Key themes

Savills EME Investor Sentiment Survey (October 2022) indicates that investor appetite remains most prominent for those sectors benefiting from structural tailwinds, such as multifamily, logistics and CBD offices.

For investors willing to embrace the risk of repurposing distressed real estate assets, 2023 promises to be a year of opportunity, due to substantial price corrections, ushered in by declining capital flows and softening yields. Intercontinental investors will be keen to take advantage of a weaker euro, so we expect to see plenty of US, Singaporean and Middle Eastern capital invested in the eurozone.

Rising debt rates will continue to impact pricing across all sectors during H1 2023, as cash-rich buyers look to take advantage of discounts. Deal activity will bring more price transparency, which should encourage more sellers to bring more products to the market at the right price, unlocking liquidity.

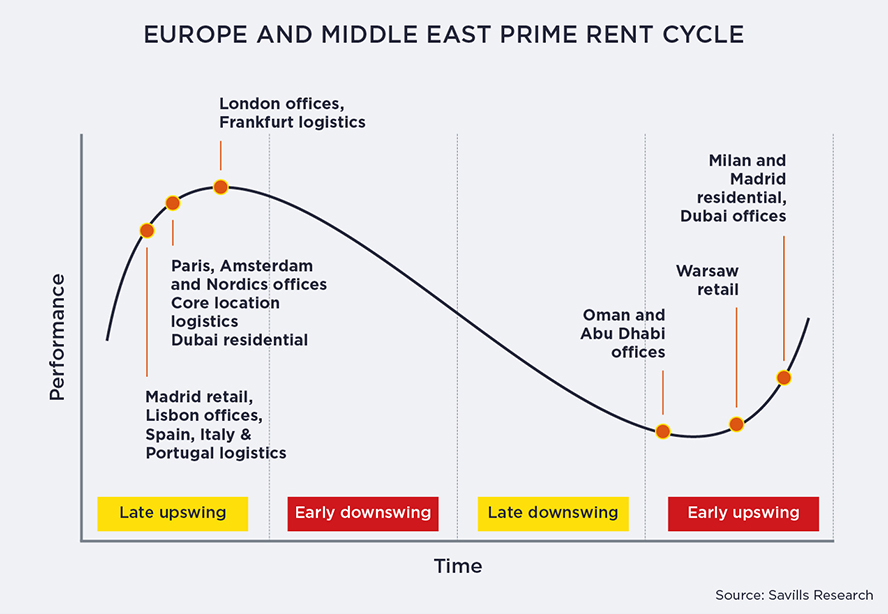

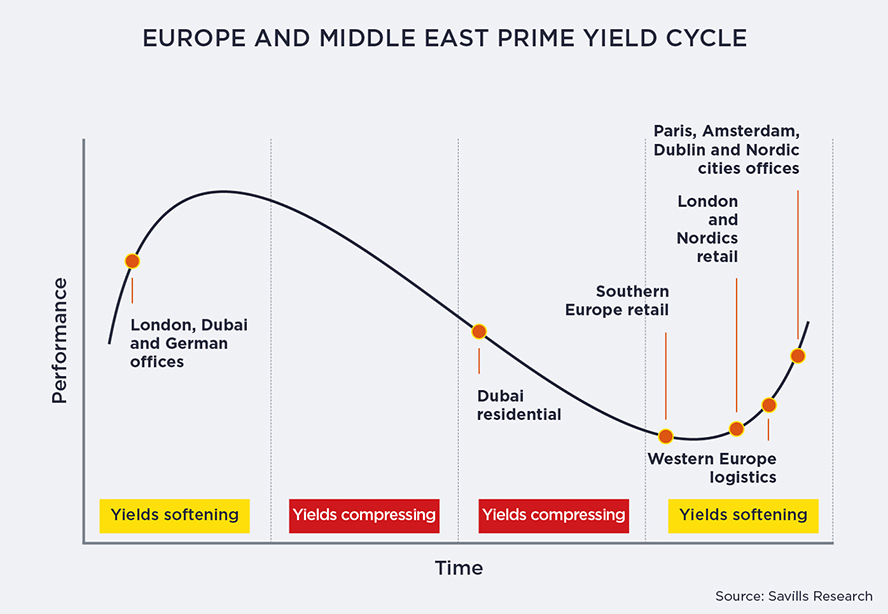

Prime rent and yield cycles

Europe real estate predictions for 2023

Offices remain the most liquid European real estate sector, with investors eager to acquire prime stock in CBD locations. We anticipate that the average office-risk premium over risk-free rates will revert to pre-global financial crisis levels. Mainland Europe’s rental indexation will act as an inflationary hedge and we expect the low supply of high-quality office stock to further fuel market rental growth in 2023. In Madrid and Paris, where the post-pandemic return to the workplace has been swiftest, occupier trends show the demand is for less space, but higher quality.

