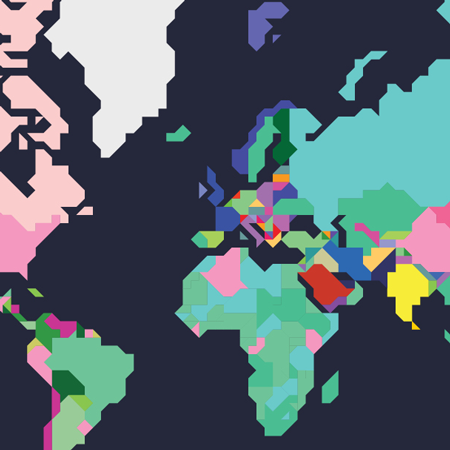

1. The Asia-Pacific 14 account for 65% of the world’s population

Sheer population size is one reason why the region will lead the 21st century, especially economically. Asia-Pacific’s 14 leading nations – China, India, Indonesia, Japan, the Philippines, Vietnam, Thailand, South Korea, Malaysia, Australia, Taiwan, Hong Kong, Singapore and New Zealand – account for nearly two-thirds (65%) of the world’s population.

2. The region drives global economic growth

The Asian Development Bank estimates that Asia-Pacific accounted for around 60% of global growth in 2017, and this share will rise further as Asian economies get larger. Last year, China’s economy grew by more than $800 billion, more than the GDP of Saudi Arabia. If we imagine that growth as a national economy, it would be the 19th largest in the world. The region’s economic growth will not only lead to demand for real estate as an investment, but also require more real estate development to support it in the future.

3. There are more billionaires in China than in the US

The Hurun Research Institute estimates that there are 658 billionaires in Greater China, compared with 584 in the US. Many of China’s super-rich, such as Dalian Wanda’s Wang Jianlin (above), made their fortunes in real estate, and still more are shaking property markets the world over, buying up office towers in London and penthouse apartments in New York. India has the next highest number of billionaires in Asia with 104, taking 5th spot globally behind Germany and the UK.

4. South-East Asia will be the next workshop of the world

As employment and land costs rise in China, expect to see more ‘Made in Vietnam’ or ‘Made in Indonesia’ labels on goods. Chinese manufacturers are looking to outsource to South-East Asian neighbours, where average wages might be half those expected by Chinese workers. This outsourcing is driving demand for industrial real estate, both for manufacturing facilities and for logistics space to support exports and infrastructure.

5. Demographics are very diverse

There is a strong polarisation in demographics between Asia’s developed and developing nations. Countries such as India and Indonesia have young and growing populations, so there is huge demand for housing and infrastructure. Japan’s ageing population is well documented, but fewer people realise that China is ageing just as rapidly. Ageing need not be a negative, however: Japan is set to lead the world in solutions for elderly care – such as Toyota’s Kirobo Mini robot, which provides conversation and companionship for the lonely – and for helping older people to remain in or rejoin the workforce.

6. India is a sleeping giant

The world’s second-most populous nation has lagged behind China in terms of infrastructure and growth. However, with Prime Minister Narendra Modi’s stable, business-friendly government at the helm, India is making up for lost time by investing in infrastructure and introducing legislation to boost the economy, including a real estate investment trust (REIT) regime. India overtook China in terms of GDP growth in 2015 and is forecast to grow faster for the foreseeable future. The world’s biggest real estate investors recognise this and have begun to invest heavily in office parks and warehousing.

7. Asia-Pacific is home to most of the world’s largest cities

The most fundamental driver of real estate markets is urbanisation, and Asia-Pacific is in the midst of an unprecedented migration from rural areas to cities. There are 45 metropolitan areas worldwide with populations of more than 10 million; two-thirds of them are in Asia. Meanwhile, mega-regions such as the Tokyo Bay Area and the Greater Bay Area in southern China are even larger than mega-cities and will be a focus for further urbanisation, growth and development.

