likely to mandate a degree of attendance to ensure mentorship for newer and younger employees and to boost creativity and collaboration among their employees. There are roles that are not suitable to be carried out from home in the long term: some forms of banking, for instance, which are subject to oversight and scrutiny which can only take place in an office environment.

We have developed an index to assess the factors that may influence the future balance between office and hybrid working. We look at employee-driven factors, such as the size of people’s homes and commute times, as well as employer-driven factors, such as the cost and efficiency of offices, and workplace culture.

Hybrid Working Index: the employee perspective

Here, the key factors that may influence the adoption of hybrid working are: the size of homes, population composition, ease of commuting, broadband connectivity and length of lockdown

- Larger homes make it easier to provide dedicated space for homeworking. Locations such as Dubai and Los Angeles score highly on this indicator.

- Younger populations or those with smaller household sizes would be more likely to seek interaction and mentorship from the office environment. A location like Mumbai, with 50% of its working age population under 35, may see a slower shift to hybrid working as a result.

- Longer commute times by car and public transport could induce workers to prefer hybrid working as an alternative to daily commuting. This may be an incentive for hybrid working in Los Angeles, New York and Mumbai, which all have relatively long average commutes. Cities such as Lyon, Berlin and Amsterdam, where it’s easier to go into the office because of comparatively shorter commutes (often by bike), might find the office remains the most effective place to work.

- Broadband speeds and digital connectivity are critical to working remotely. Faster broadband speeds could give workers more incentive to pursue hybrid working as they aren’t reliant on the fast and reliable connectivity an office environment offers. Singapore leads the pack in this respect.

Five key takeaways

- In general, long lockdowns meant extended periods of homeworking in the West, notably in the UK, US, Germany and France, giving employees a longer ‘trial’ of working from home. Not all lockdowns were equal. For example, most German offices remained open during their lockdowns. Asian cities experienced much shorter lockdowns (if at all) and some – notably in China – returned straight to full-time office working.

- Large homes and long commutes make sprawling Los Angeles ripe for hybrid working from an employee perspective, though comparatively low office costs, long leases and a diversified economic base mean employer incentives to cut space may be lower than some other cities.

- From an office occupier (or company) perspective, Paris, London, Berlin, Frankfurt and New York are primed for a faster transition to hybrid working, given comparatively high costs, already flexible working practices, and extended lockdowns.

- Smaller cities are likely to see a slower shift to hybrid working, given shorter commutes for employees and lower costs to office occupiers. Madrid ranks above compact Barcelona for a potential hybrid shift, London above Manchester.

- A less flexible working culture in Mumbai, Shanghai and Ho Chi Minh City mean that any transition to hybrid working may be slower, while efficient use of space (higher office densities) makes the office cost-effective to occupiers – though changing employee expectations may challenge this in the longer term.

Hybrid Working Index: the employer perspective

The cost and efficiency of offices, workplace culture, lockdown length and the nature of office-using employment may influence the adoption of hybrid working.

- While a push for efficiencies in the use of space prior to Covid-19 meant fitting in more employees, employers may now be looking to organise space differently, with a greater emphasis on collaborative places and more room per employee. This could offset any shedding of space where hybrid models are adopted. Locations such as Paris, London, Tokyo and Hong Kong have higher office rents, which could prompt fi rms to examine a hybrid working strategy.

- Markets with shorter lease lengths could result in more agile decision making among firms which aren’t locked into long lease terms and could promote a quicker shift to hybrid working. Longer lease lengths in the US and UK could see firms slow any hybrid working shift as companies are tied to their office spaces for longer periods.

- Work cultures pre-pandemic will also play a role in the shift to hybrid working. Less flexible working culture in Shanghai, Hong Kong, Tokyo and Ho Chi Minh City mean that any transition to hybrid working will be slower.

- Long lockdowns, notably in the West, have shown that hybrid working is possible, but it has also highlighted that culture can be eroded if people do not have the opportunity to come together.