The world order of top global cities may feel as though it is set in stone. But with disruption on the menu through technology, demographics and leadership, all that is set to change in the next decade.

For traditional leaders such as London, New York and Tokyo, the battle will be about resilience. How can they continue to harness favourable qualities such as strong economies and demographics to maintain their position?

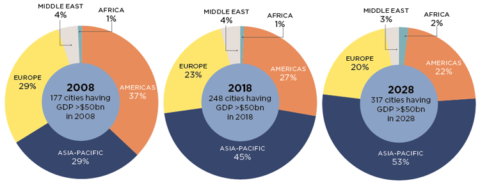

Emerging locations in China and the Middle East are snapping at their heels, challenging the status quo with rising personal wealth and fast-growing economies. They are joining an increasingly crowded field. In the past decade, the number of cities with gross domestic product (GDP) of more than $50 billion has grown from 177 to 248, underscoring the vital role that cities will continue to play in these disruptive times. By 2028, this number is expected to jump to 317. Those cities with GDP over $50 billion accounted for 83% of global GDP in 2018, an increase from 79% a decade ago. This is forecast to increase to 89% over the next 10 years as the importance of cities continues to accelerate.

Their geographical distribution has shifted significantly over the past decade, too, and is expected to change again. In 2018, Asia-Pacific had the largest share of cities with GDP over $50 billion, overtaking the Americas. By 2028, more than half of these influential cities are expected to be in this region.

A second threat to the traditional order is cities working together. The creation of mega-regions has seen cross-border collaboration in the US and Mexico and across Europe. China can do this all on its own by linking populous metropolises.

Savills Research has undertaken an in-depth analysis of these emerging themes among cities, examining them for resilience, those challenging today’s order and growing mega-regions.

Resilient Cities

In a world of change, the search for sustainable cities in which businesses can thrive is increasingly important. The Savills Resilient Cities Index identifies those that will be able to withstand or embrace the many disruptive forces facing global real estate today and in 10 years’ time. These are cities that attract talent and encourage the innovation that drives city and personal wealth – factors that feature high in the decisions of real estate investors.

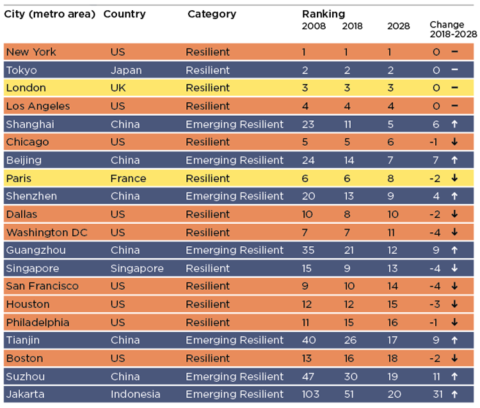

The top 20 ranking for 2028 includes familiar names alongside some of the US’s economic powerhouses. The leading four are forecast to be New York, Tokyo, London and Los Angeles, unchanged for the past two decades. These continue to have an inbuilt advantage from their position as world-class cities and are expected to remain resilient over the next decade.

Savills Resilient Cities Index

Methodology: Savills Resilient Cities Index is a measure of city wealth (GDP), personal wealth (households with an income greater than $70,000), and demographics (population dependency ratio) Source: Savills Research

The greatest change during the next 10 years will be the rise of Asian cities. From 2008 to 2028, there are seven new cities from Asia breaking into the top 20. Of these, six are Chinese cities, with Jakarta, Indonesia, taking the final place. These Emerging Resilient Cities have risen dramatically in economic and wealth terms in the past decade, and are expected to cement their position on the back of increasing middle-class wealth.

Despite the changes to the make-up of the top 20, the global percentage of GDP that these cities account for in 2028 is forecast to remain stable at around 25%, compared with 26% in 2018.

Cities with GDP over $50bn

Source: Savills Research

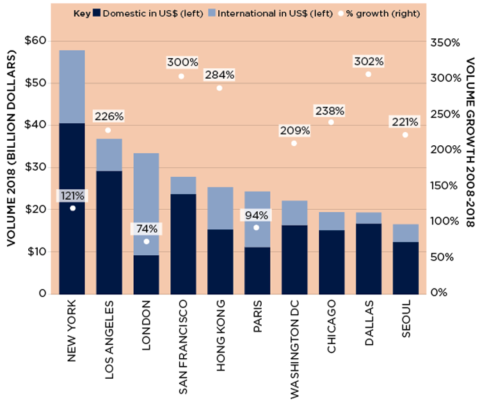

While Resilient Cities make attractive propositions from a short and long-term economic and demographic perspective, it is interesting to see how this aligns with current real estate capital flows. This demonstrates whether investors are finding the appropriate risk/return profile in each market, and the size and liquidity of the investible real estate universe.

