Key themes

Asia Pacific property markets face a number of challenges going into 2023. Some are global concerns.

First, inflation – caused by the war in Ukraine and post-Covid supply-chain disruption. This has driven central banks to raise rates and, in doing so, cool growth. It’s a relatively tame problem in the Asia Pacific region, but the knock-on effect of inflation in the US and Europe, where the bulk of Asia’s exports are sold, is significant.

Second, technology has turned the way people work and shop upside down – tearing down the old boundaries between property asset classes in the process. But, as with inflation, the disruptions in Asia are being felt less acutely than elsewhere. Flexible working and online retail, though gaining traction, are yet to take off as they have in Europe and the US.

Third, China, the region’s largest economy, accounting for 53 per cent of GDP and almost a third of all manufactured products, is becoming more isolated, due to strict – if tempering – Covid policies and a more assertive political direction. This will continue to deprive incoming real estate capital, while slowing the flow of funds coming out of China to a trickle. However, this is balanced by much of south-east Asia and India enjoying the luxury of catch-up growth.

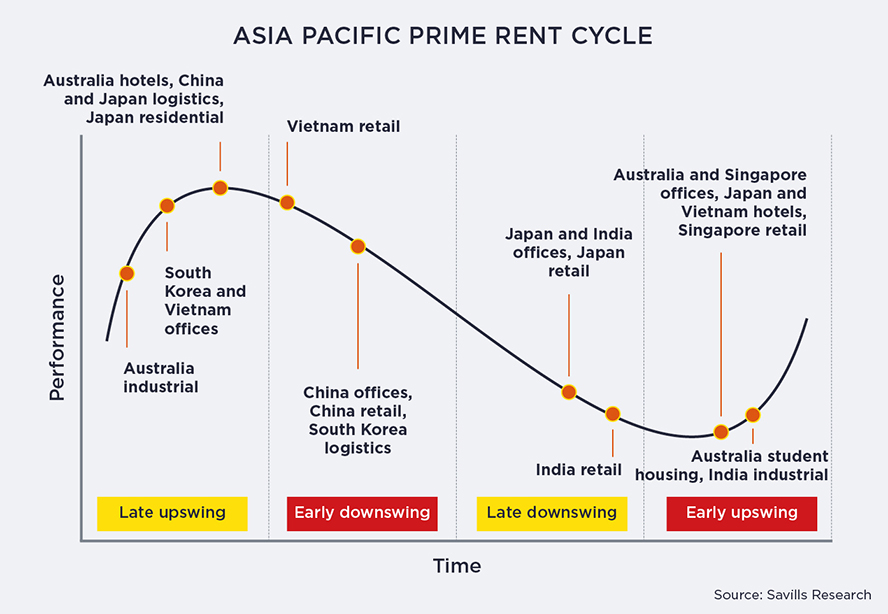

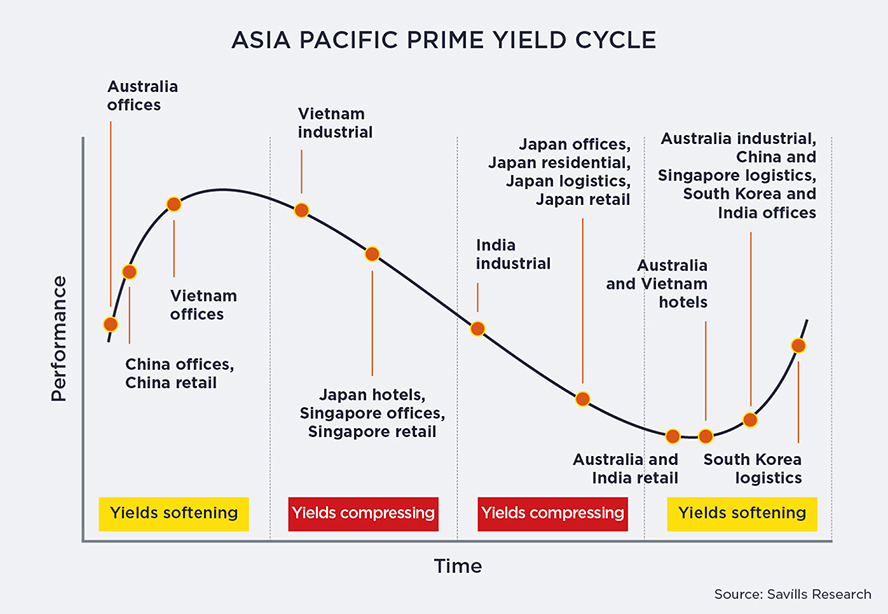

Prime rent and yield cycles

Asia Pacific real estate predictions for 2023: more positives

There are other positives on the horizon, too. A raft of imminent trade agreements, temporarily grounded by Covid-19, should accelerate Asia Pacific’s post-pandemic resurgence, as supply chains mend and the region’s low-cost base reinforces its competitiveness.

