Key themes

There will be no shortage of real estate dry powder looking for opportunities in 2023. According to RealFin, unallocated real estate funds, despite being down year-on-year at the end of 2022, stood at US$828 billion, still 73 per cent above the 10-year average.

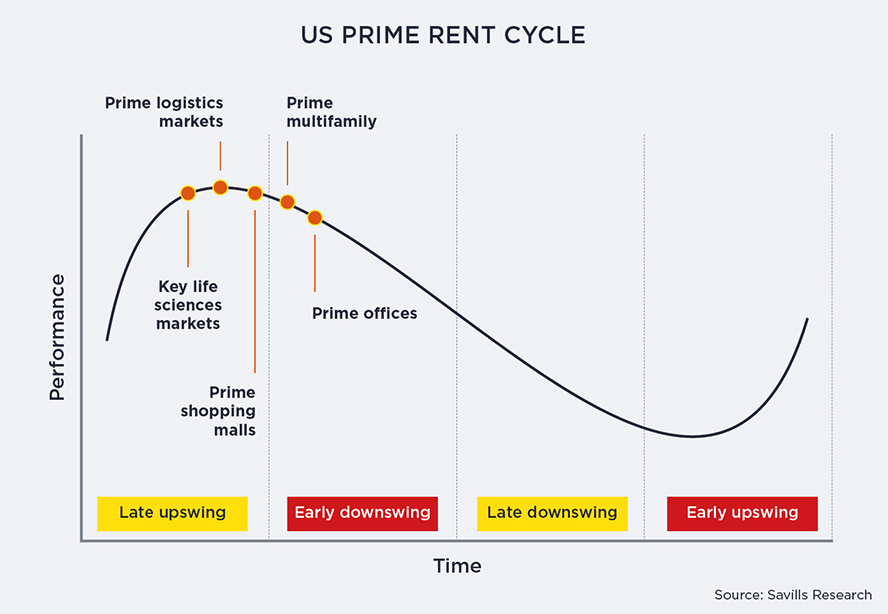

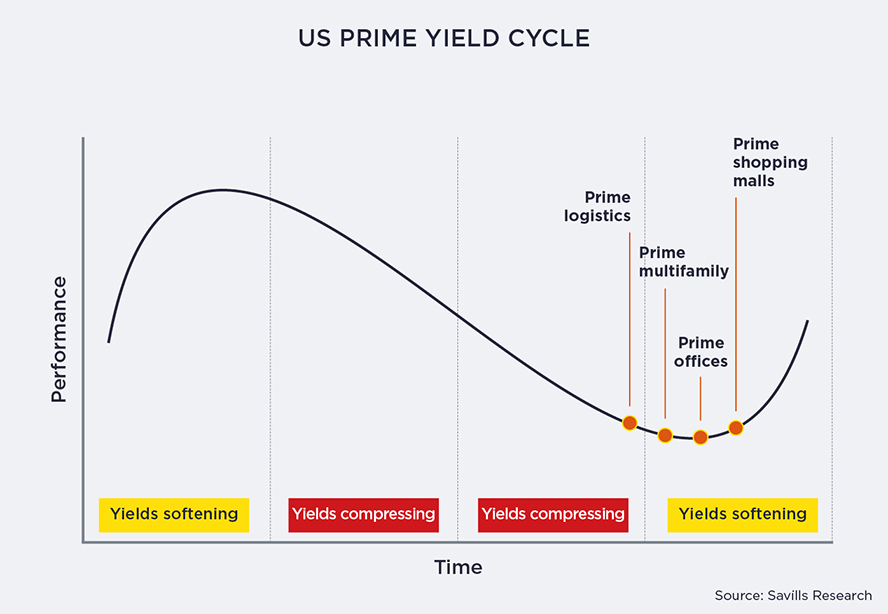

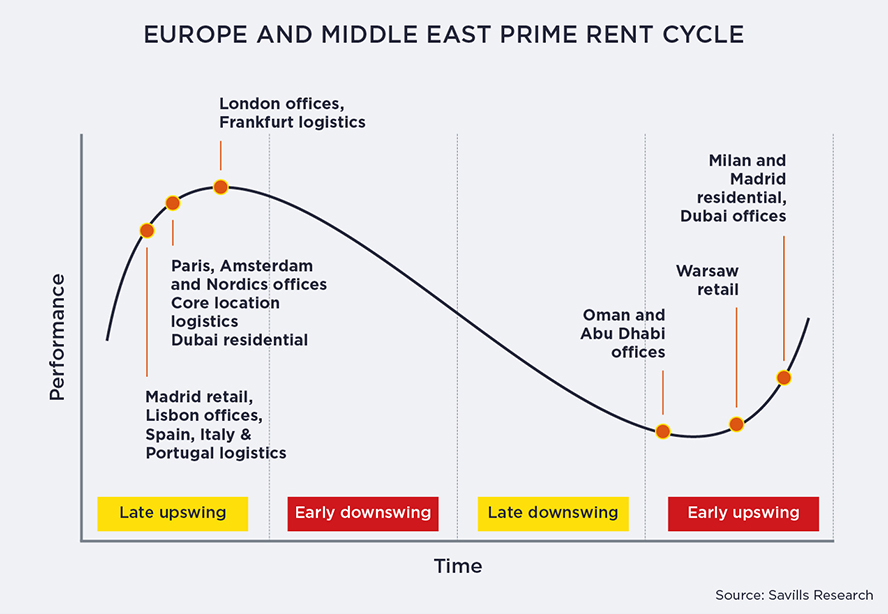

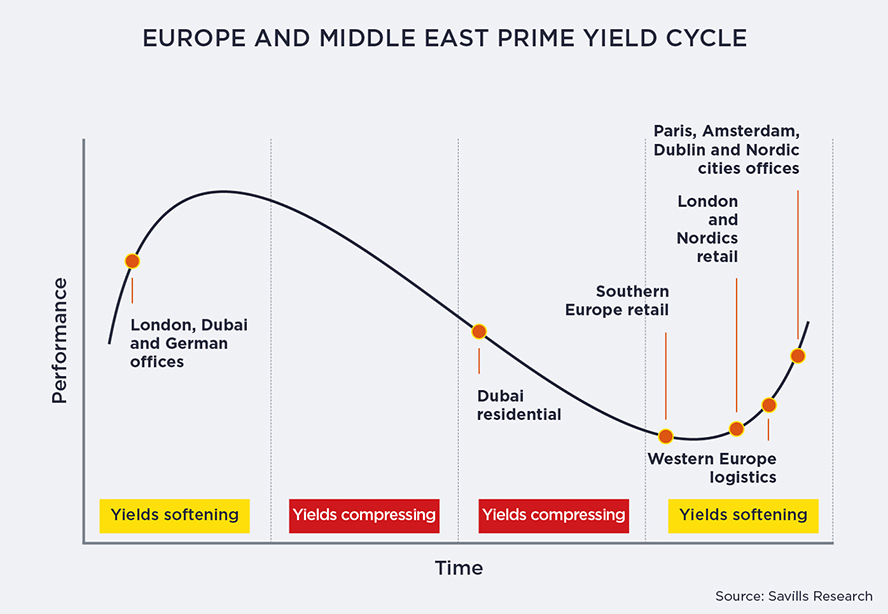

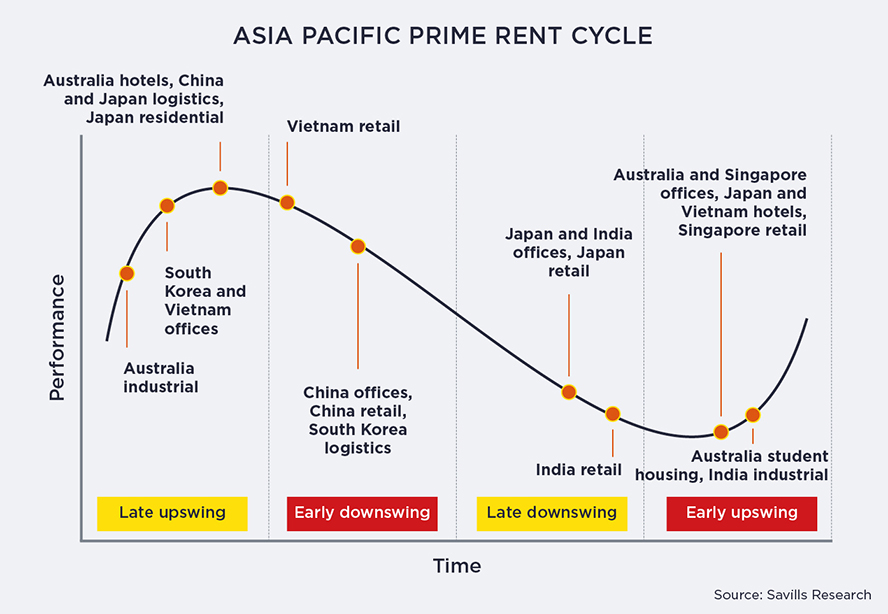

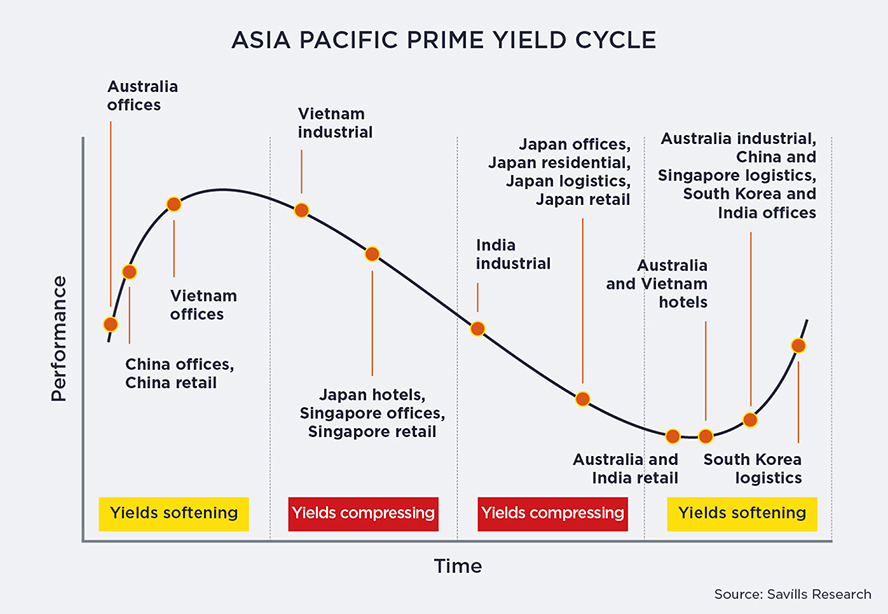

Prime rent and yield cycles by region

Investment activity to rebound

The pandemic and the war in Ukraine will continue to weigh on confidence in 2023, along with the energy crisis, inflation, tightening monetary policy and climate change.

Preliminary data from RCA shows that global investment activity dropped by 26 per cent year-on-year in 2022. According to the most recent RCA Capital Liquidity Scores, capital market liquidity in the third quarter of 2022 was down on the second quarter for 97 of 155 tracked markets.

However, we expect investment activity to rebound in the second half of 2023, along with an improvement in the economic outlook, and to normalise in line with long-term averages.

We also anticipate more emphasis on value-add strategies – such as retrofitting, repurposing and a focus on gaps of supply – to achieve higher returns.

Price adjustments to unlock investment

Real estate is cyclical, but its pricing is typically slow to adjust.

According to our latest data, yields have started moving out in the most liquid global markets, but further yield expansion is expected in 2023. More clarity around interest rates and inflation, especially in the second half of next year, is likely to bring buyer and seller expectations closer and unlock transaction activity.

