In-migration has a major impact on real estate as demand for both residential and commercial space increases. If supply is unable to match the demand, this often results in pressure on prices. We have analysed data from Oxford Economics to understand which cities are expected to attract the largest net migration over the next five years as a percentage of their population.

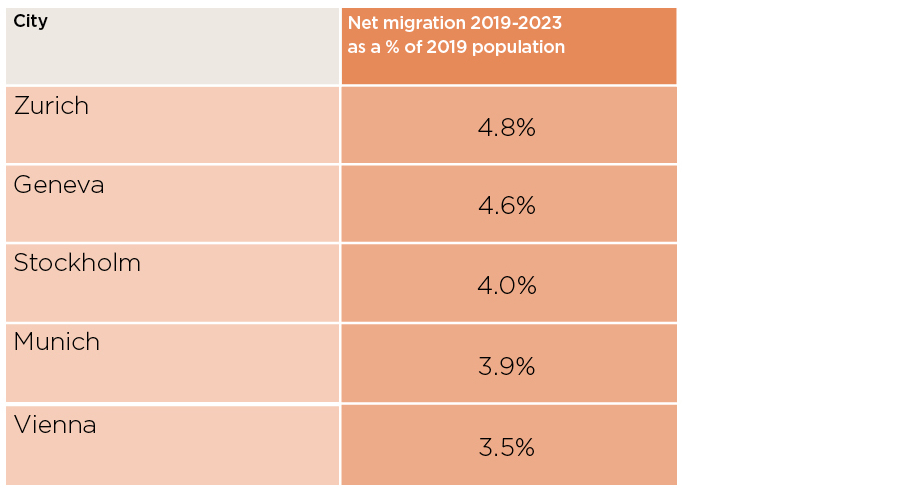

Europe: Swiss cities in demand

While cities in Europe are generally forecast to have lower levels of proportional net migration than those in Asia or even North America, there are some smaller European cities that expect high migration inflows relative to their current population.

Of these, Zurich (above) and Geneva are forecast to see the largest proportional inflows, while smaller cities with strong technology scenes, such as Stockholm, Munich and Vienna, are also expected to see comparatively high levels of net migration.

In Europe, cities that are vibrant and have strong domestic economies have long attracted both domestic and international migrants. Notably, economic arrangements that have allowed people to move relatively freely have made many Northern and Western European cities attractive to workers from the East and South seeking better employment opportunities.

“Countries such as Switzerland and Sweden have strong economies, so their cities attract talented workers looking for high-value jobs, as well as less-skilled workers seeking higher wages,” says Eri Mitsostergiou, Director of European Research at Savills.

But, wages aren’t the only pull factor. “These countries score well in quality-of-life rankings,” says Mitsostergiou. “Tied to this are the comparatively generous welfare systems, including good pensions and healthcare.”

Top five European cities for net migration as proportion of population

Source: Savills Research using Oxford Economics Note: Only cities with GDP greater than $50bn considered

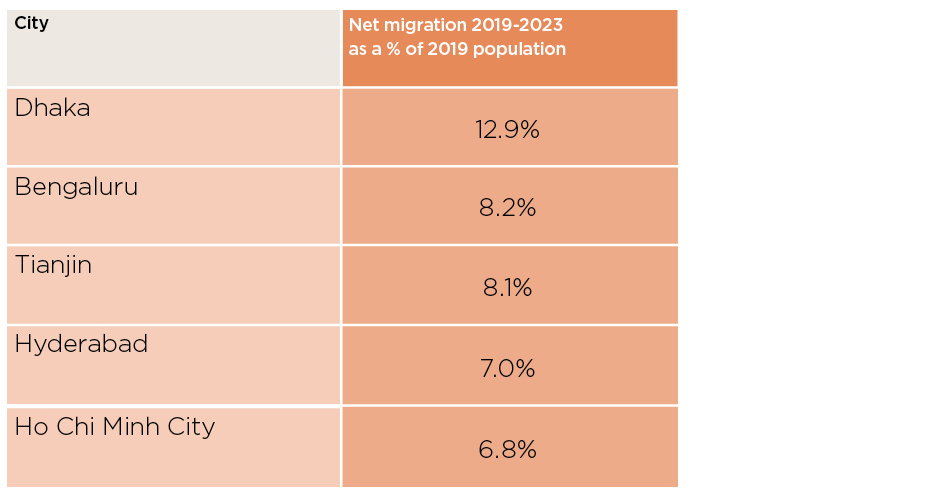

Asia: attracting talent

Asia has experienced fast urbanisation and wealth creation in recent years and this trend is expected to continue. Dhaka, the capital of Bangladesh, is forecast to see the highest level of net migration inflow over the next five years, closely followed by cities in India, China and Vietnam.

