The Savills World Research team has ranked 500 cities on the depth of their real estate market, economic strength, knowledge economy and technology and environmental resilience. The top cities in the index will be best placed to adapt to future economic and environmental challenges.

Real estate investment:

A liquid and readily invested real estate market, with security of title.

Knowledge economy & tech:

High value-add employment with venture capital funding, quality education and innovation in business.

Economic strength:

A secure, dynamic economy of scale with high personal wealth and strong demographics.

Environmental, social and governance:

A society that values sustainable environmental practices, has access to good healthcare, is inclusive and fair with sufficient governance.

For a while, the city looked in trouble. The Covid-19 pandemic hit large and densely populated metropolitan areas more dramatically than it did quieter, sparser locations. News footage from around the world showed empty city streets and a remarkable lack of the usual hustle and bustle. Any number of commentators declared that the city was over: work from home was the future and we need to address what to do with all those empty offices.

However, the combination of vaccines and antiviral drugs has reduced the impact of Covid-19 and people all over the world have begun to reconnect with cities. Savills Prime Residential Index showed price growth in 28 out of 30 major cities in 2021 and the highest annual rental growth since 2014.

Office workers have been keen to reconnect with their colleagues and occupiers with their staff. Savills data show City of London office take-up rose 65% year-on-year in 2021, and in January 2022, monthly take-up was the highest since 2018. Similarly, New York saw the highest quarterly take-up for two years in the final quarter of 2021.

In 2022, the world is facing a new threat. Two years after Covid-19 was declared a pandemic, real estate markets were beginning to return to normal as restrictions on mobility and international travel were eased across many regions. The war in Ukraine brings new headwinds, and may have a negative effect on some investor sentiment and delay recovery – particularly across markets in close proximity to the crisis. The full implications are as yet unknown, but the war’s impact on commodity prices has further pushed up inflation, squeezing living costs. In times of heightened uncertainty, the resilience of cities will again be tested.

The human preference for the city has scarcely waivered, but preferences about what type of city is most desirable are changing

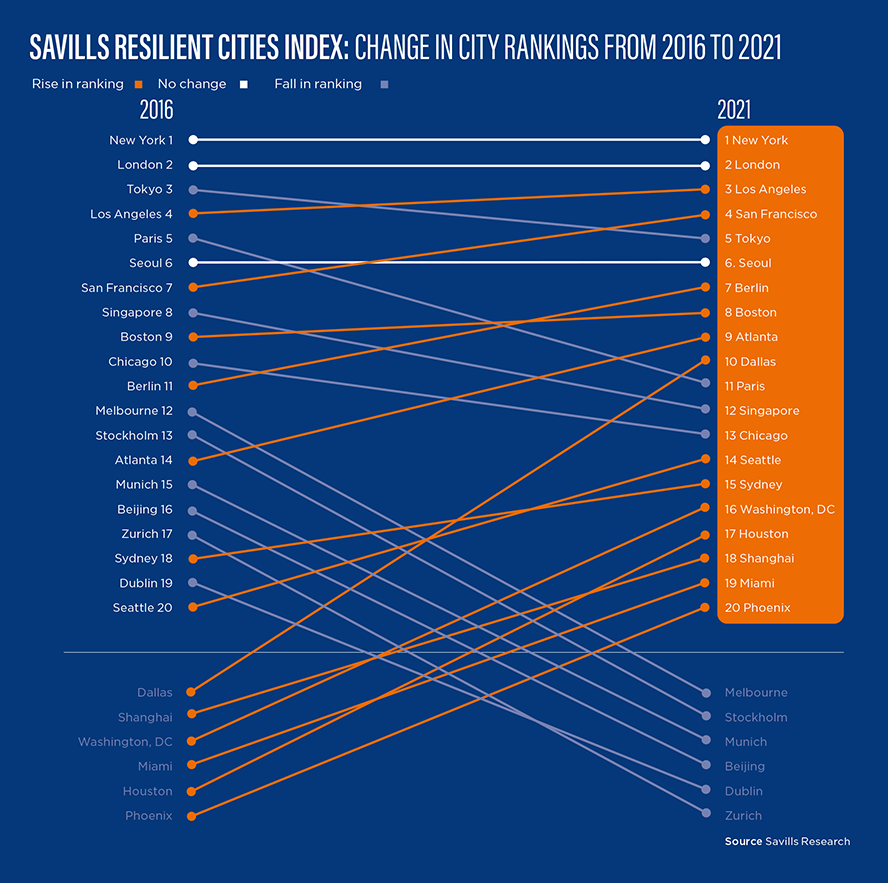

But cities have survived recessions and previous pandemics by adapting and demonstrating resilience. The Savills Resilient Cities Index assesses 500 cities on their economic strength, demographics, education and the knowledge economy and environmental resilience, as well as the depth of their real estate markets, to rank them on resilience. The top of the index is largely unchanged over the past five years: New York and London retain the top spots, while Los Angeles, San Francisco, Tokyo and Seoul remain in the top 10.

