Carbon reduction, security of supply and rising energy costs are prompting countries around the world to reduce their dependence on fossil fuels, leading to a huge increase in investment in clean energy.

This has led to significant growth in development of renewable infrastructure, creating new opportunities for institutional investors.

Figures from BloombergNEF point to the energy sector being at a tipping point. Investment in low-carbon technologies is now reaching parity with the capital being deployed into traditional fossil-fuel extraction and supply.

The majority of new investment is going towards greener technologies. As well as funding renewables such as wind turbines or large-scale solar farms, significant investment is going into the tertiary market – building and upgrading the infrastructure needed to store and distribute power.

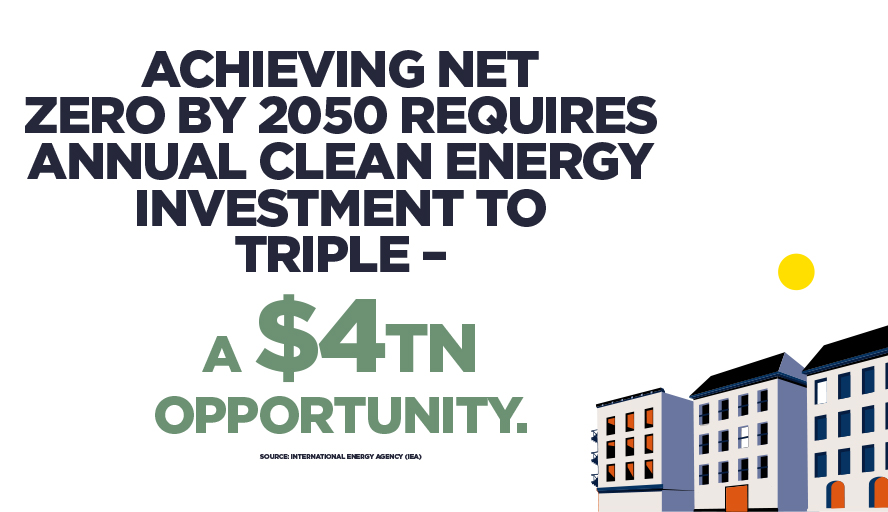

But is it enough? According to the International Renewable Energy Agency (IRENA), investment levels are languishing at less than 40 per cent of that required each year to meet net-zero targets. It estimates that investment in clean energy needs to triple by 2030 – to $4 trillion – to achieve a global net-zero target by 2050.

The major issue for many investors is the long lead time involved in sustainable projects. Getting planning permission for large infrastructure projects can take years, particularly in more developed economies.

Building costs are another challenge. Prices of aluminium, copper and steel – essential for cables, turbines and photovoltaic (PV) panels – have increased significantly, driving up overheads. Rising labour costs only add to the expense, potentially weighing on overall returns for investors.

Opportunities for private investors in clean energy infrastructure

These factors mean that there have to date been limited opportunities for institutional investors in this sector. Figures from IRENA show that total funds from institutional investors accounted for only 1 per cent of private investment in renewables – at $2.5 billion.

Most of this private money has been to fund more established technologies such as solar PV and onshore wind, which accounted for 84 per cent of these funds in 2020.

Thomas McMillan, director of Savills Energy, says that there remain exciting opportunities for investors in this sector, particularly with regard to technologies that support renewables, such as energy storage and smart technologies.

“The transition to renewable energy sources is gaining momentum globally but the rate of growth is insufficient to meet international climate goals. However, the growth we have seen recently may very much be the tip of the iceberg. With developments in the pipeline, we expect to see far more renewable infrastructure projects and smart technologies coming through in the next few years.

“Real estate companies should look at these as an opportunity to diversify risk. But they should also look at their existing portfolios – and how energy efficiency, renewables and smart technologies can be integrated into assets.

“There are infrastructure investment opportunities across different global regions and it is clear that countries that can modernise their grid infrastructure, shorten planning issues and offer opportunities to invest in tertiary infrastructure that present more attractive options for investors.

“This can be further supported by government policies, particularly those that create a long-term framework to encourage institutional investment into these important strategic areas.”

A collective effort from governments, the private sector and local communities is essential if we are to successfully transition towards a greener, cleaner energy future.

Looking ahead

Renewable energy infrastructure is a sector that looks set to be increasingly important for many institutional and private investors.

When entering the renewables market, investors should not overlook how energy underpins our day-to-day lives. Technology cannot be powered without it. Transport stops without it. Commercial and residential real-estate cannot flourish without it.

In total, the IEA estimates that more than $1.4 trillion was invested in clean energy projects last year – a record high – with the biggest swathe coming from the Asia Pacific region, followed by Europe and then Central and South America, as shown in the graph below.

Annual clean energy investment as a percent of GDP

Source: Savills Research using International Energy Agency (IEA)