Rising oil prices have accelerated the need to electrify the world’s vehicle fleet but environmental considerations are at the heart of the transition. Transport accounts for 17% of global carbon emissions, so greening it is integral to meeting global climate targets.

Nearly 10% of vehicles sold globally were electric vehicles (EVs) in 2021, a fourfold increase on 2019 levels. While adoption varies around the world (see chart), all major markets saw growth. According to the IEA, over 16.5 million electric cars were on the road in 2021, a tripling in just three years as Governments around the world support the transition through legislation and incentives.

Shifting infrastructure designed to serve internal combustion engine vehicles to EVs poses a significant challenge, and property investors, developers and landowners will be key to the solution.

Grid capacity

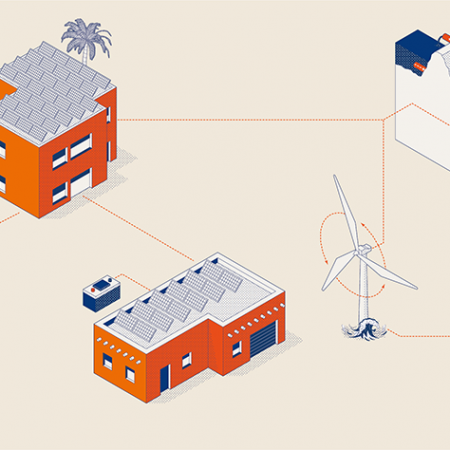

Central to EV charging infrastructure is the electrical grid. EVs in most countries are still a small proportion of total vehicle stock, but rising adoption will increase grid pressure in future. Digital grid technologies and smart charging will help manage loads, while opening up opportunities for EVs to supply electricity back into the grid at peak times.

Rapid superchargers are another part of the puzzle. Because of their high power draw, proximity to a high voltage network as well as spare capacity from the closest substation are both factors in the grid connection cost.

Silvia Manzoni, Energy Consultant, Savills UK, says “Grid capacity is concentrated in cities, but getting it to out of town sites on major routes where superchargers are needed is costly. That cost was traditionally borne by the developer, but in the UK there are plans to centralise those costs in a bid to improve the viability and support wider rollout of the charging network.”

Beyond the car

EVs are only as green as the electricity they run on. The production of their batteries is resource intensive and, like other vehicles, they still generate air pollution from tyre particles and dust from brakes. Encouraging active travel and the use of public transport is therefore central to the climate solution. Walkable development and planning solutions that give road space to those other than car users are key to a holistic transport strategy.

EVs: opportunities in real estate

- Roadside retail: EV chargers can add to the appeal of, and increase dwell time at, roadside retail. In the US, Volvo has partnered with Starbucks to install chargers on their sites between Seattle and Colorado, while in the UK, Macquarie Asset Management acquired Roadchef to develop fast-charging infrastructure at its restaurants. Gridserve has partnered with retailers including WHSmith in its rollout of electric forecourts.

- Conversion of service stations: Smaller service stations that are less suited to conversion to EV charging may pose change of use opportunities, particularly in higher value areas. For larger sites, the case for convenience retail becomes stronger due to longer dwell times EV charging brings.

- Retail space for expanding electric vehicle companies: Unlike traditional vehicle manufacturers, EV brands aren’t setting up large dealerships networks, instead using targeted physical space to communicate their brands to consumers. This has materialised as a preference for flagship city centre locations and space in trophy shopping malls.

- Provision of EV chargers in new development: Now mandated for residential in the UK, other markets will follow. As the availability of EV charging become a key determining factor in where occupiers choose to live and work, those who futureproof their schemes will have an edge. EVs are heavier than traditional vehicles, so there are load considerations for real estate, particularly when it comes to retrofitting.

- Electric micro mobility: The adoption of electric bikes and escooters can improve accessibility of areas underserved by other forms of transport, opening up development opportunities. Cargo e-bikes can allow sustainable last mile deliveries in urban areas.

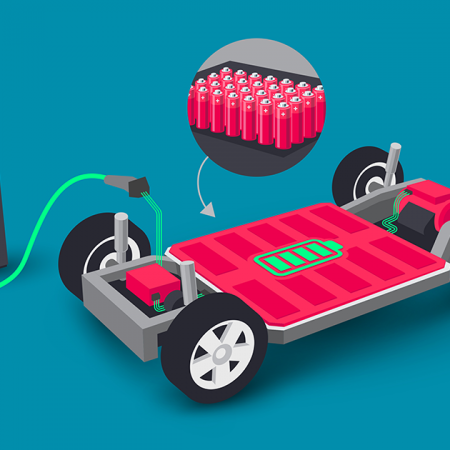

- Gigafactories: Producing rechargeable lithium-ion batteries, primarily for EVs at a gigantic scale, gigafactories will be required throughout the world to cater to the surge in EV production.

