Forget the pandemic dream of an escape to the country. The story now, across the world, is the return to the city.

2022 was a year of two halves. The first was all about a jubilant, post-Covid economic recovery. The second was subdued by geopolitical instability, rising costs and cooling measures brought in to take the steam out of overheated markets. And the result? A highly uneven playing field for 2023, with some definite winners and losers – and also some surprises.

On the rise: top prime residential real estate markets

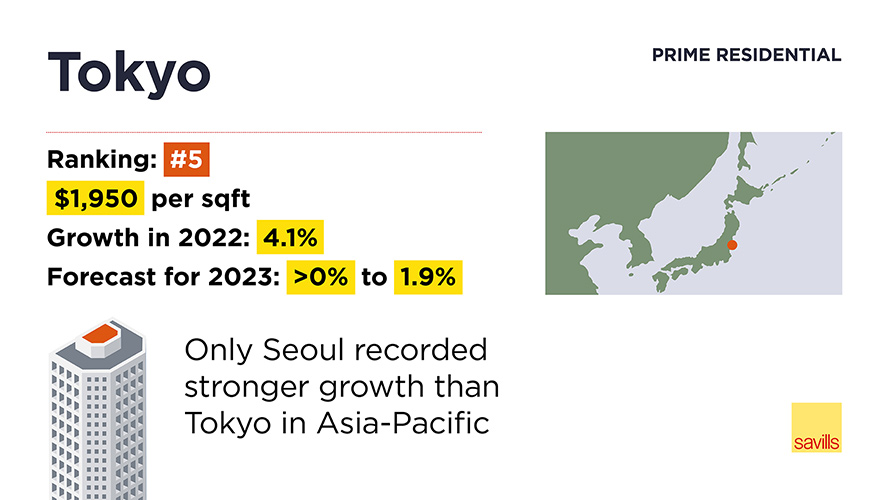

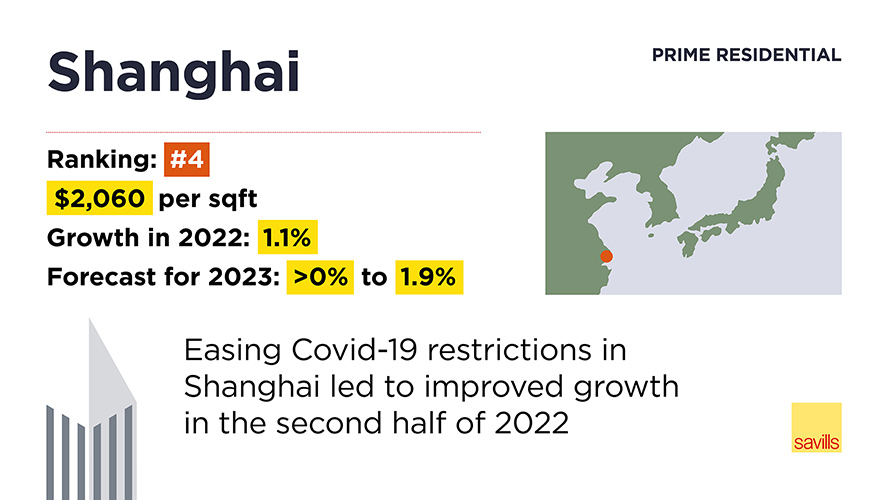

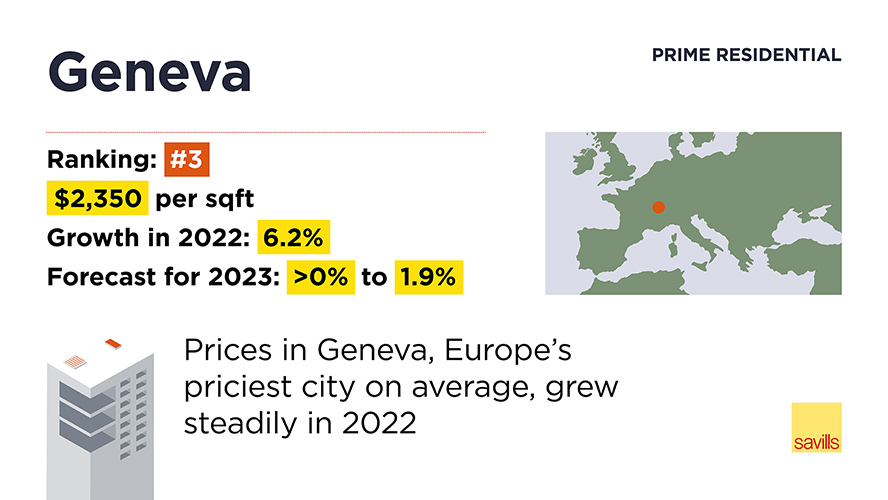

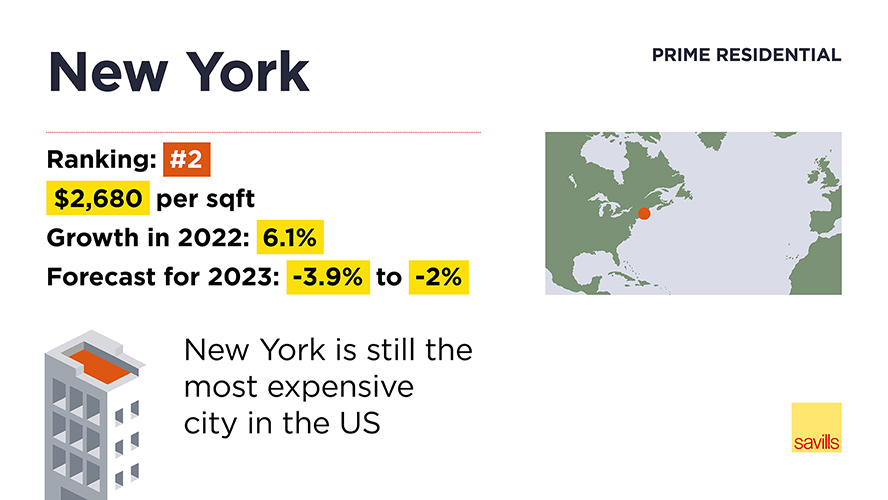

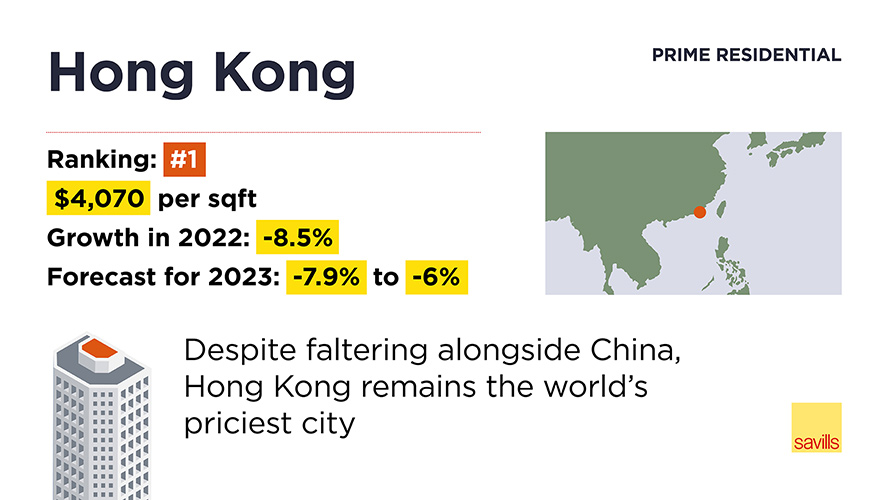

Not all cities are created equal, of course. The full story is revealed in Savills World Cities Prime Residential Index 2022, which monitors 30 global cities – from Cape Town, where the average price per square foot in the prime market is $260, to Hong Kong, where each square foot will cost you $4,070. You can also find out where – given a budget of $2 million for a second home – you’ll need to put aside 34 per cent for taxes. And where, in similar circumstances, there are almost no buying costs at all.

We saw huge nationwide variations in 2022. Miami, for example, recorded monumental capital growth of 25.4 per cent last year, leaving the rest of the world’s major cities in its wake. How will this gateway to Latin America fare in 2023?

At the other end of the spectrum, San Francisco was on mute, coming second-bottom in Savills global city rankings for prime price growth. As remote working becomes embedded and the city’s IT giants curb expansion plans, can it muster anything like a recovery in 2023?