Across India, people are migrating to cities from rural areas in search of higher-paying jobs outside of the agricultural sector. Arvind Nandan, Managing Director of Research and Consultancy at Savills India suggests Bengaluru and Hyderabad are particularly attractive to younger, well-educated workers.

“These cities have grown on the back of the service economy, and the information technology sector in particular,” says Nandan. “They are therefore a pull for highly educated and mobile young workers as most companies in this sector are operating out of these cities. For young people, this gives them a chance to upskill and participate in the tertiary sector.”

Meanwhile, Vietnam is undergoing an industrial and manufacturing boom. The country’s middle and affluent classes are growing, and people are moving to the cities, particularly Ho Chi Minh.

“Vietnam is in a period of prosperity, wealth is growing and people are moving to urban areas,” says Troy Griffiths, Deputy Managing Director at Savills Vietnam. “The country is creating a lot of households that can now pay for domestic consumption and services and all real estate assets in Vietnam are benefiting.”

Top five Asian cities for net migration as proportion of population

Source: Savills Research using Oxford Economics Note: Only cities with GDP greater than $50bn considered

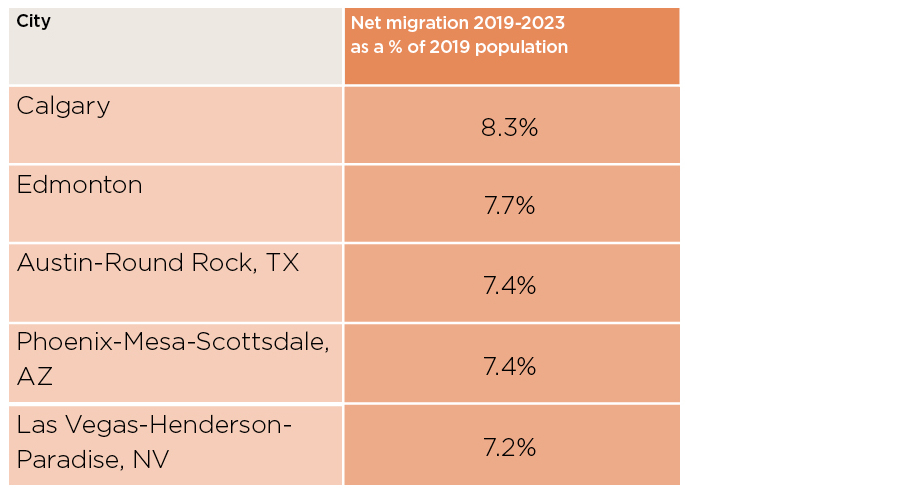

North America: quality of life

In North America, the smaller Canadian cities of Calgary and Edmonton, both located in the province of Alberta, are expected to see the largest proportional inflows over the next five years. Across the region, a similar trend is emerging where smaller cities are forecast to see the highest levels of migration inflows.

