Will electric vehicles change the automotive world?

Electric vehicles (EVs) are steadily weaving their way into the fabric of our transportation. According to the International Energy Agency (IEA), over 10 million electric cars can now be found on the roads of the world; with over 125 million expected by 2030. Between 2010 and 2020, the cost of batteries has plummeted to close to a tenth of their original price and could halve again by 2030, only accelerating the adoption of the EV.

Yet the ascendancy of the EV is by no means guaranteed, and that’s a worry. Despite improvements in the number of EVs on the road, emissions from transport are still rising at a time when they must fall by 80% by 2050.

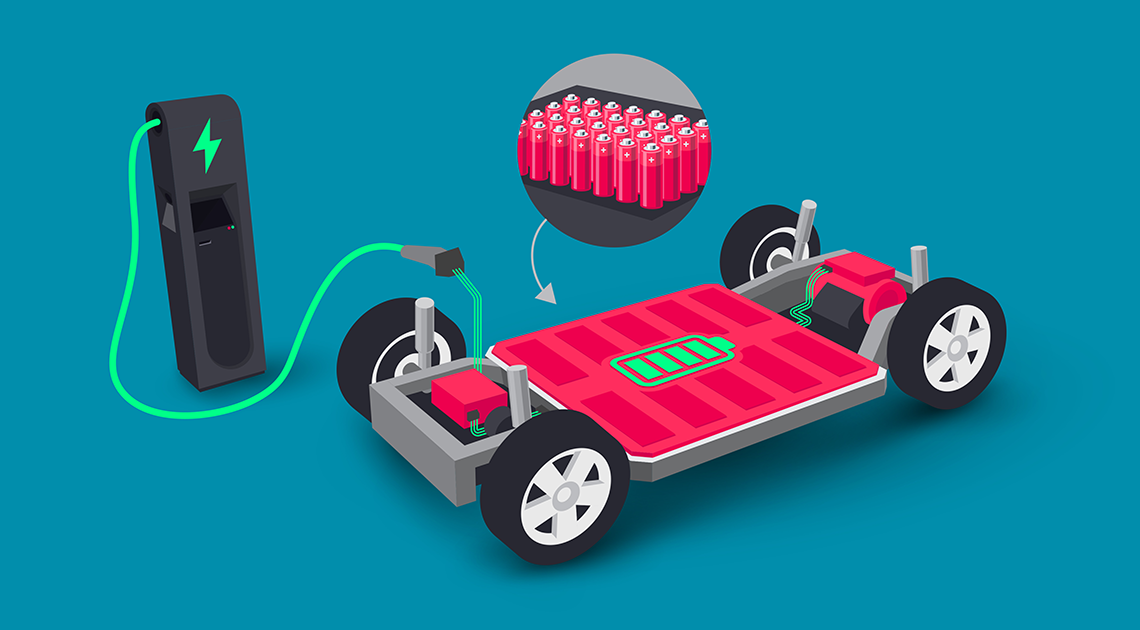

Powering the change

The cornerstone of the EV is the battery. If EV sales are to skyrocket, battery manufacturing capacity must surge alongside them. While a tripling in capacity is expected between 2020 and 2025, experts warn there may still be issues with some of that capacity, caused by the pace at which both the technology and demand is evolving. So what do battery factories, also known as gigafactories, need to be successful?

- Proportions: Gigafactories regularly require hundreds of acres of land. As gigafactories are constructed as a single, unified entity, that land must be relatively flat to avoid unnecessary cost, limiting the number of useable sites.

- Price: Many battery suppliers are start-ups with relatively limited levels of capital. Without external investment or government support, those suppliers will have to source land in cheaper locations.

- Power: Gigafactories draw tremendous amounts of power in order to operate. A site with access to such an immense power supply is required, preferably with renewable options to ensure future resilience.

- Potential: Between 2005 and 2018, patenting activity in electricity storage technologies grew at an average annual rate of 14% worldwide, four times faster than the average of all technology fields. Gigafactories must be constructed with this rapid rate of technological progress in mind; adaptability must be built in.

Which direction?

