The conventional wisdom about trade wars is that they are a Bad Thing. And, to be fair to the conventionally wise, this is generally true.

However, the trade war between the USA and China has led to some changes that are proving positive for the world economy and for real estate.

The Covid-19 outbreak has severely disrupted world trade and has shattered everyone’s predictions for 2020. It is also likely to affect trade patterns in the future. However, it is unlikely to alter structural changes linked to the trade conflict.

The trade war has been brewing for some time. US president Donald Trump has been a critic of the US trade deficit for decades, while the previous Obama administration raised concerns about China’s use of non-tariff barriers and its failure to respect intellectual property (IP) rights.

Meanwhile, China has argued that the US is using complaints about trade and currency manipulation as a means of constraining the growth of a rival.

Here to stay?

There are two important things to grasp about the US-China trade war.

1. It is going to last for a while. Tariffs tend to hang around once imposed. The US Government is committed to fighting China on trade and IP rights, and a change of US administration will only alter the language, not the stance. Meanwhile, China is committed to consolidating its position as a world economic power.

2. It is accelerating trends that have already begun – such as the growth of China’s consumption economy, financial liberalisation and its rise up the manufacturing value chain. These trends and others are significant for real estate investors in Asia-Pacific.

In January 2018, the USA announced the first tariffs, on solar panels and washing machines. A raft of others followed, with China responding in kind. In 2019, the US imposed tariffs on $360 billion worth of Chinese products; China, in turn, imposed tariffs on $110 billion worth of US goods.

However, in January this year, the warring parties signed a ‘phase one’ trade deal, in which China agreed to strengthen IP protections and increase purchases of US goods by $200 billion in 2020-2021 (the increase based on 2017 numbers) in return for a slight easing of tariffs. Some observers believe this first phase deal is an important step, however there is also widespread agreement that a second phase is unlikely to happen.

The reason for this lack of optimism is because of the difficulty China will have in moving further in the direction the USA requires. The phase one deal does not cover non-tariff barriers to trade, such as subsidies to Chinese companies and procurement rules. Nor does it address a fundamental US bugbear, that of the lack of a meaningful separation of state and business in China. And, it is highly unlikely that China’s rulers will abandon the state capitalism model that has served them so well.

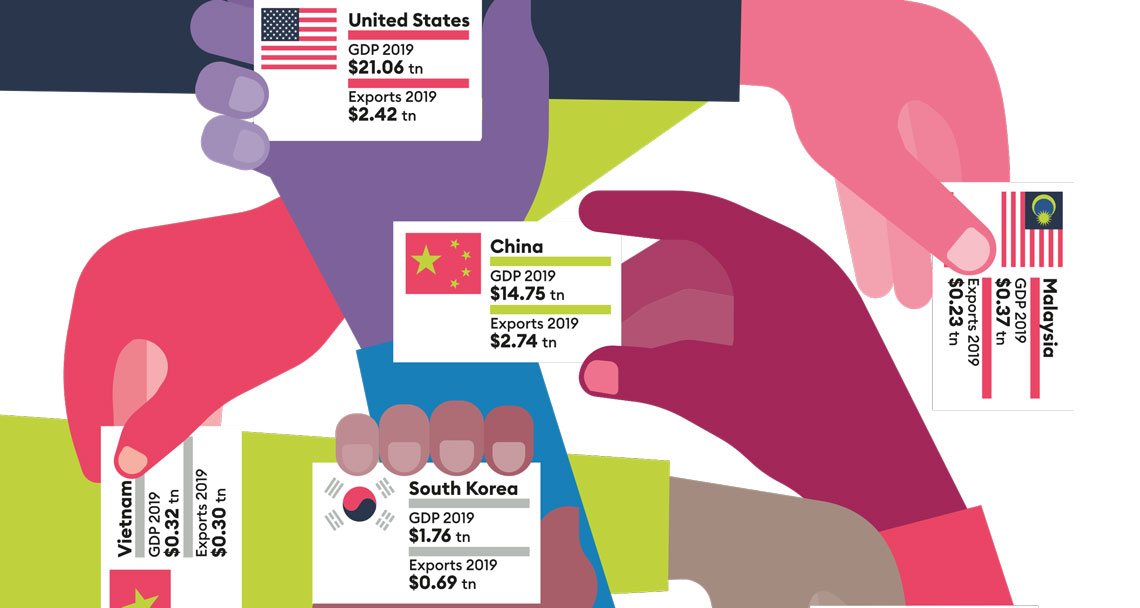

Source: Savills Research using Oxford Economics

Impact on GDP

The first bit of good news, or at least not too bad news, is that the trade war has not had a significant impact on GDP. Oxford Economics estimates US 2019 GDP might have been cut by 0.1-0.2% and China GDP by 0.3-0.5%. This year, the Covid-19 outbreak will have a far more dramatic effect on GDP in both nations.

