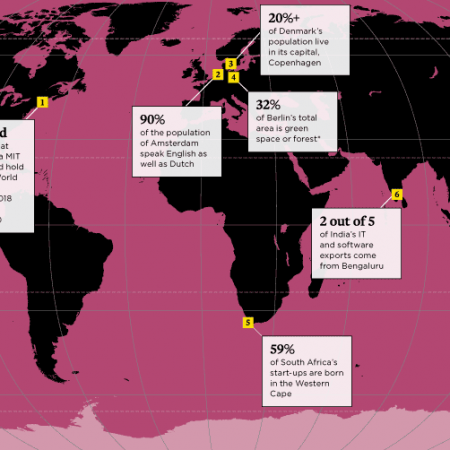

Future commercial real-estate market performances are dependent on strong economic growth, wealth, technology and positive population trends. However, not all cities will experience the positive effects of urbanisation equally. What makes a city attractive to talent, resilient to disruptive technology and a leader in the knowledge economy? Savills Investment Management launched the Dynamic Cities project to try to capture these essential factors.

Savills Investment Management Dynamic Cities shows how top cities for real-estate investors always seem to demonstrate a balanced performance across six key categories – investment, innovation, inspiration, inclusion, interconnection and infrastructure.

Heading Dynamic Cities in Europe are London, Paris, Cambridge (UK), Amsterdam and Berlin, as the top five for real-estate investment. These leading cities have strong infrastructure investment and well-developed knowledge networks, boast a global talent pool and have strong cultural amenities to help retain that talent. Furthermore, they continue to attract highly skilled labour that creates wealth over the longer term.

All three commercial property sectors – office, retail and industrial – benefit from strong growth and positive population trends. Rising employment helps support the office sector, and wealth creation in turn grows consumer expenditure, benefiting the retail sector.

Given the predicted growth of disruptive technology, it is becoming increasingly vital to identify the cities that will be likely to show resilience to future change.

View the Savills Investment Management Dynamic Cities website at dynamiccities.savillsim.com

The top three dynamic cities for real-estate investment

1. London

Global city London offers an active arts scene and a plethora of cultural amenities. It ranks first for sheer number of cafés. The creative class is helping fuel the development of technology in the City of London fringe, diversifying the Square Mile’s reputation as simply a global financial powerhouse. Technology is likewise transforming London retail: the redevelopment of Bird Street, just off Oxford Street, will represent the world’s first ‘smart street’ and traffic-free hub, hosting pioneering fashion and technology brand pop-ups.

2. Paris

Paris, one of Europe’s most liquid investment markets, has the second-highest number of world-class academic institutions in Europe and a high critical mass of patent generation. In addition to this innovative potential, the Grand Paris infrastructure project could double the reach of the city’s transport network. The Greater Paris office market is the largest in Europe, with the city’s La Défense business district benefiting from a positive shorter-term outlook.

3. Cambridge

Cambridge takes the top spot for inclusion, offering a particularly high proportion of self-organised social activities relative to its population. The city houses the largest technology cluster in Europe, and a recently opened railway station serving the science park and surrounding area elevates the city’s infrastructure and interconnectivity. Significant housing development projects to the north and south of the city will also add more than 2,000 new homes per year.

View the Savills Investment Management Dynamic Cities website at dynamiccities.savillsim.com

Image: Shutterstock