When we decided on the theme ‘tipping points’ for our 2020 Impacts programme at the end of 2019, various topics were discussed: climate change, demographics, technology and many more. What we didn’t know is that we were about to be faced with a pandemic. Covid-19 changed the way we work and live almost overnight and is likely to have a long-term impact on real estate.

As countries come out of their strict lockdowns but social distancing is still encouraged, the long-term impact of Covid-19 is yet to be seen. Many believe the world will emerge as a different place.

Here, we discuss the potential changes that may be seen across the different sectors. If you prefer to read a specific sector, click on the relevant section to go direct. Office, Logistics, Retail, Hotels, Institutional residential, Senior housing and healthcare, End-user residential, Conclusion.

Impact of Covid-19 on occupier demand after pandemic has passed, by sector

Source: Savills Research

Office sector

Despite the success of home working, offices still provide a vital role in culture, community and connection

The Covid-19 pandemic has the potential to become one of the biggest tipping points for the future of offices, impacting corporate location strategies, office design and management as well as occupier practices.

Many corporates have allowed flexible working in some form for years. However, the large proportion of employees working away from the office in the wake of Covid-19 for an extended period may be the catalyst for accelerating flexible working patterns.

According to the Savills Global Sentiment Survey of research heads in 31 countries around the world, 84% of respondents expected home working to somewhat increase, the remaining 16% expect it to greatly increase. Over half expect the use of video conferencing to greatly increase after the pandemic.

What we expected to evolve over time transformed almost overnight

But the office will still play a vital role. Katrina Kostic Samen, Head of Savills KKS Workplace Strategy & Design, says: “Workplace change was inevitable. However, what we expected to evolve over time transformed almost overnight in response to the pandemic. These exceptional circumstances are akin to an elastic band being stretched to its limit; it will go back but not completely.

“It will be down to businesses to determine how this evolves but it must be with people at the heart. The role of the office long term is vital to provide what we crave – culture, community and connection, essential after the emotional and physical impact of the pandemic.”

Hybrid office model

We expect to see a shift towards diverse location strategies and the emergence of a hybrid model, a combination of home working, local office hubs and a head office. This is an opportunity to improve long-term employee wellbeing, organisational resilience, and sustainability. A reduction in the environmental footprint may arise from less travel, shorter supply chains and sustainable building design, to name a few examples.

If the home is to become more important as a workplace, consideration will need to be given to longer term work from home policies. Cyber security and confidentiality, health and good ergonomics for a home office will all need to be managed.

Communication and policies will be needed to develop ‘flexible people’ and not just focus on flexible workplaces. In some places, particularly the developing world, slow home internet connections or high-density households mean working from home is just not feasible.

A commitment to employee wellbeing

An increase in home working isn’t the only trend that could change office space. Safety, hygiene and employee wellbeing are in the spotlight. Regular deep cleaning of the work premises has become a fundamental health and safety consideration for businesses and is one of the more visible ways in which a company can demonstrate its commitment to providing staff with a safe working environment.

Occupiers may look again at building ratings schemes such as LEED and WELL that are focused on creating sustainable spaces and delivering occupant comfort, health and wellbeing.

Contactless design in buildings, for example in appliances, lifts and doors, is expected to increase according to 87% of Savills research heads across the globe.

Some 63% expect occupier density in offices to decrease. This could see occupiers taking the same amount, or potentially more, office space as before the pandemic, but using it differently.

Impact of Covid-19 on office demand after pandemic has passed

Source: Savills Research

Lower density areas

Sarah Dreyer, Head of Research for Savills US says: “Going forward, health and safety will come first. How this plays out in office demand is yet to be seen and is not likely to be clear until more effective virus treatment and prevention measures are available.

“At one end, those organisations that have adapted well to having a remote workforce could re-evaluate future in-office functions and ultimately reduce office size requirements. The net impact on demand will be affected by changes to workplace design and a possible reversal of high occupancy densities and desk sharing to one of lower densities and more generous circulation and collaboration areas.”

Despite Savills researchers expecting a slight fall in occupier demand, they are less bearish on office investment activity. Half expect no change due to Covid-19, one-third forecast less activity and the remainder expect an increase. This reflects the ongoing demand for real estate from investors seeking long term secure income streams and the comparatively good returns the sector offers.