Structural undersupply of housing in many European countries will prompt rental growth in the multifamily sector. Because the sector is able to regularly rebase rents, investors are in a strong position to capture that growth.

Supply-chain bottlenecks, rising levels of e-commerce adoption and increased inventory holdings will continue to support European logistics occupier demand in 2023. Record low vacancy rates and development pipeline delays will further support the overall rental growth trend, as core and core-plus investors compete for best-in-class stock.

Increasing European carbon emissions regulation will continue to create openings for value-add investors retrofitting secondary stock in prime locations. The opportunity will be greatest in the more regulated markets, such as London and Amsterdam, and in cities with a higher proportion of older stock. Occupiers will increasingly refuse to sign for space if it does not match their ESG criteria.

Prime “alternatives”, such as new, purpose-built student accommodation, will also be high on investors’ agendas – particularly in Spanish and Italian cities, where the provision of beds per student is among the lowest in Europe and student populations are expected to grow. Data-centre portfolios across Europe and life science opportunities in western Europe – especially in the UK, Germany, France, the Netherlands, Belgium and Switzerland – will also be a priority for investors.

Savills top tips: European sectors to watch in 2023

- Prime logistics (UK, Germany, the Netherlands, France, Spain)

- Prime offices (Berlin, Munich, Paris CBD, Stockholm, London)

- Prime multifamily (Germany, UK, Nordics, Spain, France)

- Prime food retail units

- Data-centre portfolios

- Prime retail parks/shopping malls (Spain, France, Portugal, Italy)

- Offices repositioning

- Student housing developments (Spain, Italy)

- Life sciences (UK, Germany, France, the Netherlands, Belgium, Sweden)

- Retail repurposing

- Data centres

- Purpose-built student accommodation

- Multifamily

- Life sciences

Middle East real estate predictions for 2023

Middle East economies are among the fastest-growing in the world, due to higher government revenues and increased spending by regional governments. Regional competition, collaboration across digital and technology industries, and an end to the Saudi-led Qatar blockade will act as tailwinds driving growth.

Bahrain, Oman and the UAE have relaxed foreign-ownership rules and are pioneering new residence categories for top talent, including “green” visas (work permits that don’t require sponsorship) and residence by investment visas – all of which should encourage an increase in Foreign Direct Investment (FDI). The FIFA World Cup in Qatar and Dubai’s Expo 2020 will also continue to encourage tourism across the region. Travel and tourism now accounts for about 16 per cent of GDP in the UAE and the sector’s sustained growth should boost the overall economy. This will lead to high occupancy levels across Grade A developments, thereby pushing rental values up.

In all, the Middle East and North Africa have projects worth $1.4 trillion at various stages of development and planning. Development activity and new project launches will continue to remain upbeat throughout 2023, as regional economies prove resilient to the global headwinds of higher inflation and rising interest rates. The bulk of these forthcoming developments are concentrated in Saudi Arabia and Egypt, where the focus is on infrastructure – both building anew and upgrading existing – to diversify their economies and meet the demands of growing populations. Given that most of these projects are greenfield, they give investors a golden opportunity to create long-term, sustainable and international-grade assets.

Savills top tips: Middle East sectors to watch in 2023

- Grade A warehouses across Dubai, Abu Dhabi, Jeddah

- Prime Office across Dubai, Abu Dhabi, Bahrain, Riyadh and Cairo

- Branded Residence across Dubai, Cairo, Riyadh

- Prime Retail across all cities

- Grade B office across all cities

- Staff accommodation across Dubai, Riyadh

- Grade B industrial / warehousing stock across all cities

- Hotels across Riyadh, Cairo, Abu Dhabi

- Built-to-rent residential projects across Dubai

- Data Centers across all cities

- Life science projects