Ambitions for space

Space is around 100km from the Earth’s surface – about an hour in a car. But getting there has always been a barrier to entry – and re-entry. However, the lower cost of launch ‘vehicles’ into space presents an opportunity for companies to deliver commercial products and services.

The stories that grab the headlines usually require investment from a billionaire, but there are many sub-sectors of the space market to investigate, all of which employ thousands of people and have specific and significant real estate needs. In recent years, there has been a spate of white papers outlining countries’ aspirations for this sector. This government ambition will also drive the space ecosystem and increase the demand for real estate, from HQ offices to R&D/production and high-value manufacturing facilities.

Levels of investment

How do we measure the growth of the space sector? Capital investment is a good start. Our review of investment into three broad areas of SpaceTech – spaceflight, satellites and exploration – highlights significant growth in the venture capital (VC) world. During the five years to 2021, around $21 billion of VC was raised by companies that identify as being in the SpaceTech sector.

Putting this into context, the pharmaceutical and biotechnology sector has seen $227 billion of VC raised in the past five years. However, the SpaceTech sector has seen VC grow by 67% per annum for the past three years.

Space industry and applications

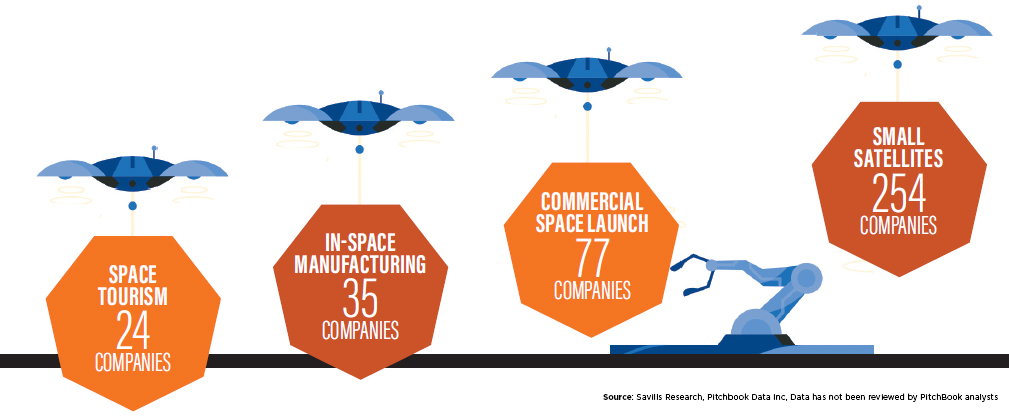

Industry sectors and applications

The future of funding is increasingly in the private sector. There are many sub-sectors of the space market, such as small satellites, in-space manufacturing and space tourism (see graphic above).

Science fiction notions of asteroid mining are also becoming credible. Goldman Sachs commented that the psychological barriers of funding a mission to an asteroid are higher than the technological barriers.

Perhaps more acceptable targets for space are around satellite technology and the delivery of commercial services for observing Earth and providing locational services. In 2021, hyper-accurate positioning was one of MIT Technology Review magazine’s top 10 breakthrough technologies to watch. Drone delivery, logistics, ride hailing and precision agriculture will all rely on hyper-accuracy, and there is a race to provide the satellites to boost accuracy from several metres down to a few centimetres.

The traditional players

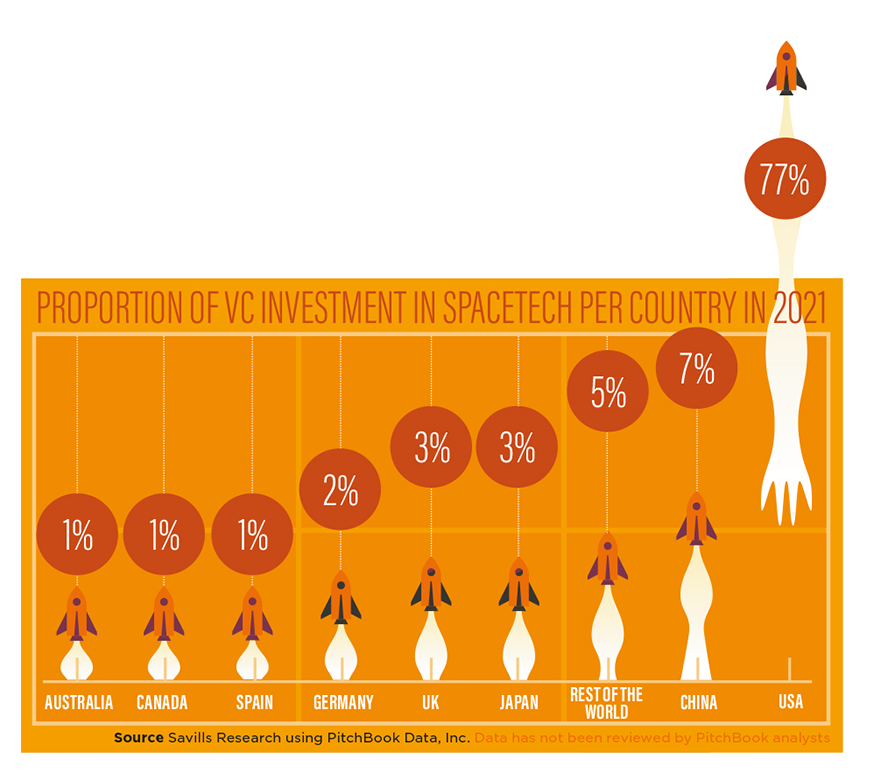

Companies headquartered in the US, China, Japan and the UK have been at the forefront of the sector in recent years. Unsurprisingly, the US has dominated, but China is accounting for an increasing share of companies headquartered in the country and attracting VC funding.

Proportion of VC investment in spacetech per country, 2021

Source: Savills Research, Pitchbook Data Inc, Data has not been reviewed by PitchBook analysts

China has set out ambitious goals for its space programme for the next five years, with missions to the Moon and Mars in progress or already completed. VC raised by China-headquartered companies has risen sharply in the past few years.

China has built space cities in the country, and has committed to developing a space port in Ningbo to rival other global locations, covering 67 sq km, 32 sq km of which will be for support facilities. This includes a wider industrial base including R&D, manufacturing, and satellite data application centres – but also a significant residential offering. The development and launch of satellite ‘constellations’ will assist with remote sensing, communications and navigation enhancement – the reconnection aspirations are massive.

China may also aspire to create a space colony, which would develop a new form of real estate that Savills will write about in this publication sometime in the 2030s (or beyond).

We have lift off: emerging locations

This new age of the space sector is also seeing alternative locations emerge, which is very exciting for the global real estate market. In terms of launch sites, the real estate need is very specialised, but possibly something that an infrastructure fund could invest in. However, there are R&D, academic-linked and corporate locations that will emerge as the ecosystem grows, akin to the life science sector.

In Finland, microsatellite manufacturer ICEYE raised $136 million in February 2022. The company provides radar satellite imaging services intended to offer access to near-real-time imagery from space. Employee numbers have increased from 11 in 2015 to 400 in 2022, with offices now in Warsaw, Poland; Irvine, California, USA; Oxfordshire in the UK, and Murcia in Spain.

The UAE, meanwhile, has developed its first economic zone in Masdar City to boost SpaceTech start-ups. As seen within the life science sector, the delivery of world-class infrastructure would have been out of reach for start-ups given their limited capital. This will drive company formation. To deliver this, the ‘four pillars’ of the new economic zone include an accelerator, workspace, government support and space labs.