Flexible offices, in particular hot desks, could be impacted by the focus on hygiene in the short term. Many flexible offices are putting together plans for adjusting the use of their space while the pandemic is still ongoing, but we expect these design changes to be temporary.

Larger companies may find flexible space does not suit them in the shorter term as they prefer to retain control of the cleaning procedures and density. However, long term, companies of all sizes are expected to focus on flexibility in terms of overall costs and office space in particular, which will likely benefit flexible offices.

Jessica Alderson, Global Researcher, Workthere, adds: “Our data, collected from over 100 flexible offices, showed that 62% of flexible office providers are optimistic about the prospects for the sector over the next 12 months.

“In the short term, flexible offices will likely face challenges, with increased risk of contract cancellations as companies go into survival mode, albeit global contract occupancy levels are still above 70%.”

Logistics sector

We expect to see supply chain diversification and the growth of regional manufacturing hubs

Thanks to the global growth in online retail, logistics was a sector already in vogue. The pandemic is expected to accelerate its ascension. Some online retailers, particularly supermarkets, struggled to keep pace with the surge in demand from consumers during lockdowns, pushing their supply networks to the limit.

With more people than ever before using online retail, the market is forecast to deepen longer term. Further investment in logistics space to service this demand and ensure resilience against future surges of demand will follow. Some 63% of country research heads expect to see some kind of positive impact on occupier demand in the logistics sector as a result of Covid-19.

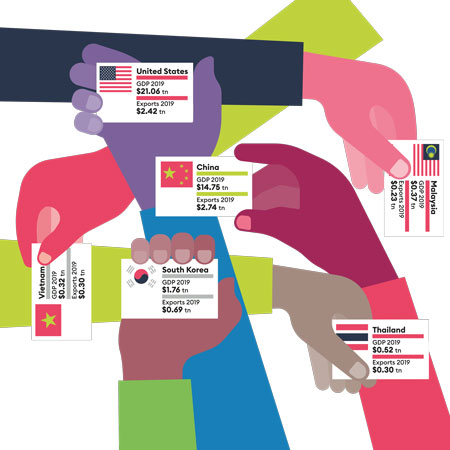

Globally, one of the most widely felt impacts of the outbreak is in manufacturing and the supply chain. In 2003, at the time of SARS, China was less integrated into global supply chains and constituted approximately 4% of the world economy; it now stands at 16%, according to the IMF.

Domestic factory closures and the disruption of sending everything from car parts to clothing overseas effects companies from Boston to Berlin. Just-in-time inventories mean the cushion for even the slightest disruption is minimal, and this resulted in empty warehouses and shelves, and consumers unable to consume.

Diversifying supply chains

Companies may look to diversify their supply chains across several global locations to insulate against possible future incidents. This is a trend that had already started in Asia as manufacturers took advantage of lower-cost locations outside of China, leading to greater investment in Vietnam, Cambodia and India. The trend was further accelerated by the US-China trade war.

However, China dominates global manufacturing, and we expect to see a gradual, not immediate, shift. Moving operations costs money. Increased automation may offset higher labour costs, but it requires huge capital investment.

By bringing operations closer to home markets, costs will likely increase

Other factors must be taken into consideration. Kevin Mofid, Head of Savills UK Logistics and Industrial Research, says: “By bringing operations closer to their home markets, costs will likely increase. Will the post Covid-19 consumer be prepared to accept higher costs at a time when economic activity is set to be slower?

Moreover, the perception that nearshoring increases the amount of inventory held in warehouses is not necessarily true. Shifting more manufacturing to the home market may in fact weaken demand for logistics as supply chains shorten.”

Impact of Covid-19 on supply chains and manufacturing after pandemic has passed

Source: Savills Research

Growth of regional hubs

In reality, we’re likely to see future investment that would have gone solely to the lowest-cost destination be spread across many. In a trade-off between cost and distance, nearshoring is likely to outpace onshoring. We can expect to see the growth of regional manufacturing hubs such as Morocco for western Europe, and Mexico for the USA.

This could change the dynamics of regional logistics networks. For example, Morocco, easily accessible to western Europe by ferry, could readily integrate into the existing logistics corridor that spans the ports of southern Spain, the Iberian Peninsula into France. This, in turn, may boost demand for logistics at strategic entry points, such as Algeciras, Valencia and Barcelona.

