Property investors can look forward to better times ahead, as cyclical headwinds subside. The Savills global research network anticipates a recovery in real estate capital markets, with investment activity and capital values expected to improve in 2025.

Market trends

The real estate industry is being revolutionised by change and no sector is immune. Meanwhile, demographic and technological change is creating fresh opportunities for investors in both traditional and emerging asset classes. Here we explore how the markets are responding to those wider shifts alongside data and forecasts across all property sectors.

A more positive economic outlook is set to fuel renewed market activity in 2025, while demographic, environmental and technological drivers continue to pose challenges – and present opportunities.

Rental growth and increased take-up across most global markets signal a positive outlook for occupiers, albeit with regional and industry-specific variation.

As shopping becomes more experiential, the importance of surrounding public spaces has increased – but balancing consumer experience with practical concerns is key.

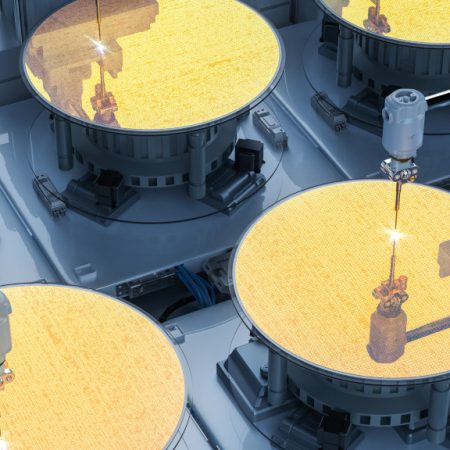

How AI is supercharging the data centre sector

Artificial intelligence is revolutionising data centres, creating unprecedented expansion and investment opportunities – but this sustained growth is revealing new challenges

There’s no place like home

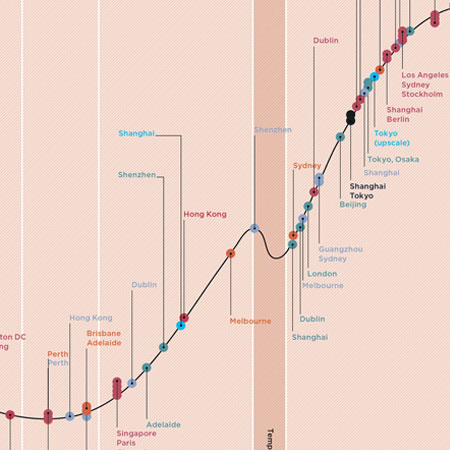

A comparative analysis of the monthly cost of buying vs renting prime residential property in World Cities

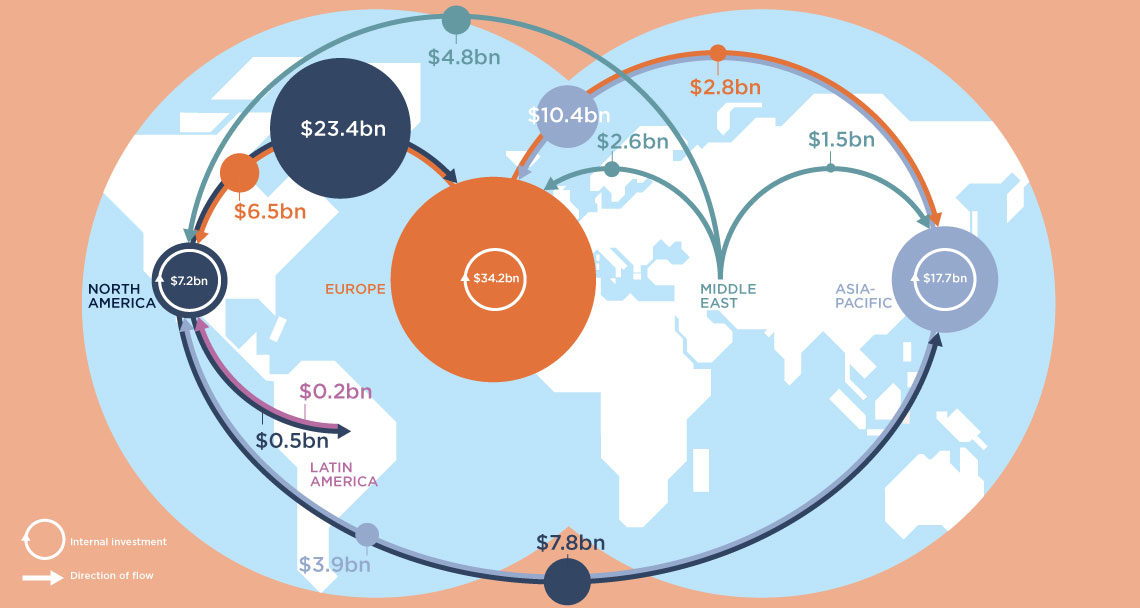

After a sharp downturn in real estate capital markets, sentiment is starting to turn. But how quickly will recovery follow? We project global real estate investment will rise by 7% to US$747 billion in 2024, with further growth to US$952 billion forecast for 2025.