In an inflationary environment Asia’s shorter lease lengths should prove appealing to companies, while “index-linked” defensive sectors, such as self-storage, student housing, multifamily housing and senior living, should draw significant investment. The ‘New Economy’ remains as fresh as ever.

Asia Pacific real estate predictions for 2023: country highlights

Japan’s low interest rates and weak yen will continue to attract overseas capital, especially for logistics assets, multifamily housing, student housing and healthcare facilities. Fuelled by tourism’s recovery to pre-pandemic levels, the hotel sector remains an attractive one for opportunistic investors.

Singapore, meanwhile, will cement its position as a “geopolitical safe space” in the region, building its financial services base, attracting private family offices and benefiting from the exodus of talent from Hong Kong. The city state’s limited Grade A office stock supply looks set to prompt value-add redevelopments, as ESG becomes a more dominant concern for tenants.

Vietnam will continue to benefit from relaxing Covid-19 restrictions and its China Plus One investment diversification strategy. Inflation is relatively controlled, retail sales are still increasing, the VND is strong and the country is expected to post enviable growth of 4% in 2023. However, a 30% fall at local stock exchanges last year, led by property, has left domestic property players squeezed for debt, opening the door to foreign direct investment (FDI). High infrastructure spend enhances the country’s appeal to investors, with luxury retail and industrial markets some of the key areas to watch.

In Australia, Asia’s principal resource-driven economy, high yields, strong comparable growth and a weaker Australian dollar will attract offshore investors in 2023. Logistics, core offices and alternatives will be the sectors to watch. Alternative/emerging asset classes such as build to rent, multifamily and student accommodation will also be buoyed by higher migration rates and the recovery of travel and tourism.

In China, as elsewhere in the region, life sciences, data centres, logistics and cold chain investments have lost none of their allure, with compelling structural drivers. Even with low inflation and low interest rates, debt-burdened firms may look to pass on distressed assets, but prices remain contentious. However, 16 policies have been issued by the People’s Bank of China and China Banking and Insurance Regulatory Commission to support distressed property developers. Xi Jinping’s resumption of dialogue with G20 leaders is a further positive.

The World Bank’s GDP growth forecast for India, a rare bright spot in the global economy, is one of the highest in Asia Pacific and private equity investment in the country’s property is set to double in 2023. As global supply chains are rebalanced, a flourishing manufacturing sector, coupled with digitisation, will drive investments in industrial, warehousing and data centres. Life sciences will also gain traction.

In South Korea, a buoyant Korean won is doing little to encourage FDI, given that prices have yet to fall. However, signs of distress among domestic LPs could expedite sales and prompt a correction. Robust tenant demand and a prevailing tight supply pipeline will keep Seoul prime office prices strong for a few years yet.

One factor affecting all global markets in 2023 will be ESG. Expect to see growing ESG commitments and more ESG initiatives as part of investment strategies across all asset classes – albeit less pronounced than in Europe.

Savills top tips: APAC sectors to watch in 2023

- Prime offices (Australia, Japan, Singapore, Seoul, HCMC, India)

- Prime logistics (Australia, China, Japan, Seoul)

- Office repositioning (Australia, Japan, Singapore, Seoul, India)

- CBD retail (Australia, HCMC, Japan, Seoul)

- Industrial (China, India)

- Suburban shopping centres (Australia)

- Hotels (Japan, Seoul)

- Affordable housing (Vietnam, China)

- Data centres (Australia, Singapore, Vietnam, India)

- Student accommodation (Australia, Japan)

- Multifamily (Australia, Japan)

- Medical offices & life sciences (Australia, China, India)

- Elderly care, senior housing (Japan, Seoul, Vietnam)