Will these requirements change the fundamentals of the automotive industry? In part, yes. Historically, automotive manufacturers have not been extensively reliant on external organisations for major components. However, the speed of the transition to electric vehicles leaves little choice when it comes to batteries. For this reason, partnerships between automotive manufacturers and battery suppliers are not uncommon as they make both practical and economic sense. Envision AESC will build a 9GWh-capacity plant as part of a £1bn partnership with Nissan UK in the North East. For Envision AESC, this means the journey to output in the region has been smoother than it otherwise would have been. For Nissan, the journey to EVs and sustainable transport is much the same.

Elsewhere in Europe, gigafactories and car factories are not quite so geographically close, but the relationship is similar. In Central Europe, Poland and Hungary have few domestic carmakers but have long supplied some of the titans of the industry based nearby such as Volkswagen and Fiat through the internal combustion age. Those nations are already making the sustainable transition, partnering with battery producing titans such as LG Chem and SK Innovation. While the partnership is not in line with the European Union’s efforts to become self-sufficient, it does pave the way for the continent to become a major player in the future despite currently being well behind Asia.

There is a third way, as demonstrated by Tesla. Although unencumbered by a history of internal combustion, Tesla has nonetheless adopted a similar production philosophy to the outgoing technology. The entirety of its production process is handled in-house, with little reliance on third party suppliers. This has seen them move away from the traditional automotive centres; Tesla’s Gigafactory 1 is not based in the Rust Belt of the USA, home to GM and the Motor City that is Detroit, but far further South, and West, in Nevada.

All of these approaches are mutually reliant on huge battery production facilities, and that is unlikely to change. By the time more modular setups become possible, whether due to technological advancement or cost decreases, the geographical centres of battery production will be firmly established, though whether they coincide with existing centres or will be found in new regions remains to be seen.

EVs are undoubtedly already changing the global automotive industry. In these early stages, it is not clear exactly which direction the industry will ultimately go in, or even if one path will ultimately prove better than the other. At present, the imbalance between supply and demand for EVs mean all approaches will likely be met with some degree of success. Only when the balance is redressed may we see the future model emerge.

Old habits

Batteries are reliant on a cocktail of minerals; cobalt, nickle, graphite, manganese and more, but it is lithium that we are all perhaps most aware of. It’s no surprise that when EVs became more common in the middle of the last decade, levels of lithium extraction also began to increase, with 71% of lithium extracted going on to be used in batteries. Compare this to 2010 when less than a quarter of all lithium extracted went towards batteries. Without adaptation, the supply chain for lithium and minerals as a whole risks bringing about another raft of environmental problems, but that need not be the case as not all mining processes are equal.

Ore mining

Hard rock ore mining involves colossal machines carving great scars into the landscape. The land impact of this method is actually relatively low when compared to the underground reservoirs discussed further down the page; the most significant environmental impact comes from the 15 tonnes of carbon emissions that accompany every tonne of lithium that is extracted from the earth. Consider that 80,000 tonnes are already extracted on an annual basis with a relatively low current demand for EVs, when we look at what will be required in the future, ore mining’s environmental impact could be very significant.

Underground reservoirs

To obtain lithium from underground reservoirs, saltwater from those reservoirs is pumped to the surface where the water is allowed to evaporate leaving a more concentrated saline solution from which salts, and therefore lithium, is obtained. Using this method cuts greenhouse gas emissions by two thirds, to only five tonnes per tonne of lithium. It does, however, require six times more land, and almost triple the volume of water for each tonne of lithium. The latter is of particular concern given that these underground reservoirs are commonly found in areas where water supply is often limited.

A third way

Both of the above methods have significant environmental drawbacks which are unlikely to be compatible with a resilient supply chain in the age of net zero and environmental consciousness. Fortunately, there is a third way. Geothermal waters are best known as a potential source of renewable energy, however these heated waters can become enriched with minerals as they pass through rock. Should those rocks be rich in lithium, as in Cornwall for example, the brine too becomes enriched with lithium. By pumping this enriched, superheated water to the surface, renewable energy can be obtained and lithium extracted with close to no environmental impacts, representing the best of all worlds.

Ore mining and underground reservoirs are highly location specific, with the largest sources found in Australia and South America. It is no coincidence that these locations are the largest producers of lithium in the world. Geothermal extraction makes lithium far more accessible across the world, with projects already underway across Europe and North America. A more diversified lithium supply chain stands to ease battery supply problems and more rapidly usher in the EV age.