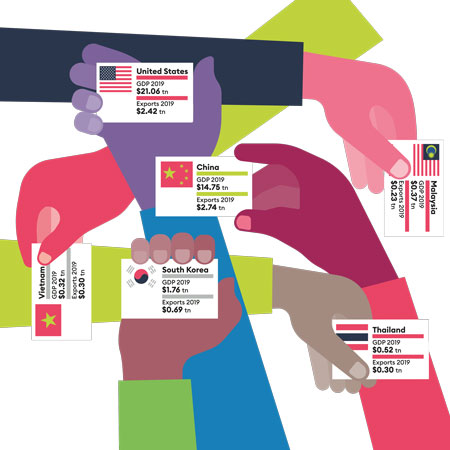

London leads with the highest costs, while nearshoring and supply chain diversification has boosted markets in Mexico and Vietnam.

We’ve been tracking prime residential property in global cities for nearly 20 years. We explain how geopolitical and economic events have impacted the Savills World Cities Prime Residential Index.

Nearshoring: home truths

Whilst manufacturers have spoken at lengths about nearshoring, unravelling global supply chains isn’t easy and comes at a cost.

Where is the equity to support a recovery?

2023 was a chastening year for many real estate investors. But despite the headlines, it is important not to get existential.

Skilled workers are congregating in new – and often surprising – clusters around the world. The Savills Future Workforces Index reveals the existing and emerging talent hotspots across the world

The Covid-19 pandemic kickstarted a new era of higher interest rates and increased macroeconomic volatility. How have real estate investors responded to this inflection point? And what comes next?

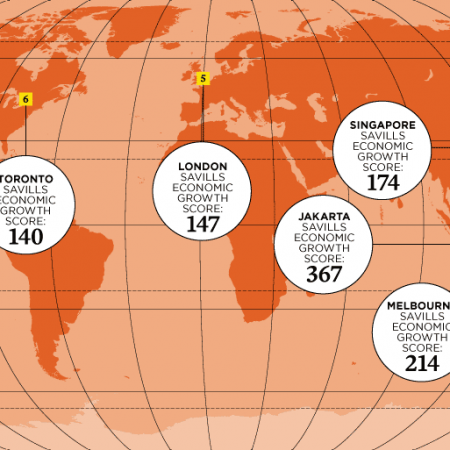

Asia’s cities lead the way in Savills Growth Hubs Index

Over the coming decades, trillions of dollars will be spent on public transport, green energy generation, digital connectivity and sustainability projects. And where infrastructure leads, real estate follows

Tackling housing affordability through supply

Global housing supply has failed to keep pace with rising populations. Boosting supply levels needs to be at the heart of any housing affordability strategy

Savills Resilient Cities: a new form of resilience?

Scale and workforce talent remain key pillars of success in the latest Savills Resilient Cities Index. But a number of smaller, nimbler cities are gaining ground on the back of strong ESG credentials.

We’re at an inflection point in the global macroeconomic and geopolitical environment. Future patterns of cross-border investment will affect the evolution of real estate capital markets

The world’s office stock must adapt to meet the needs of employers, employees and the cities in which they work. This means its owners have challenges to face and decisions to make

In the fifth of our Offices in Equilibrium Q&A series, Cyril Robert, Head of Research at Savills in Paris, explores the reasons behind the city’s reduced demand for office space – and it isn’t all down to the aftershocks of hybrid working

In the third of our Offices in Equilibrium Q&A series, Australia’s Chris Naughtin, National Director of Capital Markets Research, explain how prime office space in central business districts is essential for talent retention

Offices in equilibrium: Spotlight on Singapore

In the fourth of our Offices in Equilibrium Q&A series, Alan Cheong, Executive Director of Research and Consultancy at Savills Singapore, explains the impact of hybrid working on an office-centric culture and why ESG concerns from overseas tenants will drive the repurposing of sub-prime properties

