Overview

The Covid-19 pandemic has impacted nearly every corner of the world and, consequently, global real estate investment activity slowed dramatically over the first half of 2020.

Global investment volumes fell by 33% in H1 2020 compared to H1 2019. Asia-Pacific led this fall, with volumes down 45% in H1 2020 compared to H1 2019, while the Americas and EMEA were down 36% and 19% respectively. The impact on volumes was first felt in Asia-Pacific and this is reflected in Q1 volumes.

This fall is less than the decrease during the first six months of 2008, the start of the Global Financial Crisis (GFC). Real estate investment volumes across the world fell by 49% in H1 2008 compared to H1 2007 and continued falling until mid-2009.

Change in quarterly investment volumes by region

Source: Savills Research using RCA

Global real estate investment: H1 2020 vs H1 2019

Note: Residential includes multifamily and student accommodation. Source: Savills Research using RCA

What deals are happening?

Although there is a large disparity between global regions in the value invested in real estate in H1 2020 compared to the same period last year, the number of deals paints a different picture. During the first 170 days of 2020, deal numbers fell by 39%, 37% and 34% in the Americas, EMEA and Asia-Pacific respectively compared to the same period in 2019.

The difference between the size of deals that have taken place is particularly noticeable in EMEA where volumes by value appear to have held up relatively well, partly due to a significant increase in entity-level deals (the purchase of or merger between companies).

This was also the case globally with entity-level deals, up 191% over the same period, while portfolio deal volumes were down 13% and individual property deal volumes were down 40%. However, entity-level deals remain a small part of the market – accounting for 12% of deal volumes in H1 2020. The larger fall in smaller transactions reflects more cautious lenders and tightened lending criteria, which is less of a barrier for the big institutional players.

Cross-border transactions

Surprisingly, global cross-border volumes were down by a similar amount to total volumes, despite major restrictions on international travel, declining by 30% in H1 2020 compared to H1 2019. The Americas saw the largest fall in inbound cross-border investment (-39%), followed by Asia-Pacific (-35%) and EMEA (-25%).

Rasheed Hassan, head of Savills Global Cross Border Investment, says: “Undertaking a physical inspection of an asset is an important part of the property acquisition process for many investors and, therefore, I understand that with many travel restrictions in place during Q2 2020, the general expectation is that this would have halted cross-border trade more dramatically than it has. However, these figures do not actually surprise me.

“First, real estate transactions take months from commencement of marketing to a close. As such, for many of the transactions that did occur during H1 2020, investors will have been able to physically see the assets prior to widespread lockdowns, particularly those happening in Q1.

“Secondly, not all investors need to see assets prior to acquiring them and even where they do, many have local partners and advisors who can inspect assets on their behalf. In highly transparent markets, potential asset acquisition targets are often muted months before they are actually marketed and so investors with a conviction to invest may again have been able to see these, even just externally, prior to lockdown.”

Which sectors have proved most resilient?

Covid-19 has caused tourism and international travel to virtually grind to a halt and the industry is forecast to be one of the last to return to normal. This is reflected in hotel investment volumes, which are down 59% in H1 2020 compared to H1 2019, the largest fall of any asset.

Retail and office have seen a similar fall of around 40% over this period. Retail’s structural troubles are well-documented and there is still much discussion around how the office will be transformed as a result of Covid-19.

Meanwhile, residential (multifamily and student accommodation) and senior housing have seen similar falls of 26% and 29% respectively. The fall in residential volumes was driven by the Americas, which accounts for the significant share of total volumes (71% on average for the past five years).

However, volumes in EMEA and Asia-Pacific increased by 7% and 105% respectively, albeit Asia-Pacific from a much lower base. The strong growth here was driven by the significant cross-border deal by Blackstone of a Japanese apartment portfolio from Anbang for around $3 billion in February 2020.

Industrial has proved to be the most resilient sector, highlighting its importance during the Covid-19 pandemic and its long-term attractiveness, with a fall in investment volumes of just -4% in H1 2020 compared to H1 2019. This was driven by the Americas where investment was up 6% over the same period. In the US, Prologis completed two significant entity-level deals in the first half of the year, purchasing Liberty for around $13 billion and Industrial Property Trust for around $4 billion.

