The question of where to locate a warehouse has historically been a trade-off between local road transport networks, where product comes into a country, the retail and manufacturing final destinations and the availability of land.

However, as technology begins to transform how goods are distributed, operators’ locational decisions may change. The onset of Covid-19 has the potential to accelerate some of these locational decisions as online shopping rates increase around the world, and retailers and manufacturers realise their supply chains have been too lean and therefore need to move inventory closer to its final destinations.

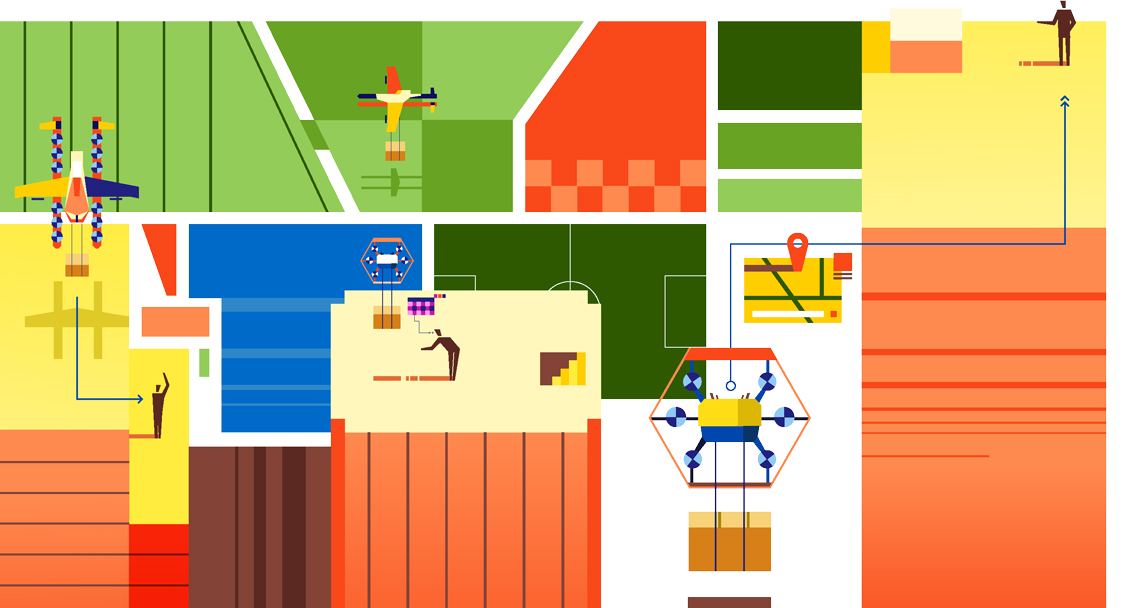

The prospect of vehicle automation, high-speed Hyperloop capsule delivery and airborne drone transport means that logistics companies and their partners must reconsider where to locate distribution centres and how to build them.

“If the future of last mile logistics is drone delivery and autonomous vehicles, then the future is almost here,” says Michael Fenton, National Head of Industrial and Logistics, Savills Australia and New Zealand. The likely impact on the real estate market is beginning to come into view.

Truck platooning

Platooning vehicles move in a group or platoon with the trucks driven autonomously by smart technology and continuously communicating with one another. By synchronising vehicle control, trucks are able to drive in close formation and at constant speed. This uses less fuel, creates fewer emissions and improves traffic flow.

The impact on property

Autonomous truck platooning will reduce demand for space in inland distribution parks, which are traditionally located 4.5 hours’ drive from ports, the longest time a truck driver can drive before they are obliged to break.

For delivery hubs on urban fringes, however, the impact on real estate location and design will initially be limited. Trials in the Netherlands and the UK are demonstrating that platoons do not solve the problem of last mile delivery through narrow, winding and congested roads. To start with, therefore, platooning will focus on ferrying goods between existing focal locations, such as ports and logistics hubs.

This means the emphasis for real estate users will be on retrofitting existing infrastructure. Ports and logistics hubs will add truck-platooning terminals to existing parks alongside dedicated rail freight terminals. But within these parks, two tiers of logistics space are likely to emerge, with users willing to pay a premium for sites immediately adjacent to major platooning points that can facilitate the fastest onward delivery.

“In China, you are already starting to see investment in terminal infrastructure that will support autonomous trucks,” says James Macdonald, Head of Research, Savills China.