Offices in equilibrium: Spotlight on New York City

In the second of our Offices in Equilibrium Q&A series, Marisha Clinton, Vice President, Research East at Savills in New York City, explains that while utilisation rates haven’t hit pre-pandemic levels, deep-pocketed tenants are trying to secure prime office space

In the first of our Offices in Equilibrium Q&A series, Mat Oakley, Head of Savills UK and European Commercial Property Research, explains that while average take-up is down 10-15% in London, many companies are looking to upsize

Prime shopping streets are proving more resilient than predicted, driven by reimagined retail spaces and e-commerce brands building a bricks-and-mortar presence. Is this a long-term renaissance or a passing trend.

From an original 15 schemes in 1993 to about 700 today – and a predicted 1,200 by the end of the decade – branded residences are on a rapid growth trajectory. What are the main drivers behind the trend?

Our forecasts point to more muted capital value growth in world city prime residential markets this year, but some locations are set to outperform.

How climate change is shaping global ski resorts

The unpredictable nature of climate change has affected some ski areas more than others. How are they responding?

Europe and Middle East investment outlook and tips

European investment is set to rebound to 20% growth, while the Middle East real estate market will be driven by non-oil investment expansion

Macroeconomic factors point to a broad rebound in US real estate activity, with the flight to quality defining the shape of investment and rental performance

Driven by demographic trends and technological developments, investment in the living sectors and data centres is poised for growth

Next year should be a better one for global property investors, with a sustained bounce back expected. However, regional variations remain

The economic outlook will remain front and centre for investors in 2024, but other drivers of returns should not be discounted.

How the flight to quality is shaping global prime office markets

Global prime office markets remain open for business as occupiers search for top-quality spaces in cities around the world.

High rate environment continues to stifle investment activity

Global real estate capital markets remain forlorn, with risk-averse sentiment hitting all sectors and all geographies. But with interest rates now peaking, the first pre-condition for stability has been met. More certainty around interest rates and borrowing costs should help to facilitate a floor in pricing, and eventually, a recovery in investment activity.

The real estate industry needs to adopt a proactive approach to ensure balance between supply and demand in an ever-evolving office market. Central to this is the provision of top-tier offices and the strategic repurposing of lower-quality assets.

Semiconductors; your country needs you!

Despite economic uncertainty and higher interest rates, global residential markets have shown remarkable resilience.

Our new index looks at the factors that make a successful prime second-home destination and consider how the best have retained their longevity.

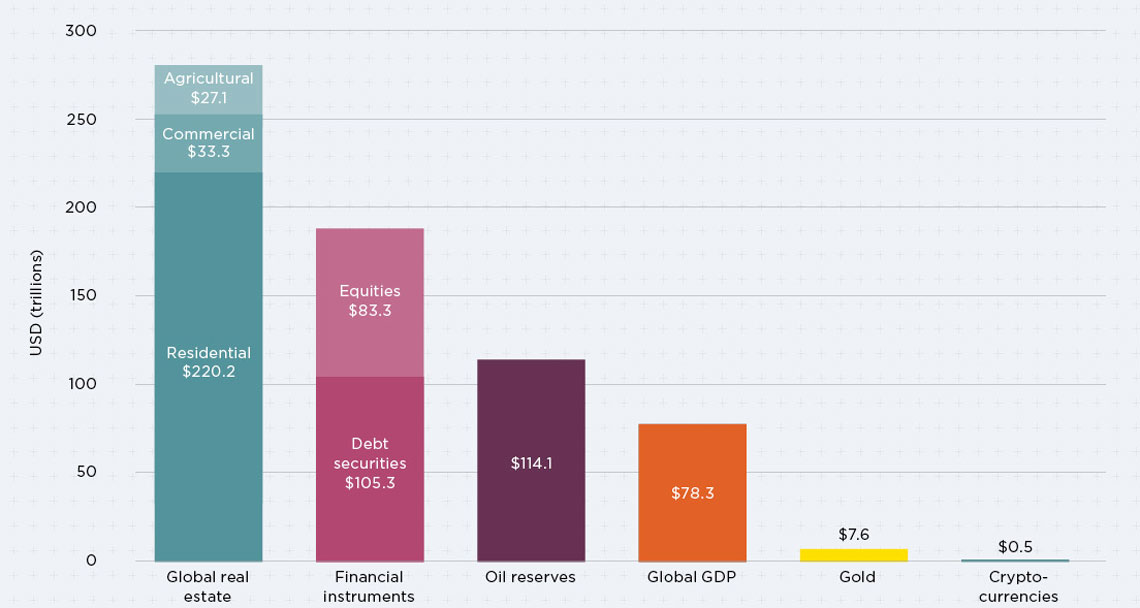

Total Value of Global Real Estate: Property remains the world’s biggest store of wealth

The value of the world’s real estate might have dipped in 2022 — but property remains the biggest store of global wealth by some margin.