However, while the human preference for the city has scarcely waivered, preferences about what type of city is most desirable are changing. Thanks to fast-growing economies and lower living costs, a number of mid-sized US cities have broken into the top 20 or climbed into the top 10 since 2016. Outside the top 20, the most successful of these cities are driven by fast-growing knowledge industries such as tech and life sciences, and include Copenhagen, Shenzhen, Toronto, Austin, San Diego, Denver, Raleigh and Eindhoven.

Cities that host high-tech industries are attracting people and capital. San Francisco, Boston and Shanghai have all climbed the rankings in recent years

The other key driver of change in ranking is technology and the knowledge economy. Cities that host high-tech industries are attracting people and capital. San Francisco, Boston and Shanghai have all climbed the rankings in recent years. Looking ahead, the post-pandemic focus on health and wellness will benefit cities that are walkable, liveable and have lower pollution. The search for wellness is strongly linked with meeting the challenges of climate change, so cities that do well in one of these factors will likely do well in both.

click on each icon to read more about the factors of a resilient city

Real estate investment

Economic strength

Knowledge economy/tech

ESG

Real estate investment

In real estate terms, a resilient city will have a large, liquid market, a good mix of domestic and international investors and strong property rights. Collectively, the world’s cities scored very highly, with 2021 investment volumes of more than $1.3 trillion – 59% up on the previous year and 22% ahead of 2019, the last record year.

While Los Angeles and New York have swapped places since 2016, they remain at the top: large, liquid markets attractive to all investors. Less travel in 2021 meant LA, which is less dependent on international capital, overtook New York.

London remains the most international real estate market in the world, with 62% of investment activity involving cross-border capital, equating to $31.9 billion of deals in 2021.

Berlin on the rise

Berlin overtook London to become Europe’s largest real estate market in 2021, although this was largely due to a single transaction, a merger between two residential property companies. The German capital’s residential market continues to attract investment.

The most significant change in the real estate part of the index has been the rise of US cities beyond the east and west coast giants. Since 2016, Atlanta, Phoenix, Boston and Houston have shot into the top 20 on the back of capital flows due to strong population growth, which has also been the case for Miami. In recent years, workers have flocked to these cities because they offer employment opportunities and high quality of life.

Both Atlanta and Miami offer good weather and lower house prices than large cities further north. Lower state and city taxes have also attracted footloose US workers.

Where people go, real estate investors will follow, not least because of the popularity of the residential sector, which overtook offices in 2021 to become the largest real estate sector worldwide. Looking forward, this preference will drive more investment in cities that are attracting workers. The difficulty of buying assets in US gateway cities is also pushing investors to look elsewhere. Another prime motivator for real estate investors is ESG considerations. The desire to buy and build more sustainable real estate will determine not just the type of assets that are most attractive, but the cities where buyers prefer to place their capital.

Economic strength

When it comes to economic strength and resilience, size matters. Larger and growing populations and higher and growing GDP (both in total and per capita) drive resilience, but so do economic diversity and low risk. The world’s largest and richest cities naturally sit at the top: Tokyo and New York have maintained their positions since 2016.

Tokyo stands out for its low risk and highly diversified economy, which still attracts migrants from provincial Japan and keeps the city growing despite the wider demographic challenges in the country. New York’s position is based squarely on wealth – it has the largest GDP per capita – double that of Tokyo.

Hangzhou, another Chinese tech city, has gained more than 30 places due to its growing and dynamic economy

China now has four cities in the top 12, reflecting its burgeoning economic strength. The dynamic tech city of Shenzhen maintains third place, while Shanghai and Hangzhou have burst into the top 10. Hangzhou – another Chinese tech city – has gained more than 30 places due to its growing and dynamic economy. Technology and the wealth it generates also propel San Jose in the tech hub of Silicon Valley, California towards the top of the rankings, despite it being far smaller than the other cities in the top 10.

GDP growth in Delhi

Delhi provides a marked contrast with San Jose, as its GDP per capita is only 1/100th of that in the Californian city. However, it has a growing and youthful population and increasing urbanisation, all of which will combine to bring economic growth.