In the Gulf, meanwhile, Dubai was playing catchup. Spectacular prime property price growth of 12.4 per cent in 2022 showed the Emirate had recovered from an earlier market-subduing over-supply of new-build properties. Prime prices should still be riding high this year, at between 6 and 8 per cent, fuelled by a broadly international cadre of global nomads, expat families and young professionals in search of sunnier climes.

Continued growth in rental markets

Global rental markets have been a headline story in recent months, as a lack of good-quality rental stock and increasing demand, plus economic uncertainty and rising interest rates, have driven people to be long-term tenants instead. Prime rents across all the global cities we monitor increased by four times the average capital value growth – partly driven by the return of international students and corporate relocators after two years in the Covid wilderness.

Digital nomads, too, are increasingly prominent players in city markets. Because they tend to rent initially and work flexibly, these remote workers head for cities with lifestyle appeal. Cities such as Lisbon, Barcelona and Milan – which are not just tech or finance hubs, but cosmopolitan lifestyle destinations – have benefited from this. This southern European trio are also each expected to record prime capital value growth of between 2 and 3.9 per cent in 2023.

Some cities will see the impact of attempts to curb rampant price inflation this year. Measures such as rent caps, higher social housing quotas in new developments, and additional stamp duty for foreign buyers have been introduced. Most extremely, Canada has put a ban on some foreign buyers. With wider housing affordability a persistent issue, political intervention in residential markets will be a trend to watch in 2023.

Although 2023 is unlikely to be a year of great capital growth – we expect an average 0.5% per cent across the board – the most sought-after cities never fail to intrigue and surprise. That’s the reason they are back on the radars of buyers and renters the world over.

Read the full Savills Prime Residential Index: World Cities report here