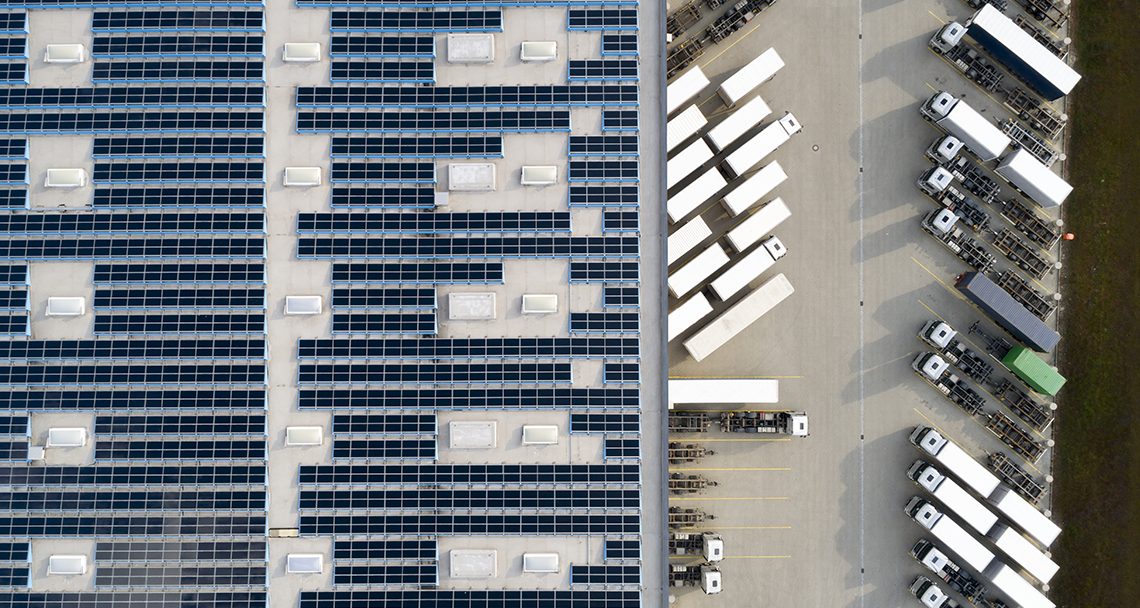

Warehousing costs around the world

Prime warehousing rents continue to rise, but the pace of growth moderates after the pandemic-induced surge. Where has this left the global warehousing cost league?

Prime residential rents are rising more quickly than capital values in the face of high demand for a limited pool of quality stock

Economic growth has proven to be resilient this year, and incoming data has consistently beat expectations. But this is supporting ‘sticky’ inflation, forcing central banks to ratchet up interest rates in response.

The flight to prime has been a frequently discussed trend across the office world; nowhere more so than in the United States, where sticky work-from-home trends have encouraged occupiers to look for top quality spaces to attract their talent back into the office.

Disruption is easing post-Covid, but geopolitical tensions and more insular government policies are redefining how businesses manage their supply chains

Repurpose and revitalise: the future of commercial real estate rent

The global real estate market has changed, but the green transition and growing urban populations present new opportunities for investors

Physical retail fights back: how high streets are regaining their purpose

The Covid-19 pandemic changed people’s shopping habits. But recent figures suggest the seemingly relentless rise in online shopping – at the expense of the high street – is slowing down

People of 50 and older – many with accumulated wealth – will drive prime residential markets around the world over the next decade

How can cities foster innovation and attract talent when costs and inflation are pushing young businesses to the margins? And how are cities addressing residential affordability and quality of life to draw such talent?

Investors are turning to alternative property sectors for resilient returns and growth opportunities

Interest rate rises may be nearing their peak, but where they settle will have long-term implications for real-estate investors

Out of office: adapting to new ways of working

Covid-19 changed office-based working almost overnight. But the rise of new work patterns isn’t the only factor determining future demand. How are different work cultures and changing needs shaping office availability around the world?