Arvind Nandan, Head of Research and Consultancy at Savills India, says: “Delhi has a well-developed social, physical and industrial infrastructure. It also has a large percentage of skilled workers relative to other states, which is driving the knowledge economy, particularly in IT, design, R&D and financial services, and thus economic growth. Average GDP growth is forecast to be 8.7% over the next five years.”

London has fallen back over the past five years, due to higher risks from its departure from the European Union, but it remains the only European city in the top 12. However, financial stability and low risk are also economic strengths that keep the Swiss cities of Basel and Zurich in the top 20.

In future, large and wealthy cities will continue to dominate this part of the Resilient Cities rankings, while the economic growth of China will move its cities upwards, although this effect is likely to be mitigated by demographics, which will, in contrast, add to the economic resilience of India’s large cities.

Worldwide, cities where a large part of the population is of working age, such as Shenzhen (86%), Dubai (83%) and Cairo (69%), should offer real estate opportunities to cater for the rising middle classes and growing business investment.

Is GDP the best way to measure a city’s success?

Overall GDP is a blunt measure that misses inequalities, and as people favour work-life balance, health and happiness more than money, there is a search for ways to measure a city’s less tangible qualities. Furthermore, GDP does not account for the environmental cost of growth, something we take account of through the ESG factors of our index. A number of countries, most notably New Zealand and Iceland, have forward-looking governments who realise that welfare extends beyond GDP. New Zealand’s Living Standards Framework is intended to “capture the things that matter for New Zealanders’ welfare” and results will drive government spending in certain areas. It seeks to measure the following three metrics:

- Individual and collective wellbeing – factors such as health, knowledge and skills, housing and leisure.

- Institutions and governance, including government, firms and markets and international relations.

- Wealth – financial capital, social cohesion and the natural environment.

Knowledge economy and technology

The world economy is increasingly driven by technology and the knowledge economy, and the most resilient cities are those that can adapt to new technologies and provide an enticing environment for workers in high-growth tech businesses. Knowledge-driven cities have good universities, a large and youthful working population, attract venture capital investments and produce innovative patents.

South Korea has achieved a unique position in the rankings due to its strong education system and well-known tech conglomerates such as Samsung and LG. Seoul has stayed at the top of the rankings since 2016, while the smaller cities of Daejeon and Gwangju have moved into the top 10.

Elsewhere, large cities with good universities, including London, New York, Beijing and Shanghai, also score well and attract substantial venture capital.

Leaders in life science

Boston maintains its place in the top 12 due to its strength in life sciences, one of the fastest-growing parts of the knowledge economy, buoyed by the pandemic and ageing populations in the developed world.

Steven Lang, Director of Offices and Life Sciences Research, Savills UK, says: “The Covid-19 pandemic has focused the need for funding into all areas of human health, both public and private. Global life science venture capital investment grew by 32% last year, following a 55% increase in 2020 – this shows that many more financial capital providers became comfortable with the life science sector and more aware of the human problems and conditions that need to be addressed today and in the future.

“The companies that attracted this capital are now in hiring mode. For many, this means physically locating in core city locations. This enables their ability to successfully attract the best talent. Those tech labour pools are mainly found in larger cities, which also provide a closer proximity to a larger pool of end-users.”

Success breeds success in the life sciences sector and other knowledge industries. Locations that offer a mix of universities, major tech occupiers and the firms that support them – as well as lifestyle options for employees – will see cluster benefits. Sometimes, cities can form a cluster, such as the Golden Triangle of Oxford, Cambridge and London in the UK or the Research Triangle of Raleigh, Durham and Chapel Hill in North Carolina.

Lifestyle and liveability factors

Attracting talent is crucial to the success of knowledge economy businesses, which means that lifestyle and liveability factors will become more important in the future.

Cities that offer great lifestyles, such as Austin, Barcelona and Copenhagen, have benefitted from workers’ migration, while the digital nomad phenomenon has knowledge workers who can operate remotely from anywhere in the world choose cities entirely on the basis of lifestyle.

Savills Tech Cities research posits that the presence of cafes that offer good flat whites and vegan burgers could well be a barometer of success as a tech city.

Environmental, social and governance (ESG)

In cities, as in every other aspect of human life, ESG issues have become a major priority. Not only do most industrialised nations have a net-zero emissions target, but so do many cities and many corporations.

However, most ESG factors are on a country level, which dominates any city characteristics as, naturally, cities within nations that prioritise ESG will tend to outperform. The index rates cities largely at a country level, on factors such as carbon emissions per capita, renewable energy consumption, food security, inequality, democracy and the rule of law. However, it also considers the Energy and Climate Intelligence Unit’s net-zero target database at city level.