The top 10 cities for investment by volume ranks New York, Los Angeles and London in the first three places: each is in the top four in the Resilient Cities Index. Other US cities in the Resilient Cities top 20 and the top 10 investment volumes globally are Chicago, Washington DC, San Francisco and Dallas.

Top 10 cities by investment volume in 2018

Source: Savills Research using data from Real Capital Analytics

New York remains the largest market with $57.5 billion invested in 2018, though it has become increasingly domestic with the share of cross-border investment falling from 37% to 30% in a decade. In contrast, Los Angeles, San Francisco, Washington DC, Chicago and Dallas have all seen their share of cross-border investment rise over the same period, albeit from a lower base.

London remains third, with investment volumes of $33.5 billion in 2018. Despite Brexit, London is still attractive to foreign investors, with cross-border investment comprising over two-thirds of volumes in 2018, an increase from half in 2008. Paris, the only other European city in the Resilient Cities Index, has an almost even split of domestic and foreign investors, attracted to the city’s large and liquid office market.

What our Resilient Cities index means for investors

The Savills Resilient Cities Index informs future real estate investment decisions. The most established – ‘Resilient Cities’ – have a thriving economy and real estate sector. Emerging Resilient Cities are expected to match this status by 2028, while the rapid progress of ‘Challenger Cities’ offers a longer-term investment opportunity.

How we define each category

Resilient Cities

These cities have been in the top 20 for at least the last decade and are forecast to remain so over the next 10 years. They are well-placed to withstand or embrace the many disruptive forces facing global real estate today and in the future.

Emerging Resilient Cities

The new entrants to the top 20, either in the past decade or forecast to be so in the next. Although they’re not currently as well-established on a global stage, we expect them to match the status of the Resilient Cities by 2028 as they continue their dramatic rise in economic and wealth terms.

Challenger Cities

Cities that are forecast to make the top 50 by 2028 by jumping at least 10 places. They are poised to rise and challenge the established cities by using disruption to their advantage. For real estate investors with a long-term view, these are the cities to watch.

Increasing climate risks

According to the World Economic Forum’s (WEF) Global Risks Report 2019, extreme weather and climate-change policy failures are some of the greatest threats to cities over the next decade. “New York is a case in point. When Hurricane Sandy hit, people in high-rise buildings became stuck as elevators flooded,” says Alice Charles, Cities Lead at the WEF.

For some cities, this requires new thinking and prioritisation from leadership, while others are already using technology to mitigate the threats of natural disasters. In Japan, for example, integrated systems can halt high-speed trains in the event of a natural disaster. “Similarly, they can communicate with the public quickly by leveraging mobile phones, so they are using all kinds of technology to inform people to take cover,” says Charles.

Urban design challenges

For Resilient Cities to thrive, they need to maintain a positive approach to good urban design. For example, Los Angeles, fourth on the Index, has been working hard to discard its image as a car-orientated city.

“This low-rise, spread-out city has made an amazing effort through good urban planning and is overcoming its reputation for poor public transport. The metro system [pictured] has been developed and expanded to areas it didn’t reach before,” says Jacqueline Beckingham, Creative Director at international architecture and masterplanning practice Benoy. “Along the path of the metro, there is now an understanding that these are places to build with greater density.” Los Angeles has also been spurred on by being named host city for the 2028 Olympic Games.

In Chinese cities such as Shanghai, Beckingham sees a different approach. “The Chinese have the capacity to do very ambitious urban planning that is supported by the government,” she says. “They do use eminent domain and can develop in a rapid way, when others would come up against special- interest groups.

“These are all ambitious schemes founded on good urban planning principles, but sometimes it can be at the expense of losing the old and favouring the new.”