Investment opportunities in renewable energy infrastructure

More private funds are investing in clean energy projects, but this needs to grow significantly to meet global net-zero targets

Economic headwinds continue to batter global real estate markets, but the medium-term outlook is brighter, with signs of growth returning later this year

In the aftermath of the pandemic, people are returning to the world’s great cities to live and work. But global turmoil remains. Head of World Research Paul Tostevin examines how cities are faring in the latest Savills World Cities Prime Residential Index

As the bears reign supreme, central banks search for the elusive ‘Goldilocks Zone’, says Oliver Salmon

Which global markets and sectors have solid fundamentals and good prospects for growth? Eri Mitsostergiou lists our top picks and the themes that inform them

2023 outlook: Real estate investment in the US

Prime multifamily and logistics opportunities will underpin a more optimistic year for real estate investors in 2023, says Michael Soto

World cities prime residential forecasts 2023

Our 2023 guide to prime residential capital value growth in world cities

New trade agreements and low-cost competitiveness remain the key drivers of the ‘New Economy’, especially in south-east Asia and India, says Simon Smith

Multifamily residential units, student accommodation, logistics and core offices will be some of the prime areas for real estate investors in Europe and the Middle East in the new year, say Lydia Brissy (Europe) and Swapnil Pillai (Middle East)

Several things will happen in retail property in the coming decade that will cause a fundamental change to how we use and design spaces and who we lease them to.

Current real estate valuations are being stretched by a precipitous rise in interest rates, but the economy has an equally important role in what follows.

Global warehousing costs

Warehousing rents have risen sharply, but in an inflationary environment other input costs have risen even faster. Where does that leave rental affordability, and which markets still offer value?

Savills Resilient Cities Index 2022

While the top of the Savills Resilient Cities Index remains relatively unchanged, which new cities are breaking into the top 20?

As life science investment continues apace, we explore the global trends that will shape the sector in the future

As student costs rise across the globe, a strong US dollar makes European markets look even better value to international students, supporting the development of purpose built student accommodation.

The just-in-time model of supply has been exposed. Is it time to bring manufacturing production closer to home?

From creative experiences to emerging markets, Marie Hickey examines four global trends that will shape the future of prime retail destination cities

Prime residential markets reinforce their appeal

As global cities spring back to life, buyers are reconnecting with their prime residential markets

Forces shaping the future of logistics

High demand requires more logistics real estate than ever. The sector is turning to some innovative solutions

Q: The logistics real estate market has been growing at […]

The pandemic highlighted the life science sector’s worldwide importance. But what does the future hold for the industry — and what role will real estate have to play?

Institutional investment shifts to large-scale rental housing in search of stable yields and reliable income – and overtakes office investment in the process

Savills Global CEO on the importance of real estate in bringing people together

Driving social value through real estate

Creating social value means taking into consideration not just market value, but also the benefits that property brings to society says Sarah Forster, CEO and co-founder of The Good Economy

Real estate investment in 2022: global outlook

We examine the global trends and in-demand assets for 2022

The global economy is expected to continue its recovery in 2022, although the easy gains are mostly confined to the past

Our 2022 guide to prime residential capital value growth in world cities

Net zero push will create value-add opportunities

Core markets, niche sectors to lead in 2022

Real estate investment tips for 2022: North America

Recovery powers ahead as multifamily and industrial take center stage

Real Estate Investment Tips for 2022: Middle East

Industrial demand could grow as e-commerce flourishes

The relationship between real estate and inflation is more nuanced than conventional wisdom suggests

Property is the world’s biggest store of wealth. Residential has pushed its value to new heights

Residential property transactions are increasing across the world

The Savills Resilient Cities Index identifies the cities best placed to adapt to change

Real Estate Market Cycles

Can previous economic downturns predict the shape of recovery from the pandemic?

