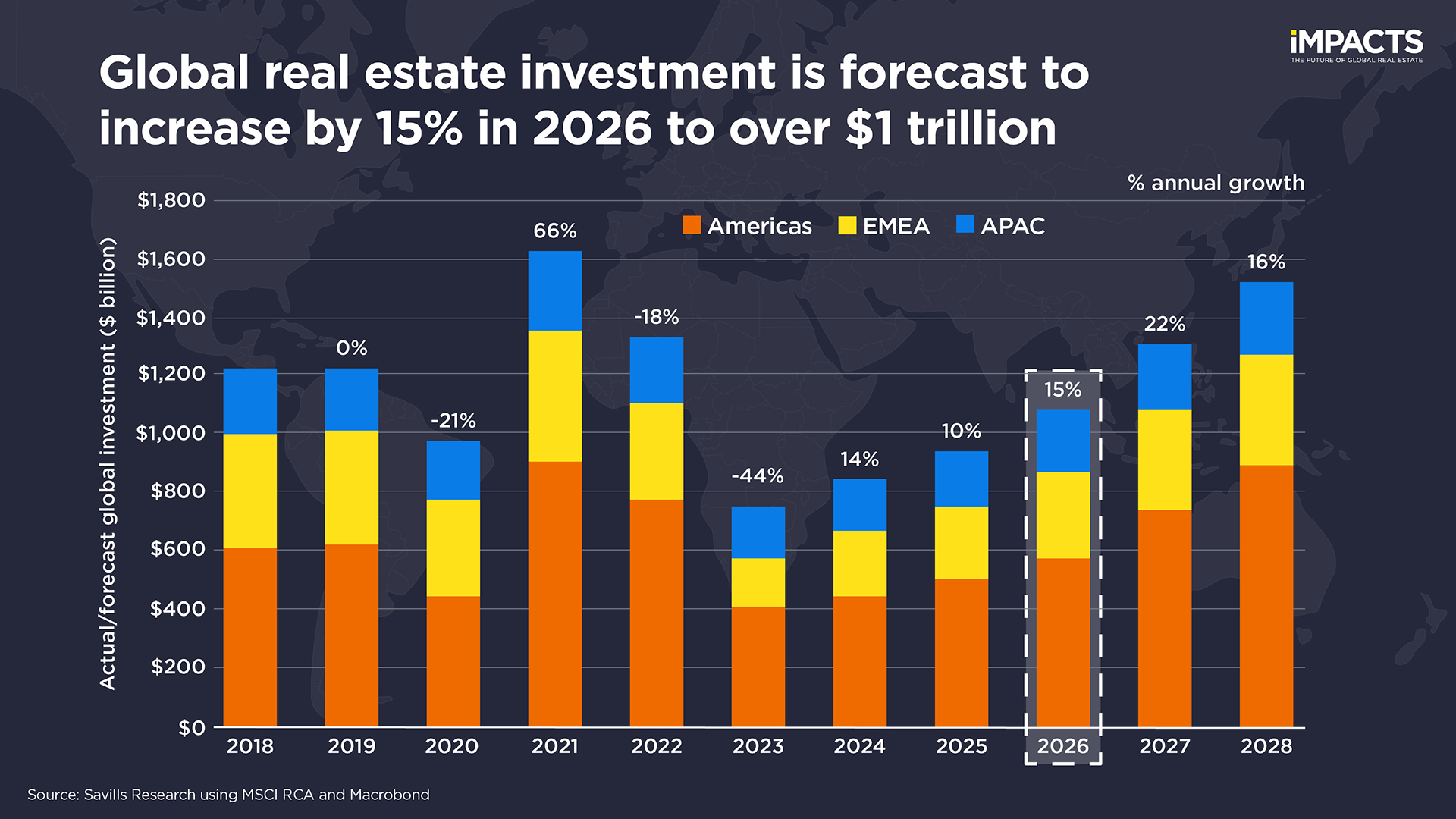

After a few years of subdued activity, 2025 marked a turning point in real estate capital markets. Investment turnover in the first three quarters was up 10% compared with the same period in 2024. More importantly, the underlying data reinforces the narrative of a nascent recovery: capital values have bottomed out, average deal sizes are increasing and debt is once again contributing positively to returns.