Fundamentals are solid, but labour market outlook is worsening

Labour markets continue to defy pessimism in the economic outlook, so occupational markets remain robust, especially for prime commercial assets in key global markets. The slowdown in construction activity, due to rising costs and supply-chain disruptions, sustains supply and demand imbalance across most prime market segments. Nevertheless, unemployment rates are forecast to rise in 2023, leading to a slowdown of corporate expansion plans and thus demand for space.

Savills top tips: Global sectors to watch in 2023

Prime offices in prime CBD locations in core markets (London, Paris, Berlin, Tokyo, Singapore, Sydney, Dubai) with low vacancy rates will retain their attractiveness for core/core-plus strategies. Occupiers are seeking energy-efficient, well-designed office accommodation globally. Green-certified offices remain in short supply, at just 22 per cent of office stock across 20 global cities (see Green office deficit article). Prime rents are likely to edge upwards in several key markets, driven by inflationary pressures and limited availability of Grade A stock.

Prime logistics in key trade hubs and markets with rising e-commerce penetration rates will remain at the top of investor strategies. Vacancy rates have reached historically low levels in several locations (the UK, US, Germany, Netherlands, France, Spain) and speculative development is set to decline. Although occupier demand is expected to soften from pandemic peaks, low availability and upward pressure on rents should be sustained.