Half-year investment volume change by sector

Source: Savills Research using RCA

Most invested cities

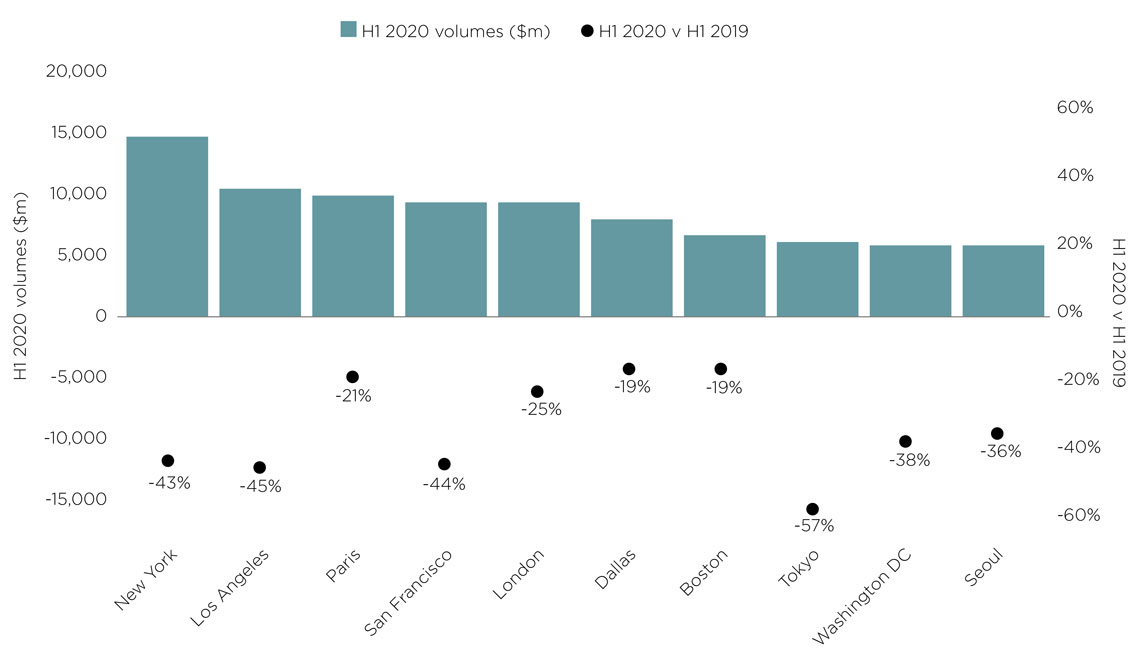

All the top 10 cities for real estate investment volumes around the world experienced a decline in volumes in H1 2020 compared to H1 2019. New York remained the most active metro market for real estate investment globally, despite a 43% decline in volumes from H1 2019.

The top 10 line-up has changed over the past year. Hong Kong fell out of the top 10 as the pandemic weighed heavily on a wide range of economic activities, and real estate investment volumes fell -81%. Boston entered the top 10 having only experienced a 19% decline in volumes.

Top 10 cities globally for real estate investment (H1 2020)

Source: Savills Research using RCA

Outlook

Looking ahead, transactional activity is expected to pick up in the second half of the year as lockdowns ease further in countries around the world.

According to Savills Global Market Sentiment Survey, a survey of Savills research heads across 33 global markets, more respondents expect to see an increase in transaction volumes in the office sector in the second half of the year (50%) than a decrease (22%), with the balance expecting ‘no change’.

Prospects are most positive for logistics, with 79% of respondents expecting an increase in logistics investment in the second half of the year. Conversely, the outlook for retail remains muted, with the majority of markets not expecting to see any sustained recovery in retail transaction volumes until 2021.

Outlook for transactions volumes: H2 2020 v H1 2020

Global Market Sentiment Survey, June 2020

Source: Savills Research

The rate of growth in investment volumes going forward will depend on the alignment of buyer and seller expectations, while the speed and shape of recovery will vary from country to country.

At the European level, Savills forecasts investment volumes to fall between 34% and 52% in 2020, the downside scenario comparable with 2008 when volumes fells by 54%.

Globally, H1 data suggests that falls are unlikely to be as severe as those seen during the GFC, though volumes are expected to remain well below pre-pandemic levels for the remainder of 2020 as investors wait for market clarity.

Simon Hope, head of Global Capital Markets, says: “Certain sectors are expected to outperform as investors focus on secure assets, namely logistics, residential and life sciences.

“Looking ahead, there seems to be general consensus across G8 governments around the world to build their way out of this downturn, turning on a tap of capital for infrastructure projects. This generally bodes well for the real estate industry in the long term as it potentially creates more assets to invest in as well as reducing unemployment rates.”

Note: Data collected 30 June 2020