Income returns will remain the overarching theme for real estate investment in 2020. Offices in core city markets will be a focus for investors, but with opportunities scarce and yields at record lows, many will be forced to look elsewhere. Alternatives, such as student housing, multifamily, co-living and data centres are increasingly becoming mainstream.

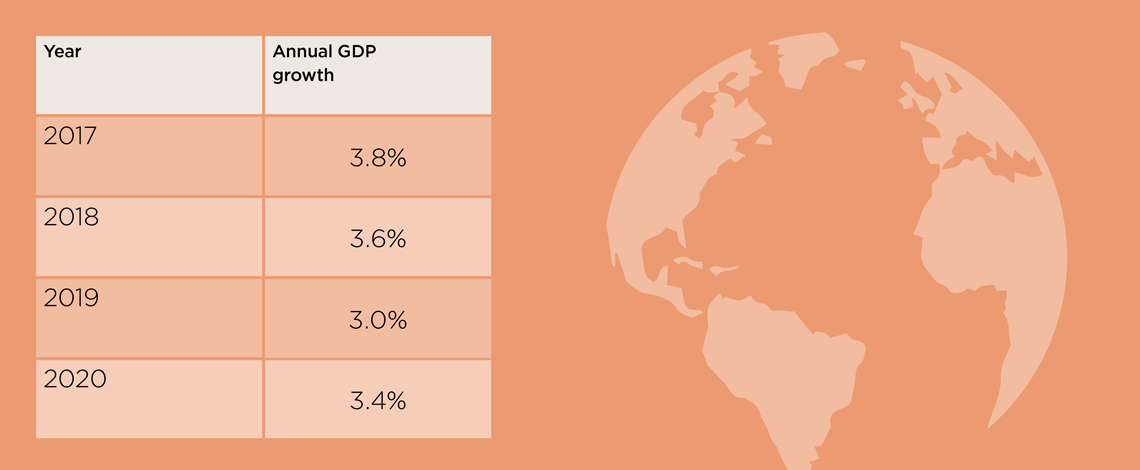

These trends are set against a muted global economic outlook and heightened political uncertainty. The IMF forecasts a modest pick-up in global growth to 3.4% in 2020, up from 3% in 2019. The US/China trade war remains a serious drag on the global economy. World trade volumes fell by 1.1% year on year to Q3 2019, the worst result since 2009. Indicators show that it will stabilise in 2020, but the environment remains fragile.

Global growth 2017-2020

Source: IMF

In spite of this, investor appetite for real estate shows no sign of abating. Global volumes in 2019 finished down on the record levels of 2018, but were still the second highest on record. This fall was not for a lack of capital, rather a lack of assets in the market.

By sector, offices and senior housing had the biggest growth in global investment volumes during 2019, both increasing by 6%. Industrial saw a more modest growth of 3%, but the sector is now the third largest following a 21% fall in retail investment.

If some of the uncertainty is removed from the market, for example an orderly Brexit or an easing of global trade tensions, there is pent-up demand waiting to invest in real estate – in many cases beyond the core assets. The comparatively attractive returns real estate can offer, as interest rates look set to remain lower for longer, will continue to drive the market.

Global themes for 2020

No single cycle

In spite of today’s globalised and highly connected world, it’s notable that different cities, countries and sectors are still at different points in the cycle.

Ongoing search for income

Supported by very low interest rates and a large volume of capital seeking income returns, real estate will remain a highly attractive asset class on a global stage compared to bonds.

Don’t ignore the macro environment

Micro markets still matter, but in today’s geopolitical environment, the macro environment can’t be ignored. Trade wars, populist government agendas and climate risk are all influencing factors when it comes to investment decisions.

Finding the right stock

Offices are the top pick for core from all our regions. The challenge will be finding the investable stock. A lack of liquidity is one test, particularly in Asia, where investors are holding for longer.

Niches go mainstream

Emerging niches such as residential and data centres are now entering the mainstream in some markets. Social and technological change will drive growth but understanding operational risk is key.

Read the trends and tips by region

North America tips: read more here