Prime multifamily housing is particularly well-placed to weather current high inflation as it is one of the few asset classes where landlords can regularly rebase rents to capture growth. In some markets, new-build properties are exempt from rent regulations. Structural shortage of rental housing and relatively low levels of new residential construction in large cities in the US, Japan, Germany, Australia, the UK, the Nordics, Spain and France will drive income returns, although affordability is increasingly becoming a political issue.

The issue of ageing, under-rented or under-utilised offices is affecting several major markets in the US, Europe and Asia. Value-add strategies including retrofitting older office buildings to green standards and repositioning assets with high vacancy into alternative uses (such as life sciences, residential and hotels) will continue to be at the forefront in 2023. However, the high cost of construction and renovation will remain a major headwind as investors seek out yield.

Rising interest rates are causing pricing corrections, which are likely to cause some distressed sales in the coming months. Investors with opportunistic strategies are likely to take advantage of assets with long-term value, through active asset management and repositioning. Nevertheless, the level of distress is not likely to reach the levels of the global financial crisis, as leverage levels are lower.

Another theme for opportunistic investors is repurposing of obsolete assets. We expect many retail properties and offices in secondary locations of major cities in the US, UK and Australia especially, to be converted to residential, hotels, life sciences, last-mile logistics or mixed use.

Structural drivers such as technological innovation, climate-change risks and demographic changes remain compelling for certain alternative asset types. Our top picks include data centres and life sciences in the US, UK, Europe, India, China and Australia, living sectors in the US, UK, Europe, Japan and Australia, and renewables infrastructure across all geographies.