Experience with convenience: Finding the new balance

A key to the evolution of retail is how logistics space can complement the experiential factor.

It seems as if there is an investment seesaw, where the weight of investment has slid from retail to logistics, leaving retail high and dry. Investment intentions surveys from real estate funds associations INREV and ANREV this year found only 29% of institutional investors plan to buy retail in 2021, while more than three-quarters plan to buy logistics.

Retail owners might hope that the seesaw tips the other way at some point, bringing retail back into favour. However, Simon Hope, Head of Global Capital Markets, Savills, says: “Attracted by the pandemic-proof nature of the housing and food sectors, investors are buying retail warehouses because they provide solid income at attractive yields in the current environment, and supermarkets are in demand everywhere. Other retail will need to evolve in order to win back investors.”

A key to that transition is understanding how the two sectors are evolving in conjunction, with logistics supporting the convenience of shopping and retail supplying the experience.

Logistics and retail working in harmony

Retailers don’t care about shops or warehouses, they care about retail. They want to use physical space to optimise sales and grow their business. It doesn’t matter where the point of sale is – retail landlords need to provide space where tenants can win customers. Experiential retail is the key. Buying online will always be easier, but a click is not an experience. Showfields, a department store for pop-ups in New York, is a great example of experiential shopping. It bills itself as the most interesting store in the world, with art shows, events, customisable products and the chance to play video games.

Experience also needs to be at the heart of shopping centres; people need a reason other than shopping to visit. This might be to dine, to go to the cinema, to work, for education, to play sport or to visit the doctor. All these ‘excuses to go shopping’ need mixed-use retail, either within a shopping centre or a town centre. All of them, and the people who use them, add up to a community.

Logistics space can complement experiential retail. Smaller logistics units in shopping centres or town centres can save shoppers’ wrists by picking up and delivering a day’s shopping. For example, the Dubai Mall in the UAE will deliver shopping deposited with them by 2pm to your home on the same day. Fulfilment centres in retail locations may also be a solution to the environmental and financial problem of returns. For example, Nordstrom’s New York flagship store has an entire floor devoted to customer service, including processing returns.

There is also a blurring of the lines between sales and logistics spaces. We see ‘dark kitchens’, which support online food delivery, and ‘dark retail’ units – stores that have been converted into local fulfilment centres. US homewares retailer Bed Bath & Beyond last year said it would convert 25% of its retail units to ‘dark stores’ in order to serve online customers. If you buy from these stores, are you investing in retail or logistics real estate?

A complex infrastructure

The environmental impact of deliveries, returns and packaging will become a greater focus for pressure groups and governments, therefore also for real estate. Bringing retail and logistics together, especially at public transport hubs, could lessen the impact.

Asia provides an example of how retail and logistics might develop together, as both sectors have developed alongside e-commerce. For example, China’s Chongbang Group builds fulfilment centres where customers can collect, try on and return items from online retailers as part of its mixed-use developments.

Simon Smith, Regional Head of Research and Consultancy, Savills Asia-Pacific, says: “Modern Asian retail space is almost always built as part of a mix of uses, including workspace and residential, and linked to transport hubs. This ensures the footfall which is key to retail success.”

Retail won’t be like it used to be: there will be less ‘pure’ retail space, more mixed-use space and more space where the lines between retail and logistics are blurred. This is a reflection of a wider evolution of real estate towards a mix of uses. However, making the most of this will require investors to think beyond either/or and require more work from valuers to assess hybrid spaces, whether they are new developments or repurposed shopping centres.

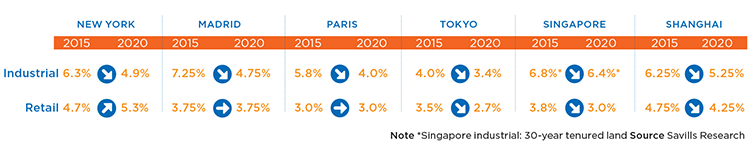

Industrial and retail yields

Industrial yields have moved in sharply over the past five years, but retail yields have also continued to fall in Asian cities.