Talent is at the heart of Tech Cities. Without a pipeline of skilled tech workers, even the most established hubs struggle to compete. So it’s no surprise that the most successful Tech Cities share common traits, including world-class universities and youthful, growing populations.

Established Tech Cities benefit from robust higher education sectors that attract and generate talent, alongside research and the innovation ecosystems that commercialise it. London, for example, is home to nine universities ranked in the QS Global Top 500, with two in the top ten. Melbourne, Sydney and New York also host leading institutions with highly international student bodies. An average of 45% of students in these cities come from abroad, contributing to diverse and globally competitive talent pools.

Yet in a world increasingly focused on skills over academic credentials, emerging markets are gaining ground, as our 2025 Savills Tech Cities Index shows. For example, Bengaluru, India, scores top marks for talent availability thanks to its vast tech workforce.

Nairobi stands out for its demographic advantage. It has a highly favourable ratio of 3.9 ‘zillennials’ (older members of Gen Z and younger millennials – those aged 20-34) for every Gen X and younger ‘boomer’ (those aged 50-64), indicating a strong pipeline of young talent. Riyadh, another youthful city, has seen tech investment supported by initiatives under Saudi Arabia’s Vision 2030 plan for economic diversification.

Cities with skills: the top locations for talent in our Tech Cities Index

Source: Savills Research.Tech talent pool pillar from Savills Tech Cities Index

Some of these emerging markets are also benefiting from the growth of global capability centres (GCCs). High costs and tight labour markets in established hubs such as London and New York are accelerating the growth of GCCs in lower-cost markets such as India, Poland and Mexico. These hubs allow multinationals to centralise strategic functions and access skilled talent at scale while mitigating the effects of talent shortages, ageing workforces and tighter migration controls in Western markets.

Tech hiring trends stabilise

After aggressive post-pandemic expansion and subsequent retrenchment in 2023 and 2024, the headcounts of major FAANG+ companies (large US tech firms including Meta, Apple, Amazon, Netflix and Google) have levelled off. However, they remain 92% above 2019 levels, underscoring the sector’s long-term growth.

The nature of hiring is also evolving. Tech companies are increasingly reskilling internally and prioritising skill-based hiring over traditional degree qualifications. This marks a departure from the rapid hiring of recent years, in favour of more targeted and strategic recruitment.

Average FAANG+ headcount

Source: Savills Research using company reports from Meta, Amazon, Apple, Netflix, Alphabet, Microsoft, Tesla, Nvidia, Advanced Micro Devices

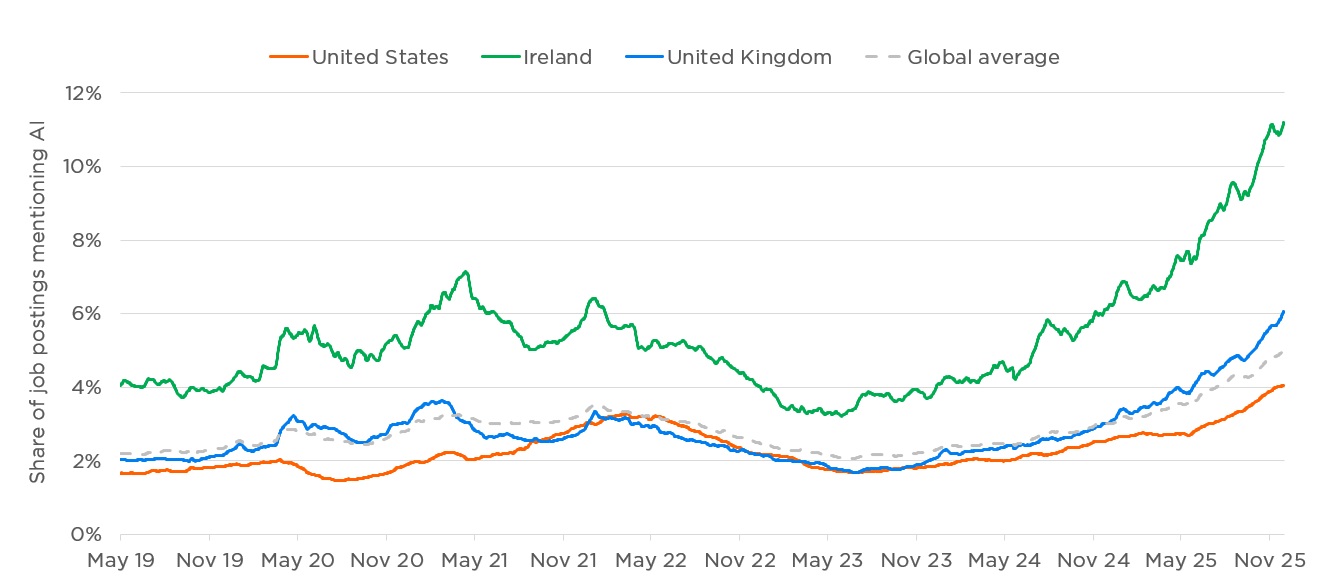

Demand is shifting towards specialist skills, particularly in AI, cloud engineering and cybersecurity. Job postings mentioning AI surged in 2022 (the year generative AI went mainstream), then dipped in early 2023 but have been steadily rising since mid-2023 as AI adoption has grown. Ireland stands out globally with the highest share of AI-related job postings, thanks to the presence of a large number of US-headquartered tech corporations in the country.

Job postings mentioning AI

Source: Savills Research using Indeed

How are workplace strategies evolving?

Tech firms lean on amenity-rich, collaborative offices to attract and retain talent. The sector has been slower to return to the office than others, often employing hybrid working models and delaying major changes to office footprints. However, attendance policies vary widely, from full-time office mandates to flexible arrangements, reflecting the sector’s ongoing experimentation with post-pandemic norms.

Initially, many occupiers renewed or adapted existing space following the pandemic. Analysis of major tech leasing deals in the second half of 2023 and the first half of 2024 shows that most involved no change in office footprints and that lease renewals were common, as existing spaces continued to meet evolving needs.

However, by the second half of 2024 and into the first half of 2025, expansions became more common, signalling renewed confidence and growth. In key North American cities, for example, tech companies have accounted for 29% of the largest leasing deals since early 2024.

Global tech office leasing deals by type of deal

Source: Savills Research. Data represents major Tech Cities in each region

Share of take-up by tech companies, H1 2024 – H1 2025

Source: Savills Research. Data represents major Tech Cities in each region

New York leads in tech office space take-up by volume, followed by San Francisco and Tokyo. By average deal size, New York, Delhi and Boston top the list. In cities where tech dominates – as in Seattle, Shenzhen and San Francisco – more than 50% of all deals come from the sector.

Global tech hubs are undergoing a profound talent and workplace shift, shaped by new workforce dynamics, evolving talent demands and the rise of AI. Renewed leasing momentum reflects the sector’s continued belief in the office as a strategic asset for collaboration, innovation and talent attraction.