Retail sector

Online retail will accelerate, but the desire for physical retail will remain

Consumers were already looking for more from their retail experience prior to the pandemic. As Tom Whittington sets out here, we can expect even greater consumer appetite for community and convenience-based retail, and a higher share of discretionary spending on leisure experiences rather than superfluous purchases.

This will have a further knock-on effect to the way we shop and the amount of retail space we need. More repurposing and re-imagining of existing retail space will follow.

Room for physical retail

While the rise of online retail is expected to accelerate, shopping is a sensory experience and the desire for physical retail will remain. In emerging markets in particular, shopping is a recreational activity and a hallmark of the burgeoning middle classes.

Our researchers in India, Indonesia and Thailand all cited a more positive outlook for the sector once the pandemic has passed. These countries have among the lowest e-commerce penetration rates in the world and for the majority of consumers physical retail is still the only retail.

Hotel sector

Hit hard in the short term, but the longer-term fundamentals driving demand will stay unchanged

The hotel market was one of the hardest hit by the Covid-19 pandemic in terms of operational performance. International travel restrictions and national lockdowns saw many hotels close across the globe.

Yet, the long-term demand fundamentals remain largely unchanged. Marie Hickey, Director, UK Commercial Research, Savills, says: “Once travel restrictions are lifted there will continue to be short-term challenges facing demand and operational recovery. However, the longer-term fundamentals driving demand remain, with many commentators forecasting that hotel performance will be back at pre-Covid-19 levels by 2022.”

For our research heads across the globe, the expectations of travel patterns once the pandemic has passed vary. Just over half believe personal domestic travel will increase, compared with 29% who think it will fall. However, 71% and 77% expect personal international travel and business travel to decrease respectively.

Business travel in many parts of the world was not back at pre-GFC levels when Covid-19 struck, some of which was down to technology trends such as video conferencing. This trend is likely to be intensified post Covid-19.

International leisure travel may be impacted by some lingering nervousness to travel too far from home, at least in the short to medium term. Leisure destinations benefiting from good international rail and road connections are expected to see earlier demand recoveries than those more dependent on air connections.

The pandemic may also see environmental concerns among travellers move higher up the agenda, shaping both mode of travel and hotel choices, to the initial benefit of locations with good rail connections.

Institutional residential sector

The outlook for multifamily is positive, while the need for quality rental product remains

Institutional investment into residential asset classes has grown by almost 50% in the past five years. Once considered alternative, residential has entered the mainstream and the defensive benefits of investing in beds are set to continue, reflected in our survey.

The outlook for multifamily, in particular, remains positive, with 55% of countries anticipating no impact on investor demand into the sector, and 27% expecting a positive impact.

Operation and design may see some long-lasting changes. Cleaning regimes will be upped. The nascent co-living sector, which is founded on the idea of smaller, denser individual units and larger communal areas, may see its model evolve with a rebalancing of private and communal space.

Need for quality rental

Some 67% of our researchers expect to see a slightly negative or negative impact on occupier demand for co-living as a result of the pandemic, although only 52% expect to see a negative impact on investor demand. This recognises that the underlying need for quality rental assets remains, particularly in major cities with high concentrations of young professional migrants.

Student housing is a sector that has grown rapidly as the number of international students has risen. After rapid development in the USA and the UK, the sector is building momentum in Australia, mainland Europe and in strategic regional hubs, such as the UAE.

The Covid-19 pandemic turned the higher education sector on its head overnight. Learning switched online, exams were postponed and student travel was halted. Students and on-campus instruction will return in time, likely with a greater emphasis on health and safety, but many institutions face a loss of income and cost-cutting measures in the meantime.

Regional hubs, closer to the international student market may benefit

The associated global economic downturn, affecting the ability of students to afford a higher education in more costly overseas markets will also have an effect. Marcus Roberts, Head of Europe, Operational Capital Markets, Savills, says: “Regional hubs, closer to the international student market may benefit, such as Malaysia and the UAE, together with some of the lower-cost European destinations. In Germany, for example, the cost of tuition is negligible, for international as well as domestic students.”

But the caché associated with studying at top-ranked institutions will not disappear. Students will be looking to maximise their investment and the most established university towns and cities in the USA, UK and Australia will continue to attract students from around the world, in turn supporting the market for student accommodation.

Healthcare and senior housing sectors

The healthcare sector has specific real estate requirements. Housing with care is emerging as a major alternative sector

Health and wellbeing is now firmly at the top of government, corporate and personal agendas. This specialist asset class has particular real estate requirements.