Five for 2022

Our global research heads forecast future leasing and investment activity

Changing priorities are shaping residential real estate markets

The influence of private wealth in prime residential markets

Lauren Sorkin, Executive Director, Resilient Cities Network

Mark Ridley, Group CEO Savills, introduces our theme of Evolve

How to find the best value warehouse space

Warehouse demand is surging. We assess the cost equation for occupiers

Redefining the shape of retail places

A radical rethink of urban development is needed to meet our changing lifestyles

Our city reports examine established and challenger cities in four sectors

We examine the global trends and in-demand assets for 2021

Our 2021 guide to prime residential capital value growth in world cities

We see a return of cross-border investment and competitive deal making

Real estate investment tips for 2021: North America

Expanding Big Tech remains a bright spot for 2021

Real estate investment tips for 2021: EMEA

Investment strategies to focus on low-risk assets and income stability

Exploring residential transaction volumes and prices since Covid-19

Our team of experts examine the evolving office market across 10 key global cities

Global luxury expansion is experiencing a geographic rebalancing to Asia-Pacific

Real estate investors are anticipating higher demand from life science companies

Industrial and logistics: 2020 global investment

Industrial investment is at record highs. We examine the trends and opportunities

Activity in global real estate investment

How Covid-19 has impacted real estate investment during the first six months of 2020

Will Covid-19 hasten a trend towards regional supply chains and nearshoring?

From residential to retail, offices to logistics, the long-term impact of Covid-19

We assess the opportunities for real estate as global trade and production shifts

Mark Ridley introduces an Impacts programme that examines industry tipping points and the effects of Covid-19

Risk and return in real estate

Where investors look to find the risk/return values they need from the market

The role of real estate in the life sciences

New investment in life sciences will trigger high demand for real estate

Despite a volatile market, real estate remains attractive compared with other asset classes

Investor insight into how real estate investments and strategies are evolving

Investor insight into how real estate investments and strategies are evolving

Can China’s approach help other countries design an effective response to Covid-19?

Real estate investment in 2020: global outlook

We examine the real estate trends and hot-pick assets for investors in 2020

Global prime residential forecasts 2020

Our 2020 guide to prime residential capital value growth in world cities

The rise of e-commerce is driving demand for logistics space, while the outlook for prime offices is positive

Against a backdrop of geopolitical tensions, regional uncertainties linger. India and Vietnam are future bright spots

A booming tech sector will provide opportunities for office, industrial and multifamily investment in US tech cities

We highlight the factors driving construction activity in 20 countries

Global real estate investment H1 2019

Real estate continues to attract a healthy level of cross-border demand. We examine the busiest routes for investment

Savills top resilient global cities

Technology, demographics and leadership will disrupt the world’s top cities

The factors influencing prime residential real estate prices in key world cities

How the markets are shaped by international buyers

How the current climate of political upheaval will affect the global economy and real estate

As more retail shifts online, delivery facilities are moving closer to population centres

Second home costs in key global cities

How the additional costs of second home ownership add up across the world

11 ways Asia-Pacific will dominate the 21st century

The region is set to play a key role in the coming decades

And what could it mean for occupational and investment markets around the world?

How the market is changing, from tech disruption to Spain’s resurgence

Rising residential costs push Hong Kong back to the top of the Savills Live/Work Index

The risks of core markets and a search for alternatives

China dominates global city rankings for house price growth

Chinese cities recorded world-beating house price growth in 2017

8 things to know about global real estate value

The world’s real-estate value has reached a new high, underlining its global economic role

All eyes are on Chinese debt growth, but is it really a threat to global markets and real estate?

With yields for traditional assets low, is it time to look further afield to create income?

There is support for an 18-year property cycle, but not everyone is convinced. Our three experts bring their views to the table

We asked the heads of local markets to position the rent level for different sectors in their cities on our Savills ‘wave’

Risk is the watchword

To plan for and invest in a built environment that will outlast us, we need to redefine and reassess risk

The effects of rising rates on real estate

With the prospect of future interest rate rises, we assess the real-estate implications

How does his £10,000 a year income translate to current values?

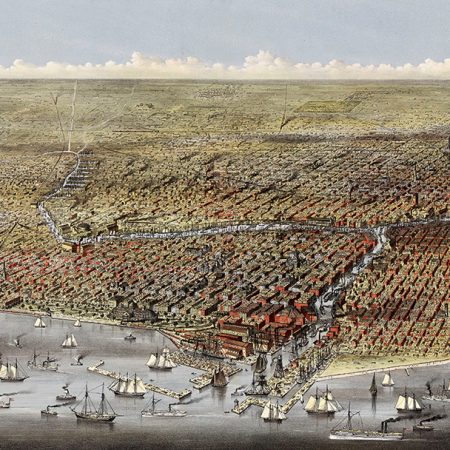

Land values in Chicago from 1830 to 1933 show that real-estate history has a habit of repeating itself

We take a look at some of the best economic performers across the globe