Learning from the leaders

Select country to read more

Norway

United States

China

The Netherlands

United Kingdom

Norway

EV sales share 2021: 86.2%*

EVs on the road: 649,000**

New petrol and diesel car sales ban: 2025

Norway boasts the highest EV penetration rate in the world. Last year, 86% of cars sold here were electric. Critically, EVs in Norway cost the same as their equivalent petrol or diesel models, thanks to VAT exemptions, while EV drivers benefit from reduced road and ferry tolls, discounted parking, use of bus lanes, and reduced annual ownership tax. Fast charging is available on every major road and grants are available to housing associations to buy and install chargers.

Success didn’t happen overnight: the country started incentivising EVs back in 1990. There are also some factors that are harder to replicate in other countries. Almost all of the country’s energy is renewable, most of which is hydro making it particularly stable. Population density is low with plentiful off-street parking making home charging easier.

With penetration at a saturation point, Norway is now rolling back incentives to get people walking and onto public transport.

*Battery electric vehicles and plug-in hybrid electric vehicles (cars). Source: IEA

**Battery electric vehicles and plug-in hybrid electric vehicles (cars, buses, trucks, vans). Source: IEA

China

EV sales share 2021: 16%*

EVs on the road: 8.93 million**

New petrol and diesel car sales ban: 2035

China is home to almost half the world’s electric vehicles. In a country where intercity driving is rare, smaller EVs dominate, including two wheel EVs. In common with the US, the Chinese government has fostered a home grown EV industry to support jobs and exports, reduce its oil dependence and improve energy security. Home-grown BYD is now the world’s biggest electric vehicle maker, while the country produces 80% of lithium-ion batteries globally. The electrification of vehicles is a key pillar in China’s ambitions to reduce its carbon emissions, while combatting urban air pollution.

Subsidies are available for EVs and have been in place since 2009, and a major rollout of charging infrastructure is underway. China is a global leader in the use of plug-in commercial vehicles and electric trucks. Such is the power requirement for these vehicles most charging is done overnight in depots, but China is also spearheading pilot battery swapping technology. More broadly, the country is planning for growth in hydrogen fuel cell vehicles, targeting 50,000 vehicles powered by the technology by 2025.

*Battery electric vehicles and plug-in hybrid electric vehicles (cars). Source: IEA

**Battery electric vehicles and plug-in hybrid electric vehicles (cars, buses, trucks, vans). Source: IEA

The Netherlands

EV sales share 2021: 29.7%*

EVs on the road: 396,000**

New petrol and diesel car sales ban: 2030

The Netherlands is second only to the Nordics for EV market penetration, and boasts the highest number of chargers per capita globally. The focus has been on delivering slow chargers, while at large public locations multiple charging point operators work in the same place, eliminating queues. The 1.2 million homes in the Netherlands that are part of an owners association that have their own parking facilities can apply for a subsidy to provide advice on installing EV charging.

The Dutch government has established the National Charging Infrastructure Agenda, bringing together local governments, grid operators, businesses and industry organisations to deliver 1.8 million charging points by 2030.

In common with other markets, subsidies are available for EV purchase, together with benefits such as free parking. The Netherlands is a small, flat country, making it ideal for electric vehicles. High fuel prices and an environmentally conscious population have further driven adoption.

*Battery electric vehicles and plug-in hybrid electric vehicles (cars). Source: IEA

**Battery electric vehicles and plug-in hybrid electric vehicles (cars, buses, trucks, vans). Source: IEA

United Kingdom

EV sales share 2021: 19%*

EVs on the road: 777,000**

New petrol and diesel car sales ban: 2030

EV adoption in the UK is growing rapidly, and incentives have become more targeted. Recognising the need to support EV adoption among those that don’t have their own parking, government grants for home chargers have pivoted to support renters and those with shared facilities. In Scotland, grants are available toward the installation of charging points for homes and businesses in rural areas specifically. When it comes to new development, new homes, workplaces and supermarkets in England and Scotland are required to provide EV charging.

Globally, the UK is a leader in smart charging regulations. New charging points sold since June 2022 must have smart charging capabilities, allowing better management of peak electricity loads and integration of renewable energy sources.

*Battery electric vehicles and plug-in hybrid electric vehicles (cars). Source: IEA

**Battery electric vehicles and plug-in hybrid electric vehicles (cars, buses, trucks, vans). Source: IEA