As Steven Lang, Director, Savills UK Commercial Research, describes here, even before the pandemic, investment into vaccines was up 150% over five years, to give one example.

43% of countries expect to see a positive impact on investor appetite for the healthcare sector

This kind of activity has fuelled the biotech sector and the core innovation markets in which it is concentrated; cities such as Boston in the USA and Cambridge in the UK where venture capital, universities and hospitals combine. According to our global researcher survey, 43% of countries expect to see a positive impact on investor appetite for the healthcare sector as a whole going forward.

Housing with care

One senior housing subsector in particular, the ‘housing with care’ sector (self-contained residential units with some shared amenities) proved resilient against the challenge of the pandemic. Relatively well established in Australia, New Zealand and the USA, it is emerging as a major alternative sector for investors elsewhere.

Samantha Rowland, Savills Head of Senior Living, says: “The issue of social isolation among older people is a major challenge, brought into sharp relief during the pandemic.

“As life expectancy increases and people live healthier lives for longer, the question of where and how the elderly are going to live isn’t going to go away. Housing with care is one option, offering self-contained homes but with a resident community and care at hand when needed.”

Thanks to the demographic fundamentals, from an occupier and investor perspective, our survey shows future demand for senior housing to be unaffected by the pandemic – more than any other sector (see chart above: Impact of Covid-19 on occupier demand after pandemic has passed, by sector).

End-user residential sector

Properties with space to work and relax will be in greater demand, as will technology in the home-buying process

More home working has a direct impact on the residential market as households reassess their needs. The Savills sentiment survey indicates that 90% of research heads expect demand for home offices to increase, while 86% expect an increase in demand for high-speed internet.

The lockdowns have also highlighted the value of having access to a private outside space, and two-thirds of respondents expect demand for it to increase. These are factors that developers across the world will need to take into account when designing future homes.

Reassessing priorities

Those without a private space will look for public outdoor green spaces, which may become a higher priority in deciding where to buy. Others may decide that as home working increases, they’d like to move to a more rural location.

Nearly half of Savills research heads believe demand for rural/out of town locations will increase, while the rest expect it to stay unchanged. However, there were slightly more European research heads who expect this trend to occur than those in Asia-Pacific where city living is more common.

Covid-19 has substantially increased the attractiveness of prime properties in village and country locations

Lucian Cook, Head of UK Residential Research, Savills, gives us his take on the situation in the UK: “Our survey of potential buyers and sellers suggests that Covid-19 has substantially increased the attractiveness of prime properties in village and country locations. This is partly driven by a desire to have better access to outside space, allied to the prospect of working from home more regularly.

“It comes at a time when country property is looking good value, given the shift towards prime urban living in the five to 10 years preceding the coronavirus.”

Impact of Covid-19 on home features after pandemic has passed

Source: Savills Research

New tools and virtual viewings

Covid-19 has also increased the use of technology in the home-buying process. During lockdown, potential buyers were unable to physically view properties, which led to an increase in virtual viewings. Digital signing of documents and e-conveyancing have been enabled following legal changes.

As the lockdowns end and we look forward to a time after the pandemic, it’s unlikely that these changes will be reversed. Jelena Cvjetkovic, Director, Savills Global Residential, agrees: “The use of new technology-enabled tools for the home-buying process will be further cemented in the near future as some degree of social distancing looks set to continue, and we believe they are here to stay.

“E-conveyancing and digital signing will streamline the purchase process, with a beneficial impact on all, but particularly cross-border transactions, and a number of countries are looking at changes in law to enable these.”

Conclusion

Covid-19 has made the world take stock of how, despite increasing technological and social advancements, the way we live and work can be altered by the most ancient of forces: a medical pandemic.

The world was already undergoing many upheavals before the emergence of Covid-19. Living and working practices were evolving as new demographic groups entered the workforce at scale, retail was undergoing structural change, and real estate was being re-imagined as a service.

Forced to adopt technology en masse, employees have seen the advantages of remote working. Health and wellbeing has shot up the agenda. In the same way that security checks have become the norm, so might building entry health checks.

All sectors will feel the effect in the long term of enhanced sanitising regimes. As outlined in the rest of this publication, there are many tipping points impacting the industry. The pandemic means that some of these structural shifts in real estate may now have extra impetus.