The top performers are concentrated in a small number of Northern European countries and Canada. The total population of the cities in the top 10 by ESG is less than seven million, slightly more than a quarter of the population of Shanghai. This highlights the challenge facing larger cities and emerging economies.

Race for net zero carbon emissions

The Nordics and Iceland dominate the top 12 cities for ESG, as they are prosperous, liberal economies with abundant natural resources and low population densities. Iceland, for example, gets more than three-quarters of its energy from renewable sources, mostly through hydropower and geothermal power.

Austria has three cities in the top 10, including the capital, Vienna. Sebastian Scheufele, Managing Partner at Savills affiliate Modesta Real Estate, says: “The three cities provide an excellent public transport system, which contributes to lower emissions. Furthermore, Vienna has been voted the city with the worldwide highest quality of living several times in a row.

“Additionally, Austria has pledged to reach net-zero carbon emissions by 2040, which is a full decade ahead of the wider EU target. In recent years, ESG has become increasingly important for real estate investors, landlords and tenants in Austria and this trend is likely to continue over the next few years.”

Toronto and Montreal have seen their ranking boosted by Canada’s social and governance credentials. Toronto has also set a 2040 net-zero target date, a decade ahead of the rest of the nation.

The real estate industry, which is responsible for 40% of global carbon emissions, is more focused on ESG than ever before, with many of the largest investors and asset managers pledging to be net zero carbon by 2050 or earlier. Technology is at the heart of this process, whether it is using artificial intelligence to run buildings more efficiently or in the use of new construction techniques and materials. However, the challenge in ESG is not so much the best, as the rest. Most of the world’s building stock is not new, so more needs to be done to make existing real estate stock more efficient.

Similarly, smaller cities in wealthy nations will continue to dominate the ESG section of the research. However, the main challenge in sustainability is getting the same sort of performance from larger, poorer cities, where economic growth remains a priority and a necessity.

Risers in the Resilient Cities Index

Los Angeles, US(MOVES UP ONE PLACE, RANKED 4TH IN 2016) |

In addition to having the world’s strongest real estate market, Los Angeles is also a creative and economic powerhouse. Millions of people worldwide aspire to one day move there and make it big.

Of course, the city’s success is founded on more than Tinseltown dreams – LA is also home to a myriad of high-tech industries. Nonetheless, the entertainment business is huge and has reconnected with customers in recent years in order to meet demand for streaming entertainment.

“LA continues to appeal to talented workers from around the world who are attracted to the region’s climate, amenities, and high quality of life,” says Michael Soto, Head of Office Research at Savills in LA. This desirability sent prime residential prices up 19.7% in 2021.

Liveability and emissions are challenges for a city known for its gridlock, but Soto says: “Over the past 15 years, LA County voters have authorised more than $120 billion in taxes to fund long-term transit construction projects.

Long notorious for its traffic gridlock, LA has seen the largest transit infrastructure programme of any metropolitan area in the United States.”

Berlin, Germany(MOVES UP FOUR PLACES, RANKED 11TH IN 2016) |

The German capital’s rise in ranking is buoyed by the success of its residential market, which itself thrives because of the city’s dynamism. “For the first time ever, Berlin was the city with the highest real estate investment volume in Europe last year, far ahead of London and Paris,” says Matthias Pink, Head of Research, Savills Germany.

“Due to the large talent pool, it continues to be very attractive for domestic and international companies. We continue to observe many firms relocating their headquarters or company units to Berlin to access these talented people.”

While a Covid-19-induced stop to immigration meant population growth was halted, the city did not see inhabitants leave for smaller cities or suburban areas, says Pink, a tribute to its liveability and a factor behind a 9.6% rise in prime residential prices. As the pandemic recedes and Germany reconnects with the world, this growth is expected to be maintained, with Savills predicting 10% growth in 2022.

Shanghai, China(MOVES UP SEVEN PLACES, RANKED 25TH IN 2016) |

China’s financial capital has been climbing the resilience rankings since 2016, its performance driven by economic growth and an expanding real estate market. The city’s real estate market is liquid and transparent and attracts more overseas investment than any other mainland city.

Shanghai has also improved in terms of sustainability and liveability, says James Macdonald, Head of China Research, Savills.

“It has created new parkland and public space, particularly on the waterfront, and is working to preserve its cultural heritage. Some of China, Singapore and Hong Kong’s best developers have built LEED-certified projects for multinational occupiers, and high real estate values encourage retrofitting to upgrade existing stock.”

The city is also an intellectual as well as a financial high-flyer, says Macdonald, with a vibrant life science sector and some of the country’s best universities attracting talent and companies from China and beyond.