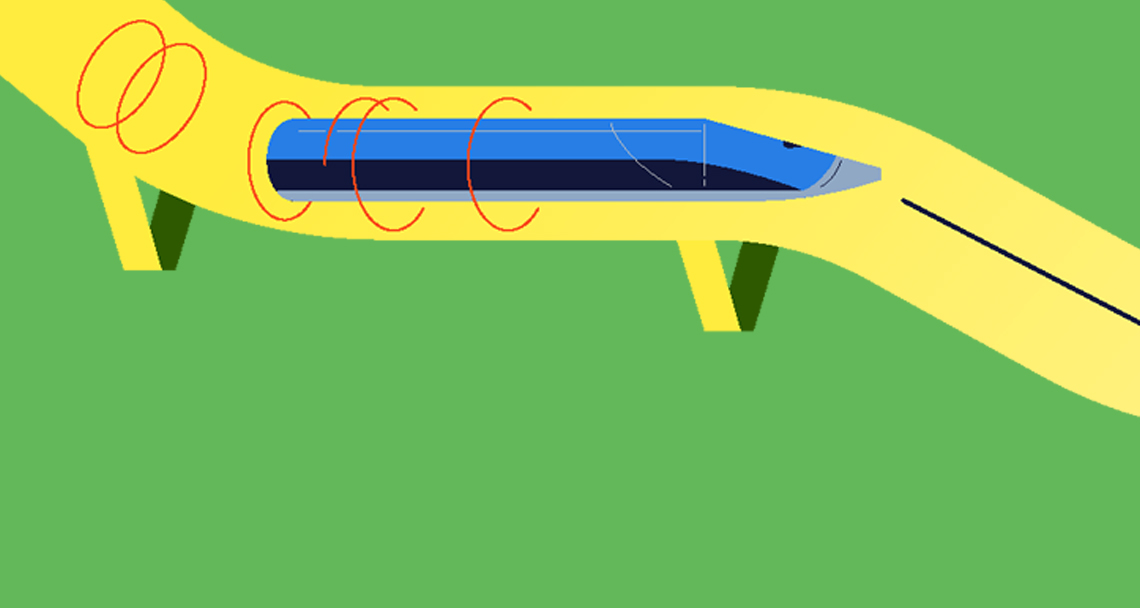

Hyperloop tunnel travel

Pioneered by Elon Musk through his SpaceX companies, Hyperloops could see passengers and freight travelling at more than 700 miles an hour in floating pods speeding along giant low-pressure tubes above or below ground. Networks will connect urban areas and link manufacturing centres. Advocates say infrastructure costs are comparable with high-speed rail, should be less expensive and less polluting than air travel and should be cheaper for low-volume users.

The impact on property

With the technology still at an early stage, judging how Hyperloop stations would look and function – including how much space would be required to load containers on pods – is hard to predict.

However, they are likely to increase pressure on existing logistics sites spurring the development of a two-tier rental market, with premiums paid for locations close to the Hyperloop infrastructure. This would mirror existing arrangements at many of the world’s leading airports where logistics companies pay a premium to locate ‘airside’ due to the time and productivity efficiencies gained.

Drones

Proponents believe that large-scale commercial drones will soon carry parcels weighing less than 2.5kg up to 15 miles, easing road congestion and slashing vehicle emissions and – it is hoped – delivery costs.

The impact on property

On the face of it, drones look set to make major real estate demands since they require new types of buildings to launch, store and service them. In Australia, Wing, run by Google’s Alphabet, has been trialling drone deliveries of burritos, coffee and medication in a Canberra suburb since 2018, and launched a commercial air delivery business in the city last year.

“A crucial obstacle to wider adoption is the design of homes,” says Fenton. “Not all residents can provide safe landing areas.”

“Drone delivery will also introduce a new dimension of value for all eligible buildings in their roof surface,” says Marcus de Minckwitz, Director, Omnichannel Group, Savills. “Companies are already looking to intermediate building owners and future drone operators by buying options to licence roof space.”

Conclusion

“With new transport technologies serving demand for last minute, last mile delivery, logistics companies will continue to make up a greater share of users of higher-value land,” says de Minckwitz. Initially, what land is used is not set to shift dramatically. Truck platooning and Hyperloops are likely to require depots in existing transport hubs, with operators having to find additional land – an already scarce resource. In return, tenants, who rely on these more dominant transport networks, will be willing to pay higher rents.