We expect these positive trends to strengthen further in 2026, when global investment is forecast to rise by 15% to over $1 trillion.

EMEA leads regional growth

Regionally, EMEA is expected to see the strongest growth of 22% year-on-year to just over $300 billion. France and the Netherlands are forecast to experience particularly high growth in investment as capital flows back into core Western European markets. Investment in the Americas is expected to reach $570 billion, up 15% from 2025. The United States will drive most of this expansion, with investment anticipated to reach $530 billion.

The outlook in APAC is more muted. Weak growth in China continues to weigh on the region, resulting in the smallest regional increase of 7% year-on-year to $200 billion. However, investors are not abandoning APAC. Instead, they are focusing on other major markets such as Japan, South Korea and Australia, which all experienced a strong 2025 and are expected to carry that momentum into 2026.

Confidence builds across markets

Our survey of the Savills global research network reflects the same optimism. Across all sectors, a net positive balance of 60% of respondents anticipate investment activity to improve in 2026, and 57% expect capital values to increase. Expectations for rental growth show the greatest divergence between sectors, largely due to the continued ‘flight-to-prime’ in the office sector.

Prime offices remain top investment pick

Last year, our global researchers adopted a bullish outlook on prime offices – and it appears they were right to do so. Through the first three quarters of 2025, global office investment reached $135 billion, up 14% year-on-year.

Heading into 2026, the office sector is expected to further increase its share of global investment, despite a cautious outlook for secondary offices in both capital and occupational markets. We expect prime offices to feature prominently across core/core-plus strategies, with around 80% of our global research network identifying them as a top investment pick for the next 12 months. Meanwhile, well-located secondary offices will continue to offer refurbishment potential given the shortage of prime space, suiting value-add strategies. Opportunistic investors may look at repurposing older offices, particularly for residential uses.

Residential and logistics maintain momentum

Investor appetite for ‘beds and sheds’ – residential and industrial and logistics – remained popular throughout 2025. Diverse structural drivers from demographic change and technological development to geoeconomic fragmentation supported this, although rising trade-policy uncertainty emerged as a headwind for the industrial and logistics sector.

Looking to 2026, the residential sector, including niche segments such as student and senior living, is poised to remain the largest global recipient of investment.

Retail and hospitality

The retail sector is expected to retain investor interest over the next year, offering good value relative to other sectors. Prime high streets in core locations and food-anchored retail feature regularly among our investment picks for core/core-plus strategies. Investors with more risk-seeking strategies may look to other parts of the retail sector, or to repurpose or reposition underperforming assets. Meanwhile, tourist hotspots continue to list hotels as an investment pick for next year.

Global Investment by Sector

Source: Savills Research using MSCI RCA

In last year’s investment outlook, we anticipated that central bank interest rate cuts would support a stronger rebound in investment and capital values. While declining rates have indeed helped spur a recovery by reducing the cost of debt, it’s noteworthy that both sentiment and transaction activity improved throughout 2025 even as long-term government bond yields remained elevated.

Adapting to a new rate environment

With the market adapting to the new normal of higher interest rates compared with pre-pandemic norms, we expect the ongoing recovery in 2026 to be underpinned by the release of both pent-up demand and pent-up supply. On the demand side, institutional capital is returning to the market; dry powder remains abundant and global target allocations to real estate remain steady at 10.8%, with some tailwinds arising from a positive denominator effect underpinned by rising global equity markets.

On the supply side, many investment funds held off from listing assets during the downturn. Now that pricing has stabilised and institutional capital is more active, some of these delayed disposals are likely to finally come to market, increasing overall liquidity and deal flow.