The Covid-19 pandemic has changed the way we work and, alongside other macro-trends, has led to a global reassessment of office requirements. Yet, as the Savills Future Office Availability Index reveals, the results are far from uniform worldwide. They certainly don’t spell the end of the office, either.

We have created an index of the top-tier office markets globally to understand the effects of current macro trends – such as cost and availability, pipelines and hybrid working trends, and future office needs – on office availability.

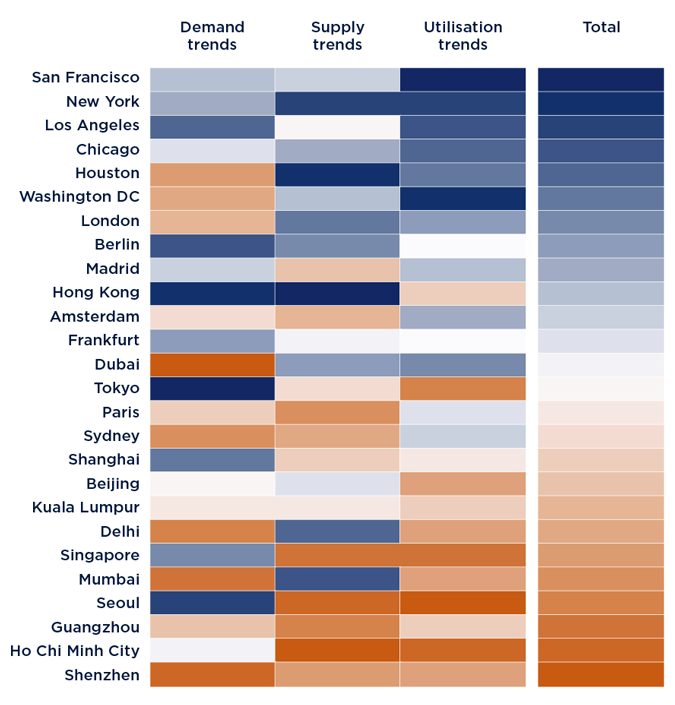

Future Office Availability Index

Note: Index is colour ranked from markets most likely to see an increase in office availability (dark blue) to those least likely (burnt orange). Each category is individually colour-scaled. Utilisation trends is given a half weighting. Demand trends and supply trends are equally weighted.

Source: Savills Research using Oxford Economics, Kastle Systems, and local sources.

East meets West

We have drawn a new map of the office environment based on future excess availability. Broadly it shows an East-West divide in markets which may see increases in vacant office space in the years to come.

One of the ways this can be seen is through current office utilisation rates – the share of workers going to the office daily. Across Asia Pacific markets, the average office utilisation stands at 86 per cent, as at March 2023. This is in contrast to figures across EMEA and the Americas, which average 61 per cent and 48 per cent, respectively.

US markets – particularly key cities such as San Francisco, New York and Los Angeles – have higher potential to see increased office availability in the future. San Francisco is the most extreme example. Pre-Covid-19, it had one of the lowest office availability rates in the US, at 9.5 per cent. In the current climate, 30 per cent of its office space is vacant or due to return to the market in the next year, representing a 30-year high in availability rate.

Asia-Pacific markets – including Chinese cities, Singapore, Seoul and Mumbai – are likely to have a lower surplus of space over the next decade. Their expanding economies are drivers for office demand and hybrid working trends have not taken root in the same way as in the West.

Office allure

Demographics are also crucial to this conversation. Growing populations, especially increasing numbers of younger people in locations such as Mumbai, Shenzhen and Ho Chi Minh City, are likely to help support office use in the near to mid-term. Office life may help the younger demographic feel more involved in company culture. It also provides an alternative to working from their homes, which are likely smaller and have less dedicated office space than those of older colleagues.

Commutability is another key part of the office/hybrid working equation. American cities with significant urban sprawl are more likely to have greater numbers of workers commuting by car, which carries time, cost and environmental implications. Their more compact European equivalents are better placed to embrace the “15-minute city” concept of mixed-use neighbourhoods designed for living, working and playing.

Growing populations, especially increasing numbers of younger people in locations such as Mumbai, Shenzhen and Ho Chi Minh City, are likely to help support office use in the near to mid-term.

Future of offices: newbuilds and refurbs

Also topping priority lists is the green factor: the need to build or retrofit office space that fulfils companies’ ESG responsibilities, in turn providing the calibre of sustainable stock that occupiers seek.

We are seeing a growing chasm between the best and the rest, with best-in-class, sustainable, people-focused office space in highest demand and achieving the highest prices. In Europe, for example, the average rent for prime office stock is 142 per cent higher than the average rental price for secondary stock.

In most cities studied for the Savills Future Office Availability Index, the majority of stock (an average of 69 per cent) was built before 2010 – meaning there was already an oversupply of non-green office stock.

Time for a rethink

Our analysis suggests we need to rethink the number and nature of the offices we are building – and reposition existing offices to suit new ways of working. By identifying the factors – including demographic shifts, quality of stock, and changing usage – leading to rising availability levels in different cities, we can pinpoint the key drivers for office market resilience in each location.

Factors include existing vacancy rates, quality of stock, ESG considerations, and the prevalence of hybrid working. Booming finance and business services sectors in certain cities – notably Mumbai, Delhi and Ho Chi Minh City – are also driving demand. Each of these cities are forecast to see the GVA from their finance and business services sectors increase by 50% or more in the next five years, and employment in the sector is also forecast to increase by more than 10% over the same period.

Adapt and evolve

The question now is how to retrofit and repurpose excess and vacant office stock to suit today’s needs. Regardless of the end-use of the repurposed office, cities becoming more mixed-use will provide opportunities for revitalisation. Given the sheer amount of embodied carbon in buildings, interest in finding new uses for existing properties is only increasing, and we expect to see this trend towards thoughtful repurposing continue.