From inception to the end of 2019, the tariffs reduced US-China bilateral trade by around 15% and the trade deficit with China has fallen sharply. However, the overall US trade deficit has not fallen significantly, because trade has shifted rather than disappeared.

In Vietnam, exports to the USA rose 35.6% in 2019 as Chinese manufacturers relocated their operations overseas

The prime beneficiary of this shift has been Vietnam where exports to the USA rose 35.6% in 2019 as Chinese manufacturers relocated their operations overseas to avoid tariffs.

Malaysia, Thailand and South Korea have also benefited. In September, Thailand announced a package of new measures to attract manufacturers affected by the trade war.

The current environment, however, has merely accelerated a trend of Chinese manufacturers moving some operations overseas in order to find cheaper land and labour – manufacturing wages in Vietnam are a third of those in China. In turn, China is moving up the value chain. This trend, accelerated by the trade war, is positive for both Vietnam and China.

There are advantages for real estate too. Vietnam industrial real estate is booming, with land prices and rents rising sharply as the nation becomes a major manufacturer. Industrial rents in Binh Duong, a district to the north of Ho Chi Minh City, rose 54.4% in the year to June 2019.

Meanwhile, China’s move up the value chain will free up former industrial land outside cities for more profitable and less polluting uses. Millions of people are still moving to China’s cities, and there is a lot of money to be made in transforming industrial land to residential and commercial use.

Uptick in India

A less widely known beneficiary of the trade war is India. Industrial landlords in India are reporting an uptick in light industrial occupation in their parks, particularly in ancillary automobile industries.

Manufacturers diversifying from China add weight to India’s resurgence in the past few years, as it benefits from the pro-business government of Narendra Modi. Global real estate investors such as the Canada Pension Plan Investment Board, Brookfield and Blackstone have noted this resurgence and invested billions in Indian real estate.

China has begun to adapt its supply chains. Overall world trade was stagnant last year, however China managed to increase exports to the rest of the world by 4%. Furthermore, falling exports galvanised Beijing to work harder in order to encourage domestic consumption: in August 2019 it announced 20 measures to help boost spending, from improving commercial pedestrian streets to encouraging night markets.

Real estate investors have already been moving to acquire assets where performance is driven by domestic consumption in the logistics sector and the retail sector. Retail was hit hard when China shut down its cities to fight the virus, however the early signs suggest it is bouncing back since shopping malls have been re-opened.

Nonetheless, malls with weaker tenants are vulnerable. Prior to Covid-19, luxury retail was performing fairly well because the government has cut VAT and import taxes on high-end goods. Not that long ago, 75% of Chinese luxury sales happened overseas; that figure is now closer to 50%.

Data from Real Capital Analytics (RCA) shows cross-border investment in Chinese real estate rose 61% to $14.8 billion in 2019. This was partly driven by domestic groups deleveraging, but also by China opening up its capital markets to the world. As in all these examples, this was starting to happen before the trade war, but the current environment has forced China to liberalise somewhat faster than expected.

For real estate investors, and indeed the wider economy, this can only be a good thing. There is speculation, for example, that China will accelerate the introduction of real estate investment trust (REIT) legislation. A working REIT structure will be a major step towards institutionalising the nation’s real estate market and will bring more capital into the sector.

One area where the trade war has hit China is the office occupier market, which is vulnerable to weaker sentiment caused by the conflict, and was already being impacted by domestic issues such as financial de-risking and greater regulation.

Savills data shows net office take-up in Shanghai fell 41% last year, although Grade A rents were fairly resilient (down 0.9%). This year, the impact of the Covid-19 pandemic will be far more significant than the trade war, however the latter will persist. Office markets will be somewhat subdued this year, although the phase one trade deal might encourage occupiers to make decisions they had previously postponed.

International real estate investment into China

Source: Savills Research using RCA

Future US-China relations

So what does the future hold? The trade war isn’t going to go away, and US-China relations are looking increasingly frosty. Economic news will be dominated by the still-unfolding coronavirus pandemic. Meanwhile, the longer-term trends outlined above – all of which are part of the story of China’s and Asia’s economic progress and development – will continue to gather pace.

Trade will continue to find ways around the tariffs, meaning that manufacturing and industrial real estate will be boosted in a number of nations, not just Asian ones. While Vietnam was the fastest-growing trade partner with the USA last year, Austria, France, Belgium and the Netherlands were also in the top 10.

Here in Asia, trade difficulties with the US may well bring China into a regional free trade bloc. Last November, the 10 ASEAN member states, along with China, Japan, South Korea, Australia and New Zealand, reached initial agreement on a Regional Comprehensive Economic Partnership, and a deal could be signed as early as this year, creating – somewhat ironically – the world’s largest free trade bloc. This would be a major step forward for the region, not least because it points to a future where trade means more than just selling goods to the USA.

The long-term benefits of this will be enormous. Free trade within Asia-Pacific will boost wealth and stability, both crucial elements for real estate investors, and the region will no longer be dependent on the actions of a single trading partner.