The rise of online retail is transforming the global logistics landscape. In some countries, ecommerce touches almost every aspect of retail. In others, it is only just beginning to emerge. We identify the global leaders – and laggards – and which markets offer the greatest opportunity for the logistic sector.

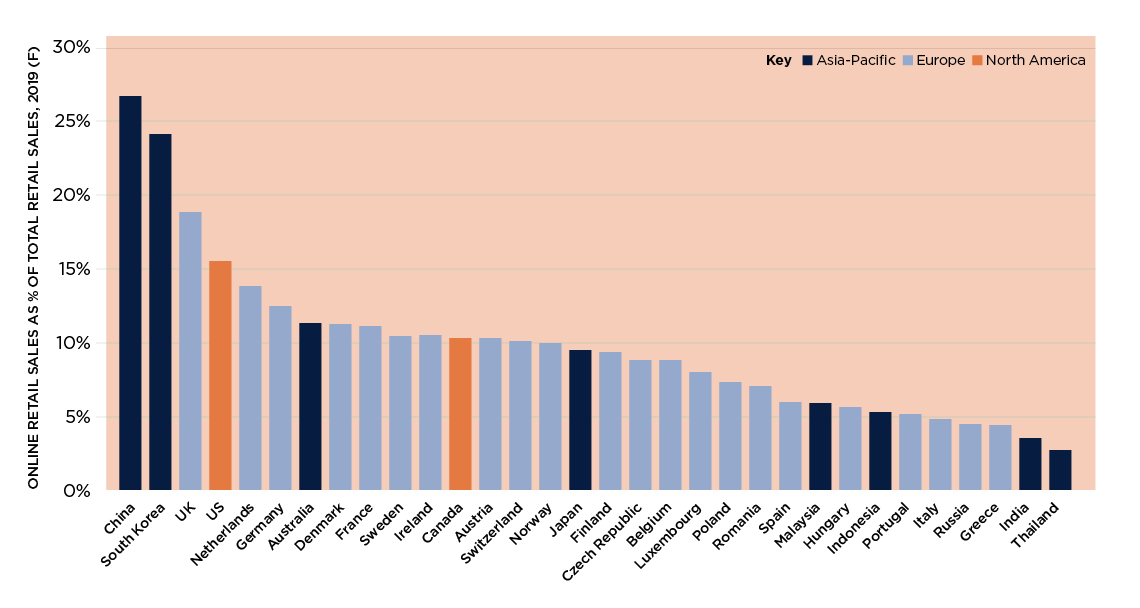

Online retail sales as a percentage of total retail sales, 2019 (f)

Source: Savills Research using Forrester

The global leaders

More than one-quarter of all retail spending in China is conducted online, making it the biggest ecommerce market in the world.

Its position as global leader is down to a number of factors. First, China’s population has embraced mobile payments. Alipay and WeChat Pay are owned by, and tightly integrated with, the major ecommerce retailers, making online shopping completely seamless.

James Macdonald, Head of Savills China Research, says, “Physical retailers in China have historically suffered from restricted product ranges. Offering expanded choice, early ecommerce entrants sold straight from the factory, making them extremely competitive on price. On top of this, high urban population densities and low labour costs made delivery fast and cheap.”

China’s logistics market is dominated by two players, although more are emerging every day. Alibaba is the majority owner of Cainiao Smart Logistics Network, a collaborative venture between Alibaba and a number of logistics companies and financial institutions. Cainiao currently processes 100 million packages a day, and is aiming to process one billion a day in a decade. Alibaba’s major rival, JD.com (Jingdong) has developed its own logistics network.

As in the West, China’s ecommerce players are moving into physical retail. Alibaba launched Fresh Hippo, a supermarket that also serves as a last-mile delivery centre. There are also rumours that Alibaba has plans for micro-stores within some communities that will offer home delivery of key products within minutes.

With a figure of just over 24%, South Korea has the second-highest ecommerce penetration rate in the world. According to Savills Korea Research & Consultancy, there are about 400 logistics centres of more than 10,000 sq m in the Seoul Metropolitan Area (SMA). There is an estimated pipeline in the SMA of 1.8 million sq m in 2018 and 1.9 million sq m in 2019, of which 25% is pre-let or marked for own use.

Yields for Korean logistics assets are compressing, but are still substantially higher than those in the office market. Cap rates are in the mid-6% to 8% range, which is at least 200 basis points higher than prime offices. Overseas investors have included CPPIB, M&G, Morgan Stanley and Blackstone, accounting for more than three-quarters of deals in 2017 alone.

While European and many Asian markets benefit from high population densities, Australia, Canada, and, to some extent, the US, have to contend with more dispersed populations. This directly impacts efficiencies in delivery. For example, Amazon’s Prime service offers a two-day delivery as standard in the US, compared with a default one-day delivery in the UK.

For high population density areas such as the Northeast Corridor (Boston to Washington DC), Amazon has implemented a one-day delivery service by establishing several fulfilment centres across the region, through build-to-suit or repurposing of existing real estate. The US has been a pioneer in repurposing redundant retail, with a growing trend of retail to fulfilment centre conversions (read more here).

Adam Petrillo, Savills Head of Industrial Services in North America, anticipates that the US online retail penetration rate will continue to inch-up steadily. “It may not be a huge double-digit jump, but a sustainable growth that companies should have a robust omnichannel strategy to support it,” says Petrillo.

Markets to watch

The UK is Europe’s online retail leader, with an ecommerce penetration rate of 19% in 2019, well ahead of its closest European rival, the Netherlands at 14.9%. Kevin Mofid, Director of Savills Industrial Research, says, “The UK’s logistics market underwent significant growth after 2012, the point at which online reached 11% of total retail sales.

“By looking at the different European logistics markets and where they are compared with the UK in circa 2012, it should help to forecast how this rapid shift in demand might be replicated,” he says. “The Netherlands, Germany, France, Demark and Sweden are all on the cusp of significant transformation on this basis. Australia is the one to watch in Asia-Pacific.”

In Savills European Omnichannel report, Germany was identified as the European market of greatest attractiveness to investors in logistics. Here, geography plays a role. Located between the eastern and western flanks of Europe and connected by quality infrastructure, it generates some of the highest levels of road and seaborne freight in Europe. Strong investor interest for the logistics sector has pushed prime yields downward, by 300 basis points in Berlin over the past five years alone.

France has a strong growth potential in ecommerce. At 11.2%, penetration is lower than the UK, the Netherlands, Germany and Demark, but on the cusp of significant growth in its logistics market. Infrastructure is excellent, but labour costs are high. Sweden is another market with strong potential, just behind France with a penetration rate of 10.5%. The vacancy rate for modern prime logistics space in Sweden is currently below 3%.

Like China, India is highly mobile-enabled and offers low labour costs and high-density urban areas, but without the same manufacturing boom. India is also much earlier on the online retail curve and has an ecommerce penetration rate of just 3.6%. However, with a population that is forecast to overtake China’s in the next five years, this market offers vast potential.