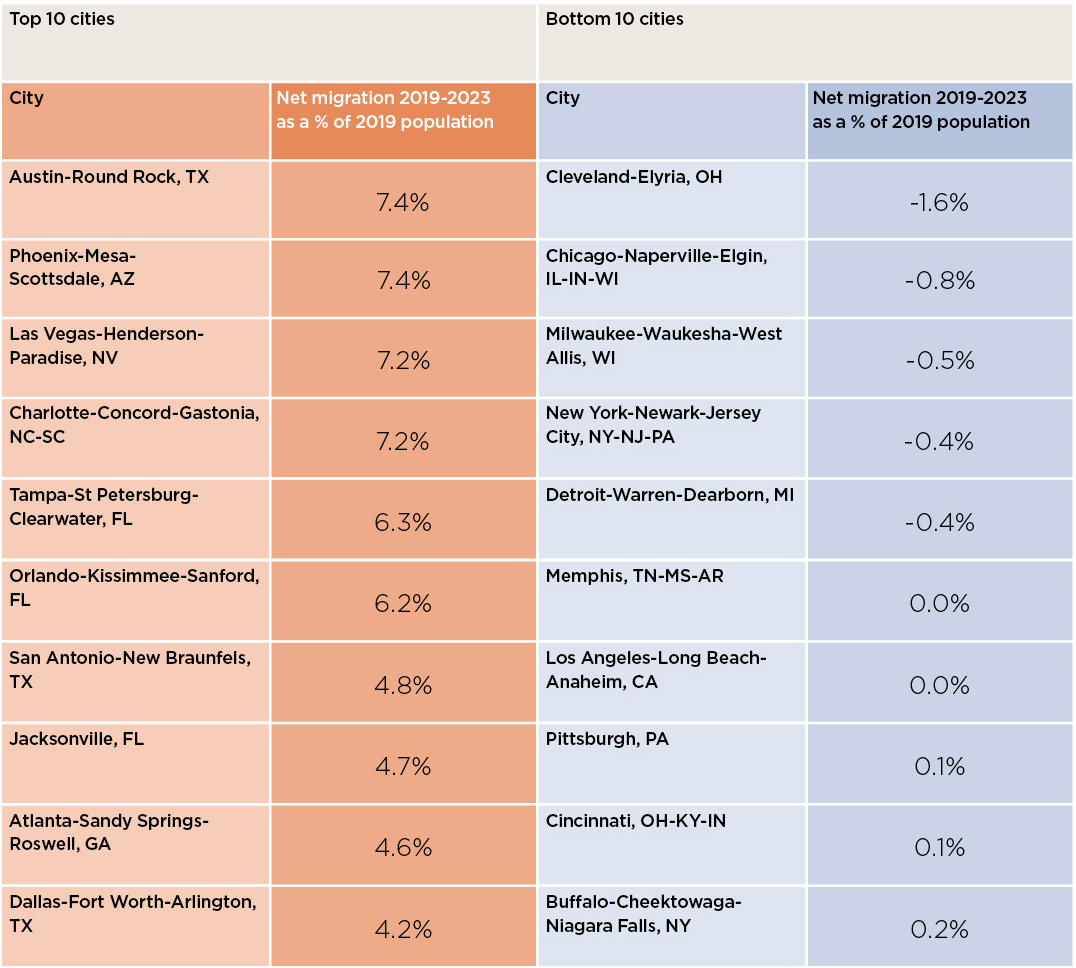

While some of the smaller cities are seeing a relatively high migration inflow, others are expected to see very low numbers of people arriving and, in some cases, a migration outflow.

Cities in the US with the largest forecast net migration outflows over the next five years include locations where job prospects have suffered, such as Cleveland and Detroit. This is expected, as people move for better employment opportunities. More surprisingly, perhaps, cities that are cultural and business hubs, such as New York and Los Angeles, are also expected to experience net migration outflows.

“Cities such as Austin, Charlotte and Tampa are becoming well-known millennial hubs capable of attracting a young and talented workforce due to their affordability and quality of life,” says Sarah Dreyer, Head of Americas Research at Savills US.

Companies seeking the best talent are driving demand for office space in these cities. “In today’s tight labour market, companies are paying attention to these migration trends in order to continue to attract a talented workforce,” says Dreyer. “Office space costs are much lower in these markets compared with more traditional mainstays like the San Francisco Bay Area or New York.”

Largely, it is technology companies which are driving new office take-up in these cities. According to Dreyer, in Austin, Google has added 1,000,000 sq ft of office space this year alone.

Top five North American cities for net migration as proportion of population

Source: Savills Research using Oxford Economics Note: Only cities with GDP greater than $50bn considered

Top and bottom 10 cities in the US for net migration

Source: Savills Research using Oxford Economics Note: Only cities with GDP greater than $50bn considered

Outlook

The next five years continue to tell a story of urban migration around the world. Increasingly, smaller cities with good job opportunities, particularly in the technology sector, and a vibrant lifestyle will be attractive to mobile and well-educated millennials. But, too often, cities do not keep up with the growing demand for real estate and infrastructure.

In Europe, many of the cities expected to experience high migration inflows have already seen population rises. This has led to strong residential rental growth and falling office vacancy rates. In Munich and Stockholm, these stood at just 2.20% and 2.94% respectively for the first quarter of 2019, according to Mitsostergiou.

Bangalore is an example of a city meeting current demand, but it appears to be in a precarious balance, as its infrastructure needs a significant upgrade. Arvind Nandan notes that the city has not had the same degree of rise in real estate prices as other Indian cities as it has been better able to expand and add additional stock. But the rapid population growth of many Indian cities has placed significant pressure on infrastructure and congestion on roads and public transport is a major issue.

As a city grows, the ability to accommodate new arrivals will be critical to its success. This includes providing suitable housing and office space and ensuring there is sufficient infrastructure in place.

Note: analysis is only based on cities with GDP greater than $50 billion. Migration is defined as the difference between the number of people coming into an area and the number of people leaving that area