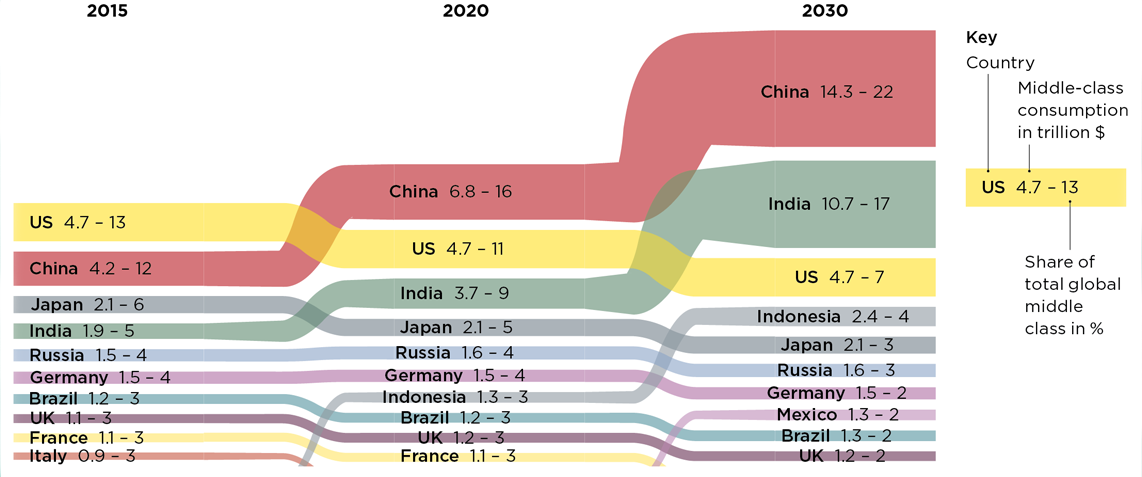

8. The middle class is growing – and fast

A key characteristic of the world economy in the 21st century has been the growth of the Asian consumer. While the region lags behind the US in terms of GDP per capita, hundreds of millions of Asians have moved into the consuming classes and are buying electronics, branded fashion and leisure experiences as never before. By 2030, more than 60% of the world’s middle class will live in Asia-Pacific, and China and India will each account for a greater share of global middle-class consumption than the US.

China will account for most middle-class consumption by 2030

Source: Roland-Holst, Sugiyarto and Loh

9. China’s companies are rising in profile

We are accustomed to US and European brands being globally dominant; everyone has heard of Coca-Cola and BMW. However, Chinese companies are getting bigger and so are their profiles and influence. More than one-fifth of the 2018 Fortune Global 500 companies are headquartered in China. Companies such as Tencent and Alibaba are not quite household names worldwide, but few people are unaware of them.

10. Huge infrastructure is in demand

The region’s rising population, wealth and urbanisation are generating substantial demand for infrastructure. The World Bank estimates that Asia accounts for more than half of global infrastructure demand. China has the ambitious Belt and Road Initiative, and emerging nations such as India and Indonesia need new roads, airports and power stations. Developed Asia needs renewable, clean energy, 5G mobile networks and same-day delivery. Some developing nations are leapfrogging their developed counterparts: India aims to become a leader in smart city development, for example.

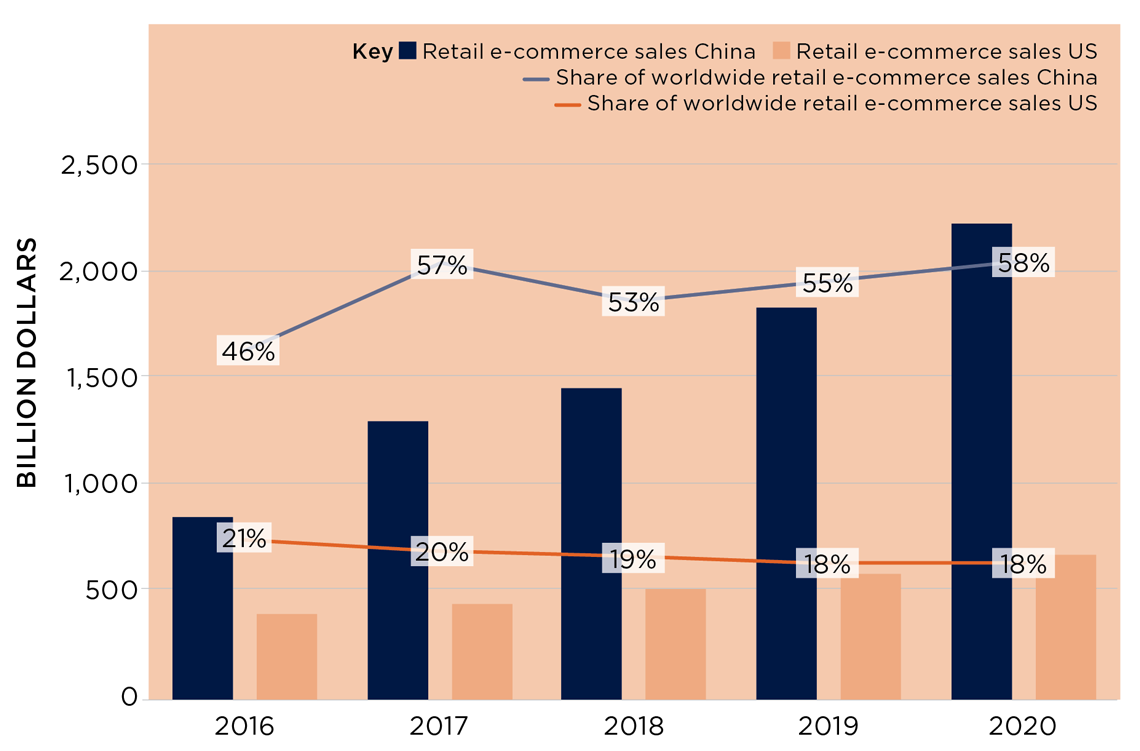

11. Asia is a growing force in technological innovation

It is a rather tired trope that Asian technology copies the West’s. Japan has been an innovator for decades (its high-speed rail network pre-dated the UK’s by 50 years) and now China is ahead of global rivals in a number of fields. It is by far the world’s largest and most advanced e-commerce market, and has pledged to take a lead in artificial intelligence (AI) technology. The prime challenge for all tech firms is finding and retaining talent: with nearly five million science, technology, engineering and mathematics (STEM) graduates each year, China has an unrivalled talent pool. India comes close, however, with 2.5 million yearly STEM graduates.

Retail e-commerce sales of China and US, 2016-2020

Source: emarketer