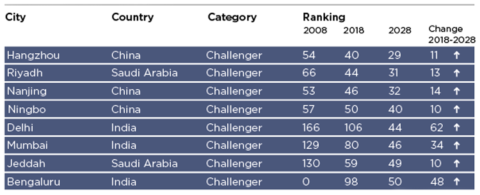

Challenger Cities

The Resilient Cities research identifies a number of Challenger Cities: ones forecast to be within the top 50 by 2028. They are expected to jump by at least 10 places in the rankings over the decade. The distribution of these cities contrasts with those in the top 20, with no contenders from the US or Europe. Instead, China, India and the Middle East make up the eight.

From India and the Middle East, these are well-known international cities such as Delhi, Mumbai and Bengaluru (Bangalore), and Riyadh and Jeddah in Saudi Arabia. However, the Challengers from China come from a second-tier league of large, but less internationally recognised, cities such as Hangzhou, Nanjing and Ningbo.

Source: Savills Research

India

The Indian Challenger Cities have very different dynamics driving growth, says Anurag Mathur, CEO of Savills India. “Delhi is the seat of government, so attracts industry that needs to be closer to policy-making,” he says. “Mumbai is the financial capital, while Bengaluru has traditionally been about science and engineering.”

Delhi and Bengaluru have growing tech industries attracting younger talent. “As the home of the Indian Space Research Organisation, Hindustan Aeronautics and the Indian Institute of Science, Bengaluru had a strong legacy of science and engineering before it saw a new wave of start-ups and other tech companies,” says Mathur. “Tech growth in Bengaluru was initially about cost arbitrage, but it has moved up the value chain and is now a core tech research and development (R&D) centre,” says Mathur. General Electric and Shell have located their R&D centres here.

For India’s young, mobile population – 65% are under 30 – Delhi and Bengaluru are favoured destinations. Mumbai, by contrast, has a higher cost of living which does not support a start-up culture.

Middle East

The presence of Riyadh and Jeddah in the Challenger Cities rankings come as Saudi Arabia focuses on transforming its retail sector with the rise of e-commerce. With a population of 33 million willing consumers spread across a large area, e-commerce has provided retailers with a solution to get more goods to customers.

Real estate investors have been capitalising on the changes by investing in logistics and warehousing focused on e-commerce tenants, such as Kaden’s The Logistics Park in south Riyadh. Here, Noon.com signed a lease on a 40,000 sq m logistics facility at the park, while Jollychic took around 130,000 sq m. Both companies have also signed up for headquarters space at the new Business Front in north Riyadh.

“The change in consumer behaviour has had an effect for physical retail,” says Richard Paul, Head of Professional Services and Consultancy, Savills Middle East. “The most successful shopping centres are now anchored by food and beverage and entertainment, to attract customers who generally purchase electronics, durable goods and clothing online.”

China

The rise of Chinese cities stands out as they make up the majority of the Emerging Resilient Cities (those that have risen dramatically in economic and wealth terms in the past decade and are expected to continue to do so to enter the global top 20) as well as many on the Challenger Cities list (those that are expected to enter the top 50 in the next decade).

For Emerging Resilient Cities such as Shenzhen and Guangzhou, this is reflected in their GDP, which is now ahead of Hong Kong’s. That said, Hong Kong’s importance should not be underestimated. Its location and financial and legal expertise are all factors that make it a real estate investment hotspot, ranked fifth globally.

Shenzhen has been a Resilient City in the making for several decades. Designated the first special economic zone in China in 1980, it is home to established companies, such as insurer Ping An and car-maker BYD. It has also moved with the times, and attracts tech-related companies, such as gaming firm Tencent and mobile giant Huawei.

For Challenger Cities, tech is driving many of the trends. Hangzhou, for example, is attracting tech companies and people that want to cluster near the Chinese e-commerce conglomerate Alibaba. “A lot of talent was moving to tier one cities, but Hangzhou emerges and people are more willing to move for a good salary and a lower cost of living than nearby Shanghai,” says Siu Wing Chu, Managing Director, Central China, at Savills. Shenzhen and Guangzhou will continue to see their influence increase as part of the Greater Bay mega-region that will unite 11 cities through major railway investment.

“It is going to be a powerhouse as the region is becoming more integrated,” says Woody Lam, Managing Director of Savills Southern China. “They already have lots in common, such as Hong Kong companies locating their factories in the area, and many people travel in the region to work in the different cities.”

Given China’s size, there are a number of cities not mentioned that are growing in global importance and attracting real estate investors. By 2028, forecasts suggest that 43 of the top 100 resilient cities will be in China. These include cities such as Wuhan (the most populous city in central China with fast-improving infrastructure) which aims to be the economic engine of China’s central region.

The growth of the mega-region

With rising urban populations, metropolitan areas are joining together, often across borders, to form powerful mega-regions. With a level of resilience that goes beyond even city status, this creates a favourable attribute for real estate investors. These regions can be identified using satellite images – continually lighted areas, correspond to economic activity. Mega-regions benefit from shared resources and talent, access to labour, expanded consumer markets and knowledge exchange. Challenges, especially if they cross borders, include differing national legislation, political risks and currency fluctuations.

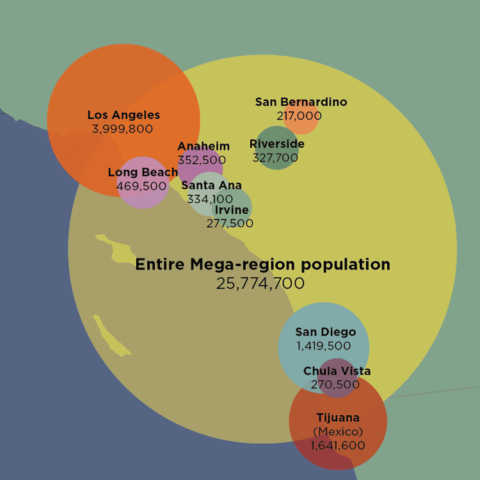

Southern California

The bulk of the Southern California mega-region is in the US, stretching from LA to Tijuana in Mexico. As a mega-region, it is one of the largest economies in the US, with key sectors including entertainment, tourism, tech, automotive and finance.

Source: Savills Research using Oxford Economics and national sources Note: Metro area populations cited

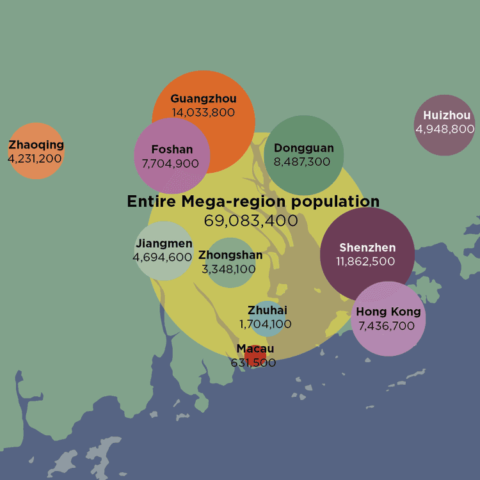

Greater Bay Area/Pearl River Delta

This consists of nine Chinese cities in the Pearl River Delta and the two special administrative regions of Hong Kong and Macau. With a GDP of $1.3 trillion, it is comparable with the San Francisco Bay Area and the Greater Tokyo Area, yet will overtake both by 2030. High-speed rail will transform travel times between major cities. What used to take 240 minutes is now 100. Hong Kong, Shenzhen and Guangzhou can be covered in 48 minutes.

Source: Savills Research using Oxford Economics and national sources Note: Metro area populations cited

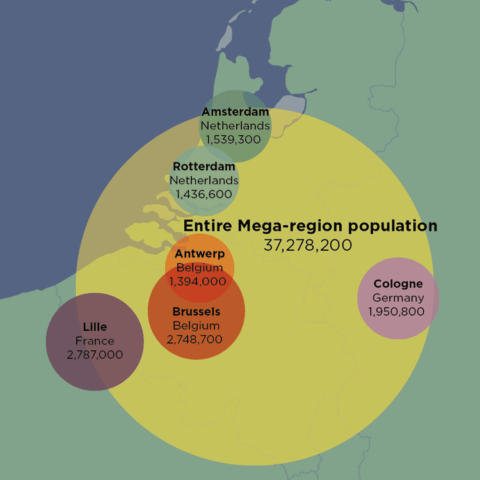

Amsterdam-Brussels-Lille-Ruhr

This mega-region spans four countries in northwest Europe, including the major urban centres of Amsterdam, Rotterdam and Brussels. It is an interconnected network for knowledge exchange and business innovation, housing some of Europe’s best universities such as Delft University of Technology, the University of Amsterdam, Eindhoven University of Technology and Leiden University.

Source: Savills Research using Oxford Economics